Quick Introduction to Market Depth and Whale Anatomy

Whales. Such majestic creatures. Since the ancient times, people have been writing stories about them, and legends tell tales of mighty whale hunters. These incredible men and women of the sea risked their lives, hunting whales in the deepest oceans of the world for wealth and glory!

But wait, what does a whale hunter have in common with a trader?

Thankfully, I'm here to tell you all about that, my friend. Grab that virtual harpoon of yours and get in that yacht you've always dreamed about since you started trading. It's time to go whale hunting!

Unless today is the first day in your life as a trader and you've spent the past few hours scalping some random shitcoin and getting lucky with it, you've probably already heard other traders talk about whales and their mystical walls and their incredible super powers in market manipulation. Just as a reminder, here's a quick recap of what these nonsensical words even mean:

whale

/(h)wāl noun a very large mammal with a streamlined hairless body, a whole lot of money, and a crazy appetite for destroying your sweet gains.

wall

/wôl/ noun a continuous vertical brick or stone structure that either terrifies or excites you whenever you see it in the order book.

Always remember that the goal of almost every trader is to become a large mammal with a streamlined hairless body. Not only do whales get to enjoy a luxury suite on the lunar surface and a brand new Lamborghini every day, but whales can also use walls to actually be more successful traders. When you're a whale, you don't even need to use silly trend lines and triangles to try and predict the future price of a coin. You can just set the price of that coin to whatever you want!

Basically, if trading was an online FPS game, the whale would be the classic wall hacker. Makes sense? Cool.

But how do they do this?

Very good question. But you're not ready for the answer yet, little fish. Before we learn the mystical secrets of whales, we have to take a closer look at a thing called the market depth.

The Market Depth, sometimes also incorrectly referred to as the order book, is just a pretty diagram that shows all the buy and sell orders currently placed on a coin. In other words, it shows you the supply and demand for the asset. If you don't know what the law of supply and demand is...well. I don't know what to tell you. Go do some research. Trying to be a trader without knowing the basic economics is like trying to be an astronaut without understanding basic physics. Jesus. What are you even doing here...?

Anyways...

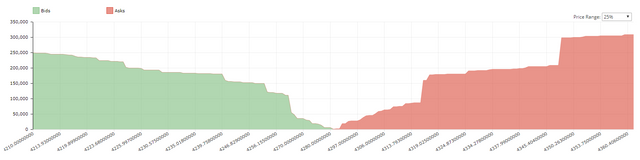

Most exchanges provide the market depth diagram as public information. Some exchanges charge money to display it, because it's a very useful tool. Just in case you've missed it, here's how a boring market depth chart looks like:

The market depth may look different depending on which exchange you're using. But typically, they look like that, or some variation of that. I'm using Bittrex throughout this post since it's my favorite exchange filled with so many shitcoins that they're running out of unique symbols for them.

On the left, you can see the "bids". These are all the buy orders, or the demand. On the right, you can see the "asks". These are all the sell orders, or the supply. The price is on the x-axis, and volume is on the y-axis. Just as we expect from the law of supply and demand, the demand increases as price decreases, while the supply increases as the price increases.

Right in the middle of that diagram is where all the magic happens! I call that area the battle arena! This is where all the action happens. This zone is where the highest bid and the lowest ask face each other. The difference between the highest bid price and the lowest asking price is called "the spread".

Price moves up whenever someone buys from the lowest asking price. Price moves down whenever someone sells to the highest bidder. When the volume is high, this means there are lots of people buying and selling, and the spread is usually small. When the volume is low, this means there aren't many people buying or selling, and the spread is usually larger.

Whenever you see a rapid price increase (i.e. a pump), that's when buyers are charging towards the sellers, killing each and ever single one of them! There is blood and sweat, and the sounds of clashing steel! Sellers are screaming as buyers are snatching their bags right out of their bloody hands! Similarly, whenever there is a rapid price decrease (i.e. a dump), that's when the sellers retaliate and push right back into the buyers, using their heavy bags filled with coins to pulverize them!

I have a very vivid imagination. I'm sorry. I should have put a parental advisory warning at the top of this post. Oh well...

So now that you know how to read the order book, it's time to look at some market depth diagrams! Because why not!

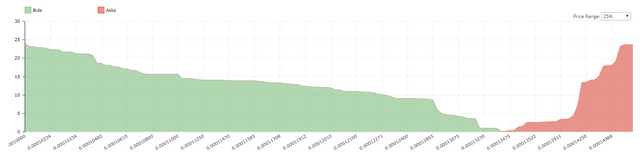

It looks like the buyers are eating up those sellers like a horde of angry Spartans fighting the Persian Empire. But how far can they go? Surely the sellers will push back, right?

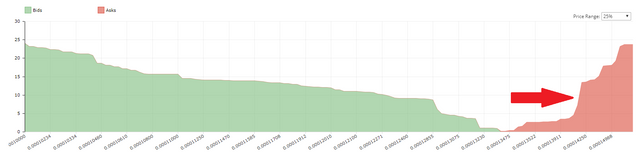

Oh they will. You see that giant red wall towards the right?

That one! That giant wall is equivalent to a whole fresh army of sellers, just lining up, ready to ambush the buyers as soon as they come charging. In more boring terms, that wall means that there is a massive supply at that particular price, and until that supply runs out, the sellers behind it won't get a chance to sell their bags. That also means that the price will not increase beyond that value until that supply runs out. Therefore, the wall is a price resistance.

The same situation can happen on the buyers side. A large demand for a particular coin at a price means that buyers looking to buy the asset at a cheaper price won't get a chance until that demand disappears. Therefore, the wall acts as a support.

But what does all of this nonsense have anything to do with whales? Keep holding that harpoon...

Let's stop thinking about war and bloodshed for a second. Instead, let's think of chocolate cakes!

Imagine you recently learned how to bake tasty chocolate cakes, and you're thinking of opening up a bakery to make some money out of this newly found, imaginery talent of yours. You buy a place, you do all the paperwork, you bribe a few people, you hire some pretty cashier lady, and after you've baked a fresh batch of cakes, you're ready to start opening the doors and make some sweet profits.

But what price do you sell your cakes at?

You start looking around, and you see that Jane across the street is selling some cakes too at the price of $10 per cake. She has a pretty small shop though. Beside it, there is another small bakery that belongs to Steve, some jerk you know from high school. He's selling his cakes at $9, but he also has a pretty small shop similar to yours.

So if you want your cakes to sell fast, you probably need to undercut Steve and sell yours at $8. Or maybe you think that Jane's and Steve's supply will eventually run out since there is a lot of sugar-addicts in the neighbourhood, so you could sell at $11 and wait a bit. Alternatively, you could just sell your cakes at Jane's price, or Steve's price. But you hate Steve. He's an idiot. So you start selling at $10 per cake!

After a few hours, Steve runs out of cakes to sell, cause he's an idiot and doesn't know how to run a business. Now some people are buying from Jane's bakery, and some are buying from yours. Life is good, business is sweet!

But just as you get comfortable in your chair, counting all your cake money, you start hearing a crowd outside. You step out to see what's going on, and OH MY GOD. Cake Factory Inc. has just opened a bakery right in your neighborhood. FUCK. This massive corporation can probably make enough cakes to feed an entire city, let alone your neighborhood. And they're selling for $8 per cake! This is the worst! Why would anyone buy your cakes when Cake Factory has an endless supply of cheap cakes?!

Now Jane across the street has already lowered her price to $7 just to keep up with Cake Factory! Now you need to compete with Jane too! You are sitting on a whole pile of cakes that are just gonna rot in the kitchen unless you do something fast. Just to keep yourself in the business, you now start selling your cakes at $6 a cake!

Meanwhile, Steve, being the idiot that he is, hasn't changed his price at all. He has a small batch of cakes still on sale for $10. Nobody even looks at his stupid shop anymore!

But life is still good. Now that you're selling your cake at $6, there are a lot of people visiting your shop. Some of them are even wearing Cake Factory employee uniforms! Hah! Those suckers can't even afford their own cakes! You're the bawss of cake industry!

This goes on for a while, and you make small profits and keep making cakes, only to sell them at $6. More and more employees from Cake Factory come to your shop and buy your cakes, and you're happy to sell them your cakes to keep your business running.

A few days pass, and you start hearing a commotion outside in the neighborhood. You step outside a second time, only to realize that Cake Factory Inc. has just raised their price of cake to $15, and they have even a bigger supply now. Meanwhile, you sold all your cakes at $6. Jane doesn't have any cakes either. Even Steve managed to sell all his cakes at $10 while you were too busy serving customers! No body has cakes to sell anymore, except Cake Factory Inc., and they're selling them at $15! How the hell did this even happen!?

So you roll up your newspaper and march into the street, stomping your way through the crowd to see what Cake Factory is really up to. You step into their massive store and the reality slaps you right in the kisser!

Cake Factory Inc. is selling your cake now at $15. The cakes you sold to its employees at $6. Oh and look. There is a separate aisle with Jane's cakes, being sold at $15! They're even selling Steve's shitty cakes at $15 now!

Cake Factory Inc. has robbed all of you!

The story above was a bit sad and depressing, wasn't it? Welcome to the trading game, little fish. That story is exactly what happens in the market every day, and little fish like us are the Janes and Steves in that story, while the big whales are Cake Factory Inc. This is how the whales can manipulate the market.

Using fake sell walls, the whales scare the other sellers into selling below the wall price. Meanwhile, they buy their cheap bags from the other side. Once they're satisfied with the number of bags they've bought, they can then simply remove the wall, which means sellers can start selling normally again. This raises the price, and the whale can now sell all those cheap bags at higher value, thus making profit. The same logic applies to buy walls, except everything works the opposite way, and the whale is trying to keep the price high. I'll let you figure that one out on your own. Because I'm lazy.

So now that you know how the whales manipulate the market, what can you do to not be a victim of their scheme?

The short answer to that question is a bit depressing. You can't do anything, because you can never know for sure when a buy or sell wall is "fake" or "real". And if a wall is "real", it might make you lose the trade.

However, there are some things you can do to resist the manipulation. These are some simple tactics I use to avoid being whale food:

- Never trade purely based on market depth.

Understand that the market depth is in constant fluctuations. Trying to pinpoint support and resistance points based on the order book is tricky, and sometimes those support or resistance walls can be fake. Additionally, many traders don't even put orders in the book, and would rather buy at market price when they feel like it. - Verify walls using technical analysis.

One trick I like to use is drawing support and resistance lines in the chart based on where the buy and sell walls are in the order book. If the support and resistance lines make sense from a technical analysis standpoint, then they're probably real walls. For example, if a sell wall lines up with a moving average, then it's probably a good indicator that the resistance is real. - Real walls don't move!

Go and slam your body into the nearest wall in your home right now. Did it move? No. Neither should real buy and sell walls. If you see a buy or sell wall constantly shift up and down in the order book, that's a fake wall. Trust me. - Try not to buy or sell into a wall.

When you place an order at the price of a wall, that's called buying or selling "into the wall". Don't do that. That's how you end up being whale food. If the wall is real, let others buy into the wall, which will eventually break it and you can sell higher. If the wall is fake, the whale will move the wall immediately when it gets bought into. Same logic applies to buy walls. - You can always just accept the walls.

Sometimes it's okay to undercut the whale by selling below their walls, because you've already made the profit you're happy with. This way, whether the wall is real or fake, you've secured some profit, which is always nice.

Of course, as always, there are exceptions to these guidelines, and different people have different opinions on how you can fight the walls when trading. These are just my general rules of thumb I use when seeing walls in the trade book.

Now off to the sea with you, little fish! Stay strong, and brave. Go and hunt some whales!

I hope you found this post useful. If you did, or if you have any suggestions, questions, or ideas for future posts, let me know in the comments below. I'd be happy to post more about my experience so far in technical analysis and trading.

If you wanna chat with me, you can always find me in the ONEX Capital Discord Server. It's a place full of nerds who get aroused by charts and profits. So if you also feel something tingling in your nether regions whenever you look at trend lines, you'd feel right at home.

Cheers!

Zeeno killing it with these posts. I actually really digging them.

But if you're a whale, you don't bump into walls, you only bump into bigger whales.

But you're not a whale... yet. :P

This is an awesome explaination and awesome post.

Thanks a lot! I'm glad you found it useful.

Congratulations @zeenobit! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPyour explanations are on point 👍👍

This was one of the most informative posts I've read in a long time my friend..thanks for the great in depth explanation...cheers

This is to much fun to read! Grabbed my attention the whole way through and made it very easy to understand! soo good!

Interesting

I will follow you to see your future posts!