How to Earn Profits from Trailing Stops in Crypto Trading?

Making use of advanced orders in crypto trading is always exciting. Trading cryptocurrencies could be one of the most challenging things that one can ever do, and very few traders can succeed in the long term. To succeed in this market, traders have to use advanced orders or trading strategies to cope up with the volatility.

Crypto trading is not a game for beginners and it requires huge patience as well as experience to earn profits. If you are a beginner or a seasoned trader and can’t wait to seek the perfect moment to buy or sell an asset, try out trailing stop sell Binance orders from TrailingCrypto. This is one of the best crypto trading platforms allowing traders to play smartly by making use of advanced orders and automated trading methods. Trailing stop orders help traders to unlock multiple opportunities to get the most from their trading.

Traders use trailing stops to limit their downside risks and maximize profits. The two basic trailing order types popular among traders are trailing stop buy and trailing stop sell which allow them to unlock numerous trading opportunities.

What is a Trailing stop order and how it works?

Trailing stop is a kind of advanced order that makes it easier and possible for crypto traders to manage their trading activities. It’s a variation of a stop order that adjusts to changes in the market price of the asset at a fixed value or percentage. Let’s understand about this order in deep:

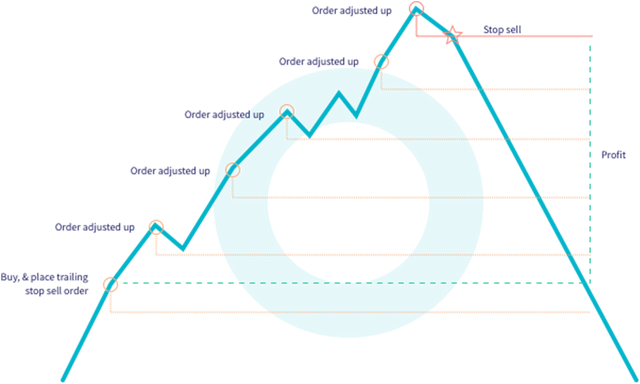

Trailing stop is a conditional order that uses trailing value rather than a stop price to determine when to submit the market order or exit the trade. The trailing amount/value could be either designated in number or percentage, which further follows the asset’s price as it moves up or down. The stop price follows the market at a fixed distance if the market price of the asset moves in the favor of trader, and it remains unchanged if the market is not favorable. So, this way it protects the traders against potential losses.

Example:

If a trader is in a long position and the current price of the asset ABC is $5000, a trader can open trailing-stop orders with a price distance of $200. This will create a sell stop order at $4800. Contrary to a normal stop order, if the price continues to rise to $5500, the trailing stop will rise accordingly to $5300. If the price falls to $5300, a market order will be activated.

The trailing stop order allows traders to automatically and continuously keep updating the stop price threshold based on the movement of the asset’s market price. While placing this order type, you need not to monitor the market price movement and keep sending replace requests to update the stop price which is quite close to the latest market movement. This way, stop price in the trailing stop order keeps on updating automatically.

Placing trailing stop order Binance

If you are trading via any crypto trading platform like TrailingCrypto, Cryptohopper or any other platform, first you need to connect it to your Binance account via making use of APIs. After that, you have to simply set up trailing stop order in Binance with some given guidelines. Here the trail market price will follow the market automatically.

Trailing stop order is the best tool to enter or exit positions at the right time. It allows traders to ride the market trends as long as it moves in the favor of trader. Trailing stop Binance order allows traders to maximize their profits while minimizing any kind of risks of loss.

Traders can use this order on Binance in two ways. Let’s understand this one by one:

Trailing stop buy Binance

The trailing buy strategy here works at its best when you have to go long. The trailing stop buy strategy follows the market price as it goes down, and triggers the buy order for the asset if or when the asset price rises from its low by the amount set as trailing amount/trailing value/trailing distance. This will allow traders to buy at a lower price and do that if the price trend reverses while increasing your chances of earning profits.

Trailing stop sell Binance

Exiting a long position via trailing stop sell order is the best option. This order follows the market price as it moves up, and triggers a sell order if or when the price falls from its peak by the amount set as the trailing amount. Using this order will allow you to ride the market trends so as to capture the maximum profit possible by exiting as soon as the price trend reverses.

With this kind of trading strategy, the traders can minimize their maximum possible losses while having endless opportunities to earn profits. Actually, trailing stop order is a risk management technique allowing traders to specify the conditions which will trigger an order automatically to sell the position. To place a trailing stop sell order, you can place it at a price that was above the trade entry.

Example:

Assuming that a trader buys an asset XYZ at $200 and soon its price rises to $220. Here he places trailing stop sell order with a trailing stop price of $10 below the market price. As soon as the asset price moves in your favor, the trailing stop price will remain at $10 below the market price. But, if the price of XYZ reaches to $240, and then it starts to drop, your trailing stop price will move to $230. And, the asset will be sold at $230 with a profit of $30 for each coin.

The trailing stop orders on Binance are enabled on Binance Futures. And, using the third party trading platforms like TrailingCrypto, traders can perform Trailing stop sell Binance easily.