Democratizing Wall Street: Mastering Markets Secrets with Wyckoff's Wisdom

In continuation to our first exploration into “Using Theory for Trading”, this article delves into how Wyckoff's timeless principles apply to today's dynamic markets, from stocks to cryptocurrencies.

Richard Wyckoff, one of "the five titans of technical analysis," began his career at 15 in 1888 as a stock runner. He developed a method by studying legends like Jesse Livermore and J.P. Morgan, which even today remains relevant. Wyckoff's legacy extends beyond trading strategies; he was a pioneer in advocating for investor protection, exposing fraudulent trades, and pushing for market transparency.

His mission was to educate the public about finance in Wall Street, leading him to write numerous books and develop courses. In 1907, he launched "The Magazine of Wall Street," which became a critical source for financial analysis and exposés on market manipulations. However, its trajectory took several turns, and after some personal life dramas, he sold the magazine in 1927. But his magazine was part of a broader movement towards investor protection, aiming to democratize financial knowledge.

Historical Example:

Wyckoff's method doesn't guarantee success; it demands skill in interpreting markets, managing risk, and adapting strategies to lead insights and profitable trading decisions. A notable example was his prediction of the market bottom following the 1921 bear market, where he identified accumulation in stocks like U.S. Steel, enabling profitable low-price buys.

Modern traders have also embraced his principles; Peter Brandt, a well-known trader in Forex, notably used Wyckoff charting techniques to predict movements in currency pairs like GBP/USD around 2016-2017. Dan Zanger, also, who created the "Investor's Gunned Down Method," famously used these principles to catch the early 2000s rally in stocks like Netflix (NFLX). Bitcoin's price actions have similarly been analyzed through Wyckoff's lens, with traders predicting movements towards $68,000 after the 2022 dip.

Composite Man (Smart Money):

Wyckoff was renowned for his integrity, focusing on understanding market underlying logic rather than chasing quick gains, which was novel for his time when many traded based on patterns akin to astrology.

He introduced the concept of the "Composite Operator," representing the collective actions of major market players, or as we call today "Smart Money." This theory posits that market movements are orchestrated by big investors to shake out weaker hands, giving traders an edge by aligning with these major moves.

Phases of Market Cycles:

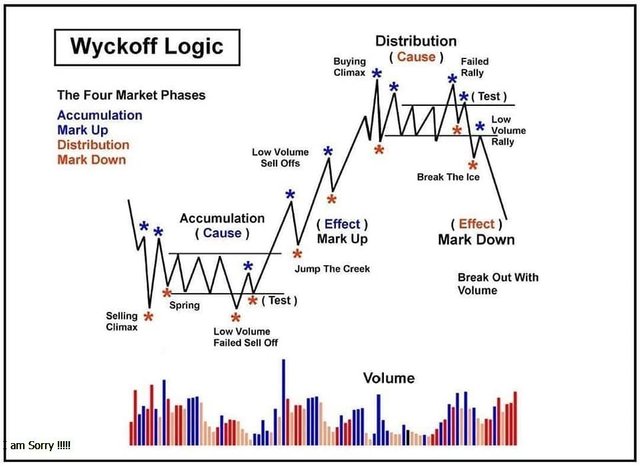

Rather than fundamental statistics, Wyckoff method operates on the dynamics of supply and demand, which can be decoded through price movements and trading volume.

The theory identifies key market phases; accumulation (where buying interest is increasing) and distribution (where selling pressure is building), which can predict future price movements known as Markup (price increase) or Markdown (price decrease). This framework challenges the notion of market randomness, by suggesting informed trading based on observed patterns.

Wyckoff's method suggests an adaptable approach to understanding market dynamics. Accumulation and distribution indicate market efficiency, while markup and markdown show inefficiencies. Traders should adjust their strategies based on current market conditions, recognizing that markets constantly change and every moment is unique.

In fact, unlike many modern methods, Wyckoff's approach isn't just about following mechanical patterns but requires judgment. It gives traders a framework to analyze, but they must gather concrete evidence before making moves. Thus, seeking perfect patterns might be less practical, especially for short-term trading.

Psychology:

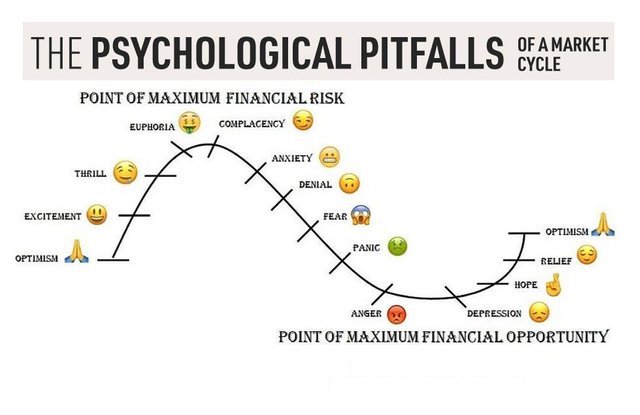

Mastering Wyckoff's method involves more than just chart analysis; it's about managing one's psychological responses to market conditions. Traders must resist emotional impulses, balancing confidence with the humility to admit errors.

Market phases test patience and discipline, where accumulation and distribution particularly challenging as they often go against prevailing market sentiments. Also, in a markup phase, traders must control the greed that can lead to buying at peak prices, expecting continual rises, and in markdown, the fear of loss can lead to selling too early, missing out on potential rebounds.

Wyckoff advocates for trading in the direction of the main trend but being alert to reversals. This method often involved looking for points where market sentiment was at an extreme. This requires traders to sometimes go against the herd, which is psychologically daunting as it can feel isolating or risky. Thus, traders must to be psychologically resilient, not to be swayed by short-term market manipulations designed to provoke emotional responses like fear or FOMO (Fear Of Missing Out).

Modern trading:

Today's trading platforms provide real-time data and tools for backtesting Wyckoff's methods. This is a significant enhancement over the delayed or daily data Wyckoff had to work with. today, algorithms can be programmed to detect patterns akin to Wyckoff's phases, and providing alerts when certain conditions are met.

However, challenges like High-Frequency Trading can obscure traditional patterns. Algorithms might generate volume spikes that do not reflect genuine market sentiment. A scenario which Wyckoff warned against. Also, dark pools and other off-exchange trading venues can hide true volume, making volume analysis less straightforward.

In essence, while Wyckoff's methods remain foundational, and a time-tested approach in understanding market behavior, and encourage traders to look beyond the charts to the psychology of the market, the application must evolve.

Today's traders need to blend traditional wisdom with an understanding of algorithmic influences, global economic interconnectivity, and the rapid information flow that characterizes modern markets. This might mean using Wyckoff's principles as part of a broader, more adaptive trading strategy.

Conclusion:

Richard Wyckoff's approach to market analysis transcends time, offering a framework that has proven robust from the early 20th century through to the digital age of cryptocurrencies. His method teaches us not just to follow market trends but to understand the psychological and strategic plays behind them; reminded that while tools evolve, the core principles of supply and demand, market psychology, and strategic patience remain unchanged. In doing so, we not only honor his legacy but also democratize Wall Street.