Maximize your Profits with Trailing Stop Sell Orders

The goal of every crypto trader is to earn as much profit as possible from the market price movements of the assets. Have you ever thought why and how professional traders earn profits even in the reverse market trends? What kind of strategies do they use and how specific their trades are?

Well, professional and expert traders use advanced orders and different automatic crypto trading tools to avoid any kind of risks while earning good profits. The best crypto trading platforms like TrailingCrypto offer traders a range of tools to help them make the best trading decisions. The different order types like stop loss, stop sell, trailing stops, etc. help traders execute an order to buy or sell an asset at the price and time that best suits them.

So, the best way to preserve capital gains while trading cryptocurrencies is to use stop and trailing stop orders. With this, you will need a solid trading strategy to make the stops work for you efficiently. Implementing a trailing stop strategy is the best way to ensure that your trading plan remains robust, automated, and agile. Before understanding about the advanced stop orders, let’s understand about automated trading and stop order.

Automated trading/stop order

Automated trading in the crypto sphere has become an attractive option for those looking for a reliable and profitable trading option. This trading systems use algorithms to buy or sell crypto assets. If you don’t have time to watch the market continuously to trade crypto or you don’t want to hold your assets for long, automated trading is the better option.

To set stop sell or trailing stop orders, it is recommended to use the automated trading method on your chosen crypto trading platform. A stop order is used to buy or sell any crypto assets at the market once it has reached the predefined price. This is an automated order which is fulfilled automatically whenever the price reaches your preset levels. The stop order is also referred to as stop loss or the take profit order.

A properly executed stop order helps traders to earn profits and cut down their losses easily. Stop sell order and trailing stop sell orders are the two popular orders used by crypto traders on the automated crypto trading platforms.

Sell stop order

Sell stop order is a market order which allows traders to enter short or sell positions on price, moving down lower to the given level. In this order type, the order is filled on the price of the asset dropping from the current market price.

The sell stop order has a specified stop price. In this case, the trader has to specify the stop price to sell an asset. If the price reaches the stop price, then a sell market order is executed. Usually, professional and smart traders use sell stop orders so as to protect their profits and limit their losses.

Let’s understand this order with an example:

Say an investor purchased ETH for $50 a few months ago. The crypto asset now trades at $40. The investor is willing to keep holding ETH hoping that the coins will change their direction eventually, but he wants protection against further losses. Therefore, he decides to place a sell-stop order at $30, the price at which the ETH would be sold.

But if ETH never falls to $30 or below, no transaction will take place. The investor can then cancel the sell-stop order or place one at a different price.

Sell-stop orders can also be used to lock in gains. Imagine that instead of falling, ETH is trading at $60 after a few months. The investor decides they’d like to make sure they’ll see at least a small profit on this investment and places a $55 sell-stop order. That way, he can give his investment a chance to realize further while guaranteeing a small gain and preventing it from potentially turning into a loss.

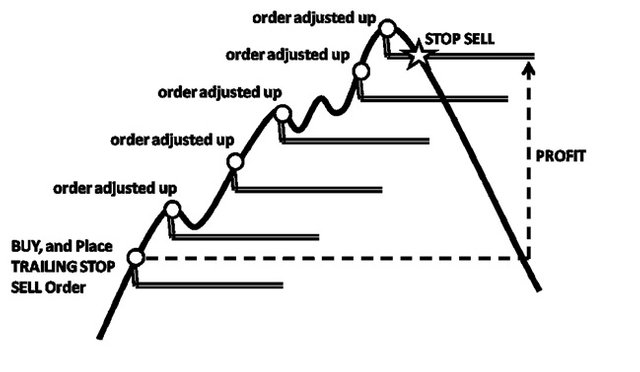

In this order type, the trader will set a fixed stop price for the order below the current market price according to the trailing amount. In this order type, the stop price is concurrently with an increase in the market price of the asset, but it keeps on rising with the initial interval set by the percentage of trailing amount.

Once the stop price is attained, the order will be triggered. The trailing stop buy order is just the reverse of this. Using trailing stop order is a risk management technique used by traders allowing them to specify the conditions which will automatically trigger an order to sell the position. When you want to place a trailing stop sell order, it would be placed at a price that was above the trade entry.

Let’s understand about trailing stop sell order with an example:

Let’s say a trader buys an asset ABC for $200 per coin. The price for the asset increases to $220. Here the trader places a trailing stop sell order with a trailing stop price of $10 below the market price. As soon as the price moves in your favor, the trailing stop price for ABC will remain at $10 below the market rate. If the price moves to $240, and then suddenly starts to drop. The trailing stop price will change to $230. And, the asset will be sold at $230 though the execution price may move away. Here the trader is earning a good profit amount of $30 per coin.

The traders can easily place stop sell and trailing stop sell order on the popular exchanges like Binance via TrailingCrypto or other automated crypto trading platforms.