USD/JPY at crucial level with potential trend reversal in play

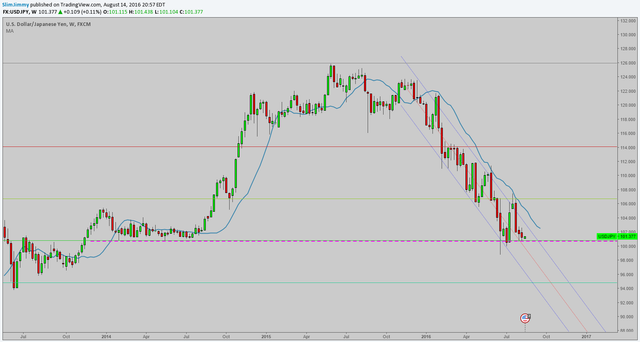

We have an interesting week ahead for this pair. Over the past few days this pair has been trying to find a bottom at a long term support level that coincides with a well respected fib level (see the below weekly chart).

I’ve been watching this one for a while, waiting for a sustained break to the upside through the current regression channel.

Over the past week this pair has been range bound. While we had steady releases of new economic figures, they fell largely in line with expectations, and any positive and negative surprises largely netted out to a neutral effect on price movement. (see calendar)

Leading into this week we still have plenty of upcoming event risk that could either push us into reversal territory, or potentially down through our current support level. In either case, I’m looking forward to a sustained move that could potentially last for several weeks.

We just saw the preliminary GDP estimates from Japan come in under estimates. I took on a small long position as I’m looking for the miss to push the price back to the top of our current range. If this week’s releases are consistently bullish for the USD, and price manages to break up through our current channel, I’ll be adding a significant long position with the expectation of holding for at least a week or more depending on whether we see sustained momentum.

If we break below the 100.00 level, I’ll plan to ride this one down to around the 96.2 level.

Cheers

@slimjim

I agree, thank you for sharing.

Certainly :)