review stock October 17: menu trading stocks today

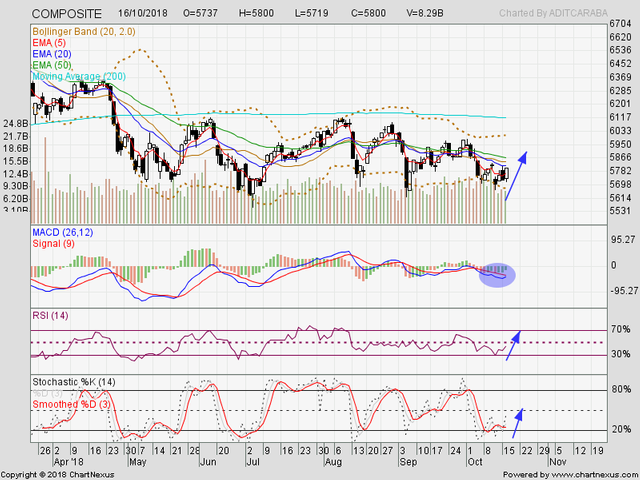

Jakarta composite index snapshot foreign still recorded a net buy in stock Exchange Indonesia in the last two days, ahead of the release of the financial statements in the past weekend this month, some sectors stock look strengthened. on (17/10) JCI closed strengthened 1.28% are in the level of 5,800. some sectors contributing increase JCI can see below; sector leader: 1. consumer goods + 2.35% 2. industry basic + 1.59% 3. a variety of industries + 1.61% macro view: finance Ministry of Indonesia proposed changes posture state budget 2019 which is in line with the assumption of a new rupiah be USD 15.000 per United States dollars (USA). in the submission of the kemkeu add allocation for energy subsidies to USD 164,1 trillion, or up USD 6,3 trillion of predefined in the design of budget state (state budget) 2019 before. comment: release of the financial statements start of concern investors in the United States (USA) release of the financial statements already started,

in the United States (USA) release of the financial statements already started, stocks like Goldman Sachs, JPMorgan, unitedhealth and a & a record performance quarterly very positive, in Indonesia this week and next week to week-week preoccupation by the financial statements issuer. we see the positive side this will be used by foreign investors and domestic to get back into the stock market. technical: JCI likely drove with signal MACD Golden cross confirmed today if closed strengthened. RSI and stochastic saturated selling. volume buy seen in the last three days. JCI will further test levels (5,822> 5,850> 5,865). range JCI: 5,756 - 5,860 prediction: bullish stocks potential 1. asii, (Astra international) MACD likely Golden cross, the potential ma5 to cut to the top ma20 and ma50. RSI already saturated sell on the level of 34.1% and is in the lower the band Bollinger band. volume buy increase. action: buy • without intermediary: 7,025 and 7,075 •

support: 6,850 • cutloss: 6,700 • area buy: 6,850-6,900 2. pgas, (state gas company) bullish one White soldier, strong bullish. RSI 53.8% (not saturated sell), followed by volume buy the highest in the past week. is in the middle the band Bollinger band. action: hold • without intermediary: 2,270 and 2,350 • support: 2,080 • cutloss: 2,040 • area buy: 2,080-2,100 3. bbtn, (savings Bank state), bbtn including shares in the decline in stock banking, can take advantage of spread ma5 to ma20. RSI and stochastic saturated selling. is in the lower the band Bollinger band. action: speculative buy • without intermediary: 2,390 and 2,470 • support: 2,320 • cutloss: 2,300 • area buy: 2,330-2,340 4. bbri, (the people's Bank Indonesia), MACD Golden cross, can hold now for stock bbri, ma5 potentially beyond ma20 and ma50. RSI and stochastic saturated selling. action: hold • without intermediary: 3,030 and 3,070 • support: 2,920 • cutloss: 2,870 • area buy: 2,920-2,940

https://www.seputarforex.com/analisa/ulasan-saham-17-oktober-menu-trading-saham-hari-ini-285771-21