The Comey/Russia distraction! Central Banks Prep for COLLAPSE!

Political Theater

Alright, so if I heard this correctly Comey is a shill. Here is a succinct background on the man himself, a puppet of the "deep state" aka central bank puppet (Hillary included). Bottom line is, the dude was fired and then turned into a walking character attack of Trump. Who gives a f--k?

These Guys

No offence to New York black glasses wearing, pasty skin, stink-beard, high estrogen, CNN watchers; but they look like they were born in a bar. For Christ sake, get drunk at an outside table for once.

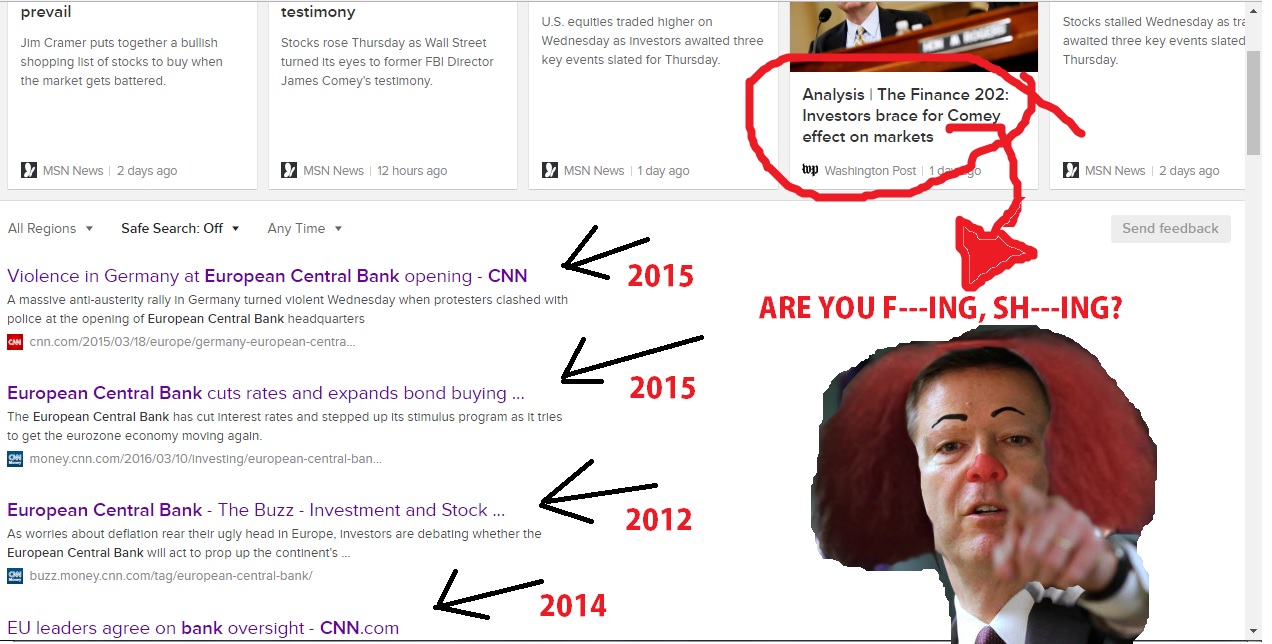

Here's what CNN is avoiding:

The European Central Bank just came out with the news that they have NO intention to raise interest rates from 0%. Furthermore, they will be CONTINUING the printing of 60,000,000,000 (sixty BILLION) Euros per MONTH to keep insolvent banks and bloated government budgets above water, going forward.

What does this mean for Europe? What does this mean for the North American and Asian markets?

These are emergency measures being taken by central banks. Emergency measures. Across the board, interest rates are at or below 1%. This means that bankers can take preferential loans from the central banks that issue their national currency. There are two MAJOR points to pay attention to.

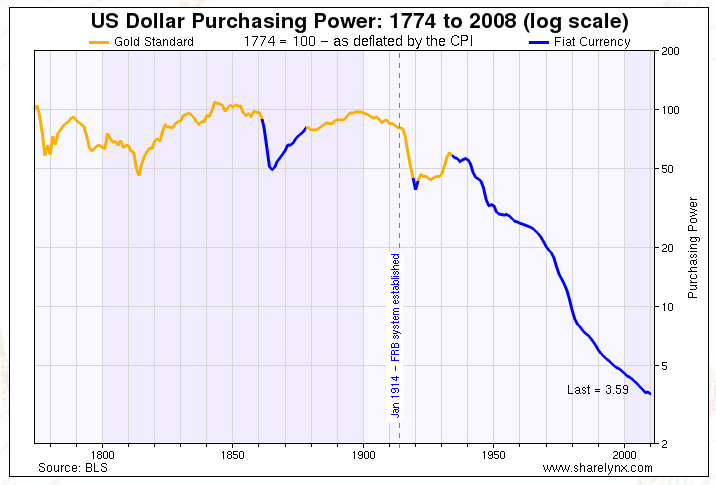

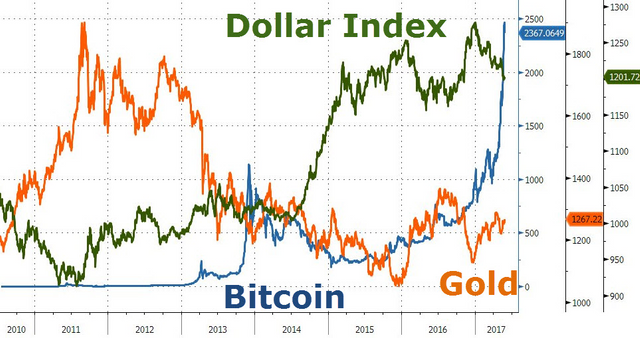

The first, since 2014 (the "end" of the recession) all growth in the prices of assets is linked to an increase of money supply. The second major impact central bank printing has had: printing enables governments to continue and expand social programs, like subsidized healthcare and pension payouts, while introducing further expansions to these programs. In America these programs are the likes of the Affordable Care Act, proposals to increase military spending and infrastructure building programs. Whereas in Europe, this money is being spent to subsidize INCREASES in social program spending that expand to accommodate "migrants" and any number of other horse manure European projects.

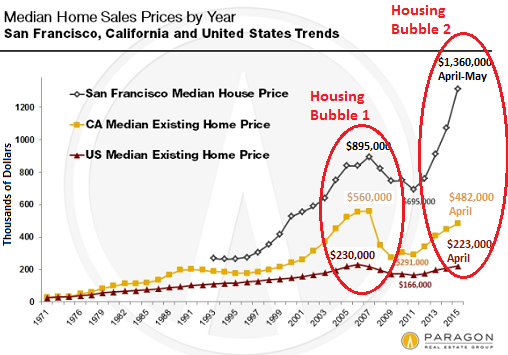

However, around the world, these central banks are printing money and loaning at low to no interest; literally handing it over to banks. This encourages massive speculation, leading to price inflation in risky assets like the stock market. This is why we are seeing record highs in just about everything, there is more money being thrown into banks, resulting in more money being thrown into chasing new market highs without regard for underlying financial health of markets or particular investments. The banks who receive these large, low interest loans, are engaging again in the same subprime loans that brought down the last market; never having to put money aside to pay interest on their loans or to the public with money in their savings accounts.

Why can't we tell that this is happening?

In good economic times, all boats rise with the tide... In bad economic times, central banks all pump cheap money into the economy in tandem and at the same low rates, in order to inflate asset prices and enable government spending at the same time. This provides the illusion to the public that there has been an economic recovery. Inflation is much worse than the market indicates currently because inflation is occurring on a global scale, rather than within a single currency as it has in the past.

With fractional reserve banking (banks loaning out 9-times their reserve money in loaned "bank notes" to the public) this bubble is HUGE! What we are seeing, based on June 9, 2017 reporting from European Central Bank, is that there is at least 580,000,000,000 (60 Billion/month x 9 fractional reserve), 580 billion Euros being created in the European banking system per MONTH to keep this market going... AND IT IS STILL NOT FIXING THE PROBLEM. That is about the amount of money that Algeria produces in GDP each year... One Algeria year, per month. European time flies quick. This is big news and the media couldn't care less to cover it.

Here are charts that speak volumes