Market Musing 4-4-2019, CUBE! and Low Volatility Trading

Glad to be back after a 8 month Hiatus. A lot has happened. Perhaps my favorite is my Grandson Cube.

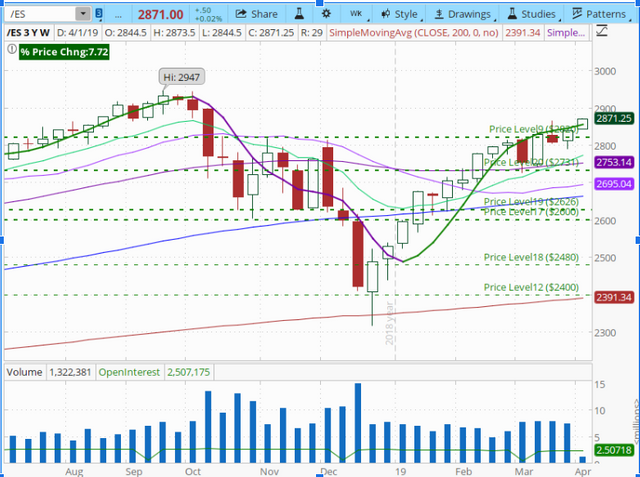

Low Volatility: VIX < 14. /ES Futures are potentially headed to new 2019 highs. The Market finally broke through the 2820 resistance this week and could add another 200 to the upside. A Fed Rate Cut is now being priced into this market in the face of poor US Economic Data. US and Global Economy are facing big tail winds Including Inverted Yield Curve in US Bonds, Real Estate Slow Down, China Tariffs, Brexit and EU Slow Down. Antipin, Jade Lizards, Put Credit Spreads, Call Diagonals and 10-30 Day Put Calendars trades are working.

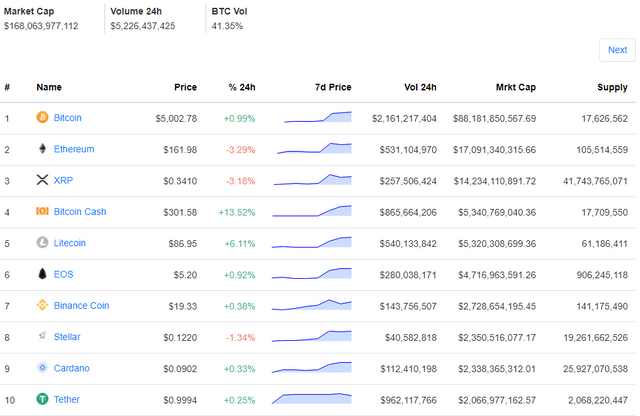

E-currencies vs US Dollar:

Bitcoin has also broken through the $4000 level and spiking to $5000+ overnight. EOS is not also broke out reach above $5.00 per token.. EOS continues to gain momentum. US Dollar is range bound between $95-$97.5 trading range since October 2018.. Euro still has challenges including Brexit, French riots and Banking Problems in Germany and Italy which should keep US Dollar elevated at these levels.

http://www.openmarketcap.com/

Cherry Picks Newsletters:

TastyTrade Researchers publish an awesome weekly newsletter every Tuesday.

https://s3.amazonaws.com/cherry-picks-s3-bucket-newsletter/live/19_04_02_tastytrade_Research.pdf?mc_cid=b8d0bbecde&mc_eid=e9e24bad07

If you are new to options or this blog sound like gibberish, please tryout Tasty Trades New 2019 Education. Includes 40 Videos, Testing and you get a certificate of completion at the end of the course.

https://tastytrade.thinkific.com/courses/beginner-options-courseTRADE Log: VIX < 15

- Credit Spread, Iron Condors

- Broken Wing Butterflies, Put Condors

- Jade Lizards

- 10-30 Day Calendars

- Weekly Antipin Butterflies

- Risk Twisted Spread for June