Ethereum TA discussion: Bollinger bands tightening! Due for a breakout (or break-down)?

Hi fellow traders,

Right now, I'm paying very close attention to the ethereum charts! Here are some of the things I'm noticing:

(1) We've had a few attempts to break down recently, but each time it seems to spring back up to around the $130 level.

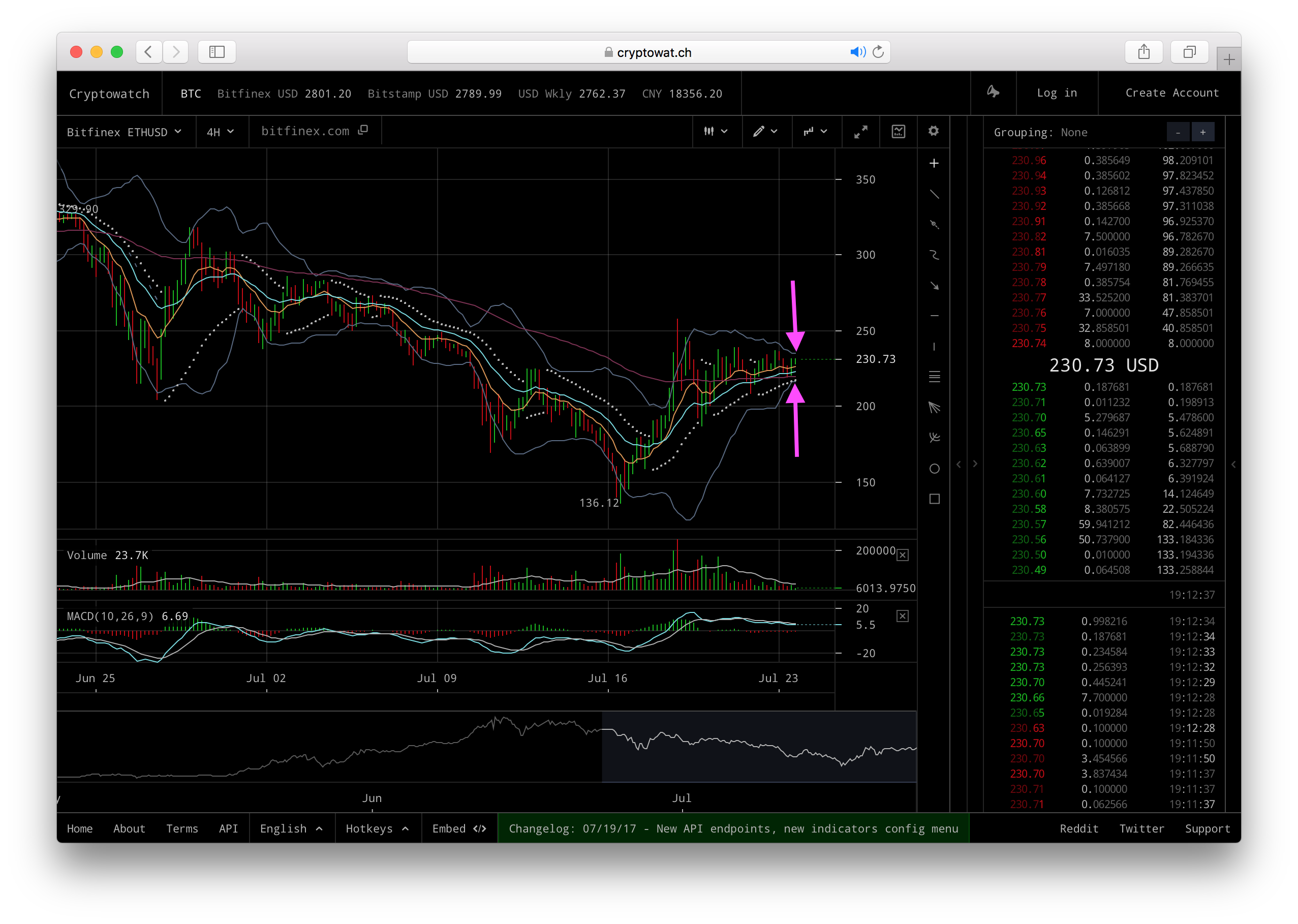

(2) Bollinger bands (b-bands) are tightening on the 4-hour chart (as shown by the gap between the magenta arrows):

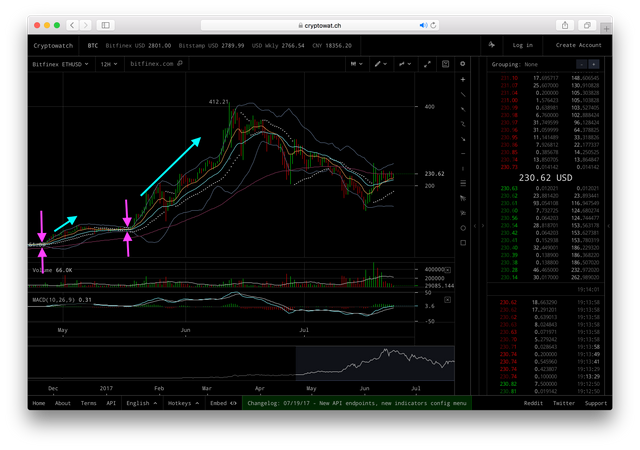

However, the 4-hour chart is quite a short time frame. The 12-hour chart had very tight b-bands before the breakouts for the recent very large moves, e.g. at around $50, and at around $100, as shown below:

If we're looking for the b-bands to get tight on this timeframe, I'm guessing that could be up to some weeks away (if we don't get a major break up or break down before then).

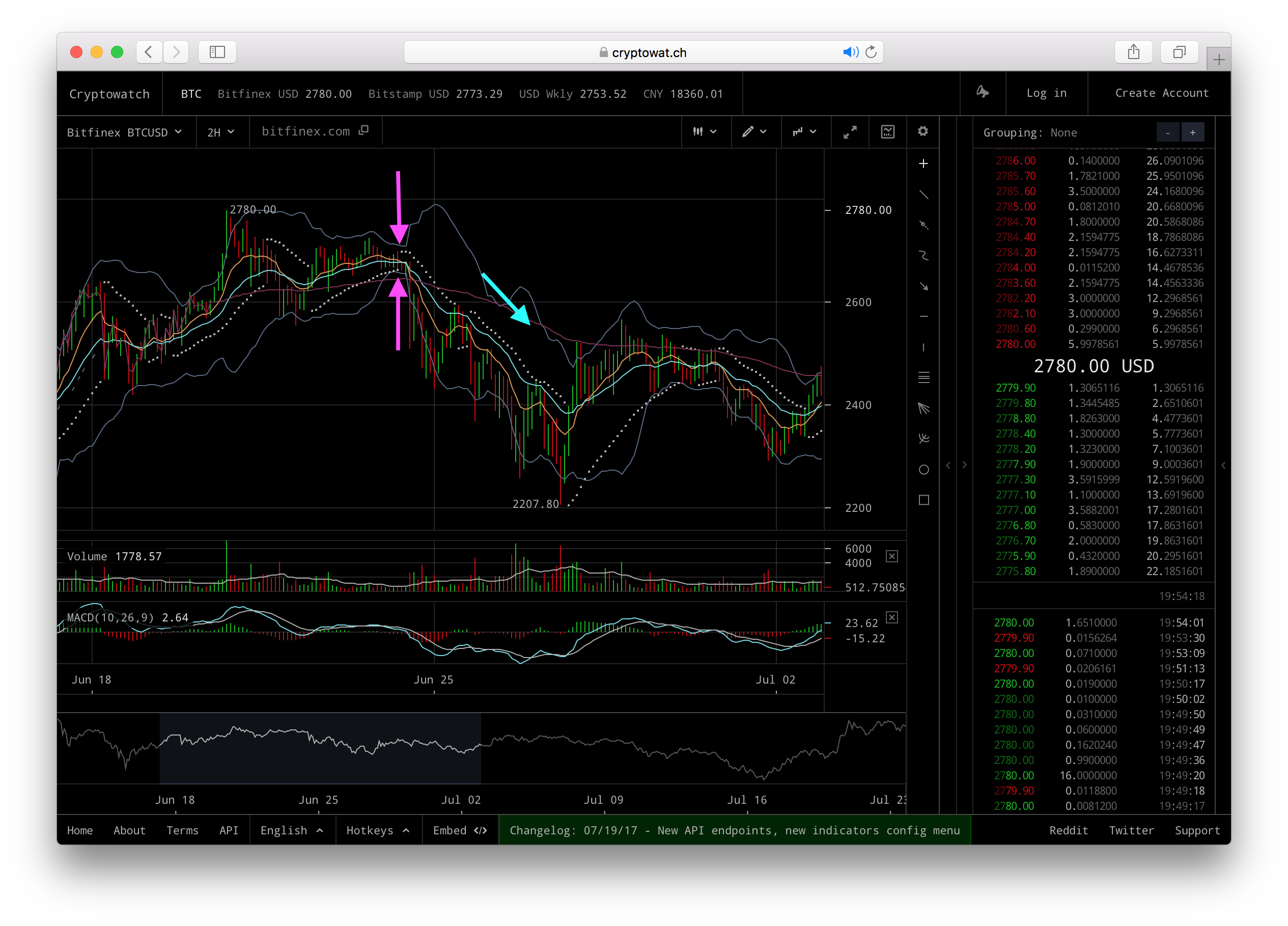

Note that tightening b-bands do not imply a break upwards, of course! This is just one possible outcome. But in my experience in crypto, tightening b-bands can often herald either a break up or a break down. Here's a counter-example which shows a recent break-down, following tightened b-bands on the 2 hour chart:

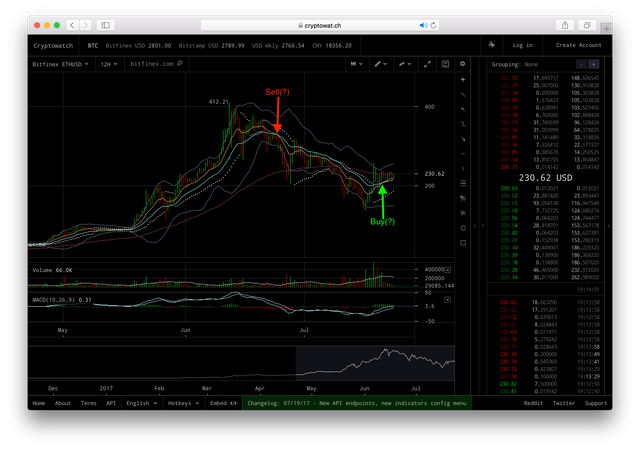

(3) The 12-hour chart EMAs recently crossed back over to the positive direction. To me, this a very bullish indicator because these EMAs were positive for the whole of the move upwards, and for most of the recent move downwards:

One trading strategy would have been to use the cross-over points on the EMAs on this timeframe as places to buy and sell (which I've marked on the chart with 'buy(?)' and 'sell(?)' annotations). However, just because this time-frame would have worked well for the last 4 months, it in no way means that continuing to use this timeframe for the next 4 months would still generate a profit. Moreover, in a consolidation period, using EMA cross-over points on largish timeframes are quite likely to lead to a loss rather than a profit (imo) - it all depends on what type of 'chop' occurs. [Just to be quite clear: I'm not advising the reader to 'buy' - because I marked a 'buy(?)' annotation on this graph; instead these are just points to sell and buy at if you had happened to be following this particular strategy during the last 4 months.]

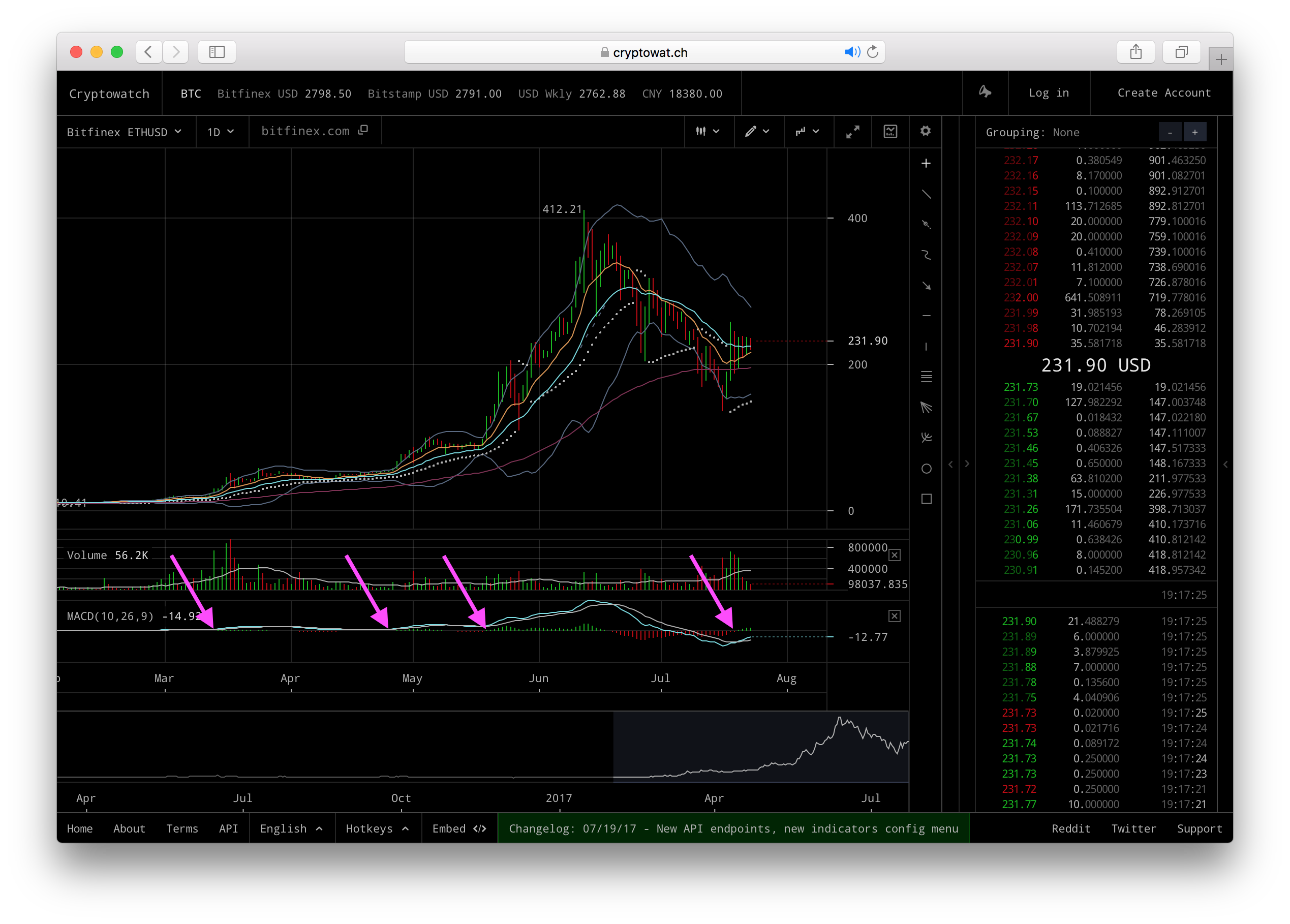

(4) The MACD on the 1-day graph recently turned green:

I've marked this cross-over point with a magenta arrow, as well as marking some previous red->green cross-over points with magenta arrows too.

(5) On the negative side, however, the MACD on the 1-week chart looks like it could turn red soon (marked with a blue arrow with a question mark!):

Also, the MACD on this timeframe is showing an 'overbought' situation. I don't think this makes a bounce up impossible - even if it were to turn red, but I wouldn't be so positive about seeing a large increase in value if and when this turned red.

(6) The 3-day chart currently consists of what I might think of as 'mixed' sentiment:

On the positive side and this is super positive imo, is that the EMAs are still in positive territory (just!). I.e., the gold coloured curve is still above the cyan coloured curve. If however, the curves had crossed, then I would take this to be very negative; but, at the moment it's just-about holding :)

On the sightly negative side, the 'bounce' on the timeframe looks to have stalled a bit. One way to see this, is that the angle of upward movement (blue arrow) is less than the angle of the downward movement that preceded it (magenta arrow). If the upward movement had had a similar angle of incidence to the downward movement then it should have followed somewhere closer to the cyan arrow marked on the chart.

(7) Finally (positive), we had huge volume on the recent bottom, but we haven't had a very significant retrace back up, since (as also discussed in the previous point). Of course, we may not get any more retrace, and we could get a lower low before we see a new uptrend developing. On the other hand, however, because the bounce did not get that far back up, perhaps there is still room for some more upward movement. The following chart shows the fibonacci retrace levels between the recent top and the recent bottom:

As we can see, the bounce briefly went above the 38.2% level, but it did not quite touch the 50% level; and it was nowhere close to the 61.8% level (or the 78.6% level!).

So what's my take on all of the above factors?

I think it's possible we could get a break upwards, but I'd be probably be looking to place sell orders in a range somewhere around the span between the 50% and 61.8% retrace levels.

Another strategy would be to wait for the b-bands on some timeframe (e.g. 4 hour, 6 hour, or 12 hour) to continue to tighten. Then, once they started 'un-tightening' due to a break in the upward or downward direction - that could be the time to buy or sell (respectively).

Another strategy is to follow the EMA cross-over points, on some timeframe. If you were using the 4-hour chart, the 12-hour chart or the 3-day chart, then you should be holding ETH at the moment. You would then need to watch closely for the EMAs to cross to the negative direction, on one of the aforementioned timeframes - and then sell, when this occurred. Interestingly, If you were following the EMA cross-over points on the one-day timeframe, however, you wouldn't currently be holding ETH because the EMAs are still in the negative formation; instead you would be waiting to buy when they crossed to the positive direction.

Out of the above, I think my preferences would be either to use the 4-hour or 12-hour chart EMA crossover points. And if I were using this strategy, I should be holding ETH right now; hoping to take a profit if we get a spike up; but looking to sell if we get the EMAs crossing to the negative direction for my timeframe. In addition to this, I might likely also sell, if the b-bands on one of the timeframes started to 'un-tighten' due a significant move in the downward direction. What what happen here is that the price would the hit the bottom of the b-band, but instead of bouncing back up, it would continue dropping, thus resulting in the b-bands widening!

Potential profit if ETH hit the 50% retrace level: (273-231)/231 = 18% profit + upside potential if we exceeded the 50% retrace level.

Potential loss if ETH breaks below the 4 hour b-bands: (231-217)/231 = 14% loss + slippage if a large spike down occurs.

Overall, though, I'm probably a bit more bullish than bearish right now: I.e., the potential profit is perhaps looking more temping than the potential loss! ;)

Does anyone else have views/TA on the short/medium term ETH price, or any comments in general? :)

Finally, thanks for reading (if you made it all the way to the end of this post ;) )!

DISCLAIMER: I am not offering trading advice. Any comments in this post are merely things I might consider doing, and I'm not advising the reader to follow any of these potential strategies. I am not advising the reader to either buy or sell Ethereum. The reader must take full responsibility for any trading strategies they use, in regard to anything read in this post.

In short term I think is break-down!

But I always buy ETH (my think is long term).

You turned out to be completely right!!!! Have an upvote😄

Really you are profesionist trader and all the time you provide us with your great analysis!

From your strategies I prefer to use the 4-hour or 12-hour chart EMA crossover points.

Thanks for good job.

Thanks very much😄

Meme for your disclaimer =)

Thanks very much! I really got to figure out something consistent for this 😀

It seems like the ETH market in particular is really volatile at the moment.

Due to your superb analysis it looks like it is leaning towards breaking free and going on an upward trend but we can't know for certain yet.

Do you think it is a good idea to put money into ETH now @xaero1?

I know you don't want to be responsible for any trading someone does but it doesn't bother me if you get it right or wrong haha

Thanks for you great analysis with the helpful graphs

Sorry, I didn't reply before. I hope you didn't put money in at that point, or took it out - but it is a case of investor beware! I did say that b-bands tightening often lead to a break, but this can be up or down. And I did point to some negative factors - but even if I hadn't, it's still completely impossible to predict where the market is going with certainty!

Personally, I sold some later when the graph's curve started to accelerate in the downward direction, at about $225.

As for the short term outlook, I'm a bit negative right now. Some obvious negative factors: The one-week MACD had gone red; and the EMAs on the 12 hour chart have crossed to the negative direction. But who knows, it could still bounce around this price level.

Sad poems touch the heart @xaero1

https://steemit.com/poetry/@nadaa/the-destruction-of-the-heart-201788t183313780z

absolutely excellent analysis. Fantastic charting.

I need to add Ethereum to my crypto portfolio but I'm a bit scared of it; mostly because of that "crash to 10 cent" ordeal that happened with GDAX.

Thanks very much, esp. coming from someone who has done traditional trading in the past like yourself!

The crash to 10 cents thing though only should have affected you if you were doing margin trading or had stop loss market orders (right?). I never do the former, but will now also make sure I never place stop loss market orders either!! But otherwise, it was more of a non-event really imho...and nothing specific to ETH I'd say....just a standard fall in price/correction😉

Instead, the thing that scares me is the current inflation rate, and complete uncertainty about when/how/and perhaps even whether the switch to Proof of stake will take place. I most definitely want to hold ETH, but ideally only when it is POS😀

been in the process of moving to both a new office and home so I haven't been on here too much; missed out on chatting with ya. hope the trading week has done well for you :)

Interesting analysis, thanks. As you said however, not sure if you can really make predictions based on the previous events, given how the situation is different now (bull market -> consolidation period)

Brilliant comment.... i agree completely.

All these memes for a technical post addressed to fellow traders, just to please @xaero1 LOL!

Still understanding BTC charts, that I have to devote some time every day to read and understand lol. So ETH not sure yet.

Now you're blogging!

Thanks! (extra special, as you can write)😄

Hope you didn't touch ETH btw at that point - as the break turned out to be downwards (although not hugely so, yet)!

Although, I guess.... as discussed previously.....if you are dollar cost averaging and believe the market cap will eventually be higher at some pont in the future, then 'any time' is a good time to buy, you could say.

I'm a big fan of eth, but it's the current inflation that troubles me and makes me wary of holding it right now, because the consequence is a huge sell pressure - that must be counteracted by a huge buy pressure or the price must logically go down until they are in balance.

But I believe that if and when it's changed to 'proof of stake' it could sustain a very high market cap. The question is when will that change happen, and also if it's announced suddenly then price could spike up on the announcement and you'd have missed your buy in point :-/ This is the conundrum with ETH, imho!

Finally....maybe I need to change my 'description tag' to 'hates memes...' LOL🤣

Thanks @xaero1

Nope I haven't touched ETH yet. I guess there's always this worry with crypto investment, an emotional roller coaster ride I should say...But do you think investing in STEEM won't trouble you as well? Do you trust the platform enough, that you won't be able to get all of it back at the same time? I am just curious because it might sense for me to invest in STEEM instead.

Yeah lol, change your desc tag ! :P

I think the jury's still out on steem...I like it, but it's still slightly crazy that I kind of bought my way into it. Now I don't know what to do with my steem power...upvote cool articles or cute selfies? ;-/.

There's an intersting project on going on steem called 'whaleshares'. The idea is steem power can be made 'liquid' effectively by creating tokens to represent a steem power holder's upvote power....then these can be traded for money (steem dollars/whatever). It's a bit a crazy...though I guess could help make sp valuable.

I am ok with my steem investment because put simply it respresents only x% of my holdings (the rest bring other crypto or fiat). So, even if steem goes to 0....but if I'm still able to earn money regularly by trading I tell myself that I should be able to make back any investment losses eventually. Of course, I wouldn't be investing if I didn't hope for a big upside....something like $10 steem would be nice 😄

But there's a fundamental rule in crypto: 'don't invest more than you can afford to lose!'

But I invested a lot in steem power and don't plan on selling it ever assuming the platform can still grow user numbers. So, I'm not going try to advise against you investing in it!😃😃😃😃😃

Haha you're funny! I guess you're reaping the benefits now. Yeah, well I believe Steemit will grow more. And $10 is good enough to make your own post seen I guess, it's a good investment with long term reward. Just post more articles! ;) Or memes lol.

Here's my repost to both 'Haha you're funny' and 'Or meme lol' ;). Not sure if you've seen the movie, but the clip is ledgendary and also the source of a famous 'laughter' meme you might have seen (Btw, did you say I was funny?:P)🤣🤣🤣🤣🤣. [edit: warning: very strong language!]

HAHAHA, it's my expression sometimes online and in real life lol, 'haha you're funny' but not like a clown! I didn't know I got it from here lol

No, I haven't seen this film yet.

btw, you should also edit your desc to "I love cute selfies!" and funny.

LOL....it's maybe not one of the 'nicest' movies ever but it got plenty of awards from the critics iirc😄

But I was only semi joking....instagram is worth a lot of money, and I also think trying to spread steem power out to countries outside the western world can hopefully build the network effect. The more diverse the user base, and the more diverse the content.....then the more chances are that some of these specific use cases could be the drivers for mass adoption of the platform, perhaps. Hopefully quality content will win, but having as many irons in the fire as possible may be a sensible play for investors I'm thinking:)

Hello friend...

How are u ???

Master @ xaero1

Occasionally see my post 😁

Please give me your little voice master @ xaero1

Let me have the capital to trade 😄

Its going down for the good of the noobs.

Good call!😀