Bitcoin Options Trading: Introduction to Options

Disclaimer

This is not investment advice.

Introduction

This is the first section on trading options in Bitcoin. Both day traders and long-term investors in the cryptocurrency can benefit from using options to manage risk and create complex "plays" that escape the bull/bear mold for market outlooks. This first section explores the details of options, whereas the subsequent sections will cover the specifics of using Bitcoin options, as well as cover various powerful strategies or plays.

Traditional Investing

On any given day, there is a chance that the major indices of the traditional financial markets will report a new all time high. For those who have only recently begun watching the markets, or perhaps never have, this has not always been the case. Instead, this is a product of the current bull market. In a bull market, as traditional investment wisdom tells us, it is enough to just buy, at any price (within reason), and hold from there until the bull market has run its course (typically years in the future). (Note that although the stock market reaches new highs routinely, its volatility is at record lows, making trading unprofitable. In the following sections, Bitcoin options will be explored, leveraging the volatility of Bitcoin to make options trading profitable.)

However, as safe a bet as this might seem, it is still a bet, and comes with inherent risk. As such, investing a significant sum of money in this manner is not advisable. Although the odds are in favor of that money's appreciation, there is also the risk that it might depreciate, and that risk cannot be discounted or ignored. To limit this risk, derivatives are used as a hedge, providing the safety necessary to make such long-term investments possible.

Derivatives: Options

There are different classes of derivatives, and each serves its own use. Although there exist other highly speculative derivatives, the focus here will be on options, which provide the most control over profit and risk, allowing traders and investors alike to benefit.

Option Types

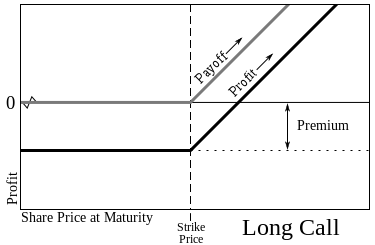

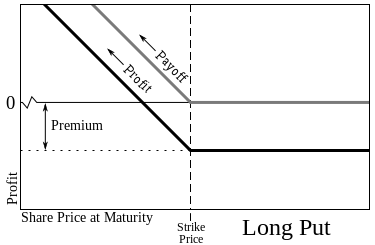

There are two types of options: calls and puts. Both calls and puts can either be bought or sold (selling is also called option writing), allowing for four different trades: call buys, call writes, put buys, and put writes. These four different trades, when combined with positions in the underlying asset, or with each other, produce a multitude of strategies related to price movements. Additionally, all options also have an expiration date and a strike price, both of which will be explained shortly. In basic terms, a call (put) option gives the buyer the ability to buy (sell) the underlying asset at the given strike price upon expiration. (Note that the options discussed here are European style options. There also exist American style options, which can be exercised - bought or sold - at any time before the expiration date. However, the explanation here is limited to European style options.) Let us begin with the most straightforward option, the call option.

Buying a call option gives the buyer the choice, at expiration, to buy the underlying asset at the strike price. As an example, say a buyer purchases a call option which expires tomorrow and has a strike price of $1000. If the underlying asset, let's call it stock in the ACME corporation, is worth $1001 by tomorrow, then the buyer can exercise the option, buying the stock for $1000 and immediately selling it for $1001, netting the difference of $1. (This process of having to exercise the option deliberately and purchasing the underlying asset can be eliminated by cash settlement, wherein the option price at expiration is just the value in cash gained by taking these actions, obviating the need for such busywork. We shall assume going forward that the options are cash settled.) In our example, if the price had instead dropped to $999 then the option buyer would not have exercised the option. That is, the buyer would not buy the stock at $1000 since the price of $999 is lower than $1000. This is the central purpose of an option, it gives the ability to make a purchase or sale at expiration, but does not require it (hence the name "option").

While call options allow the purchase of the underlying asset at expiration, put options allow the sale. Buying a put option gives the buyer the ability to sell the underlying asset at the given strike price on the expiration date. As an example, if a buyer purchases a put option that expires tomorrow with a strike price of $1000 on the underlying stock of ACME, then if by tomorrow the stock has fallen by $1 to $999, then the buyer can sell the stock worth $999 for $1000, netting the difference of $1. Alternately, if the price has risen to $1001 then the buyer will not exercise the option, since it is not profitable to sell the stock for $1000 when it could be sold on the open market for $1001.

As these two examples have illustrated, buying call and put options represent two different outlooks on the price. Buying call options assumes a bullish outlook (the price is expected to rise), whereas buying put options assumes a bearish outlook (the price is expected to fall). However, as we will discuss later, the many possibilities from combinations of different options with a potential position in the underlying stock mean that the binary outlooks of bullish and bearish do not capture the range of price targets that options can profit from.

Option Writing

Up to this point our discussion of options has ignored the price of these options. Although we shall avoid a thorough discussion of the pricing of options, it is worth noting that the standard laws of arbitrage apply, and so the prices of options in any liquid market will reflect their value. A call option with strike price $1000 of stock currently at $500 which expires tomorrow will not be worth much, if anything, whereas a put option will cost at least $500. Additionally, a highly volatile asset will have more expensive calls and puts, since the chance that it will reach farther out strikes is greater. (For further information on the pricing of options, the Black Scholes model is the defacto model for pricing European style options.)

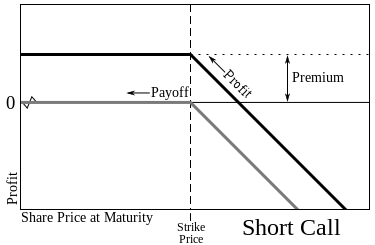

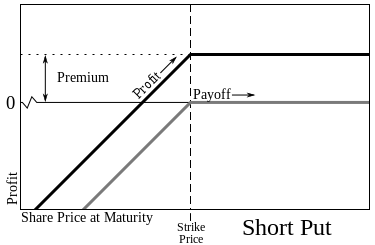

Now that we have prices for options, we can introduce the counterparty to option purchases: the option writer. An option writer receives the price that the buyer pays, but also must participate with the buyer if they choose to exercise their option. That is, if the buyer of a call option chooses to buy at the given strike price at expiration, then the option writer must sell the asset to them at that strike price. Similarly, the writer of a put option must buy the asset from the put buyer if they exercise at expiration. (As before, the mechanics of either buying or selling the underlying asset are obviated by cash settlement. The amount payed or received is just the difference in value between the strike and the underlying price.)

Consequently, writing call options assumes a bearish outlook, as the premium (price of the option) is received regardless of where the price goes, but the cost of selling the underlying asset above price increases linearly if the underlying price rises above the strike. In contrast, writing a put option assumes a bullish outlook, as the cost of buying the underlying asset at a price below the actual price increases as the price falls below the strike. Essentially, the option writer does not want the option buyer to exercise their option, meaning that the writer gets their premium and pays nothing for it. For the option writer, the cost is the risk associated with the underlying price either rising, in the case of a call option, or falling, in the case of a put option.

Conclusion

That concludes our introduction to options. We have seen examples of both call and put options, as well as option buying and writing. In the upcoming sections, we'll look at advanced option strategies that combine multiple option positions to escape the bull/bear outlook, as well as options exchanges that use Bitcoin as the underlying asset, which are especially profitable due to the high volatility of Bitcoin.

Nice information

......follow me

Thanks for the feedback! Followed :)