Road to $1K. 3 Stocks. 7 Contracts. $300 Cost to Play. Value Of Contracts $39.4K.

Background:

I remember turning 8k into 20K within one earning season back in september of 2015. But I want everyone to learn how options trading works. So I started this new folder funded it with $200 and set GPS coordinates to $1K. Join me on the this path and if you have any questions ask below.

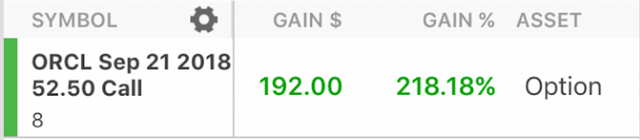

To catch you, current profit reading: 122%

Coming off recent gains in ORCL of 220%

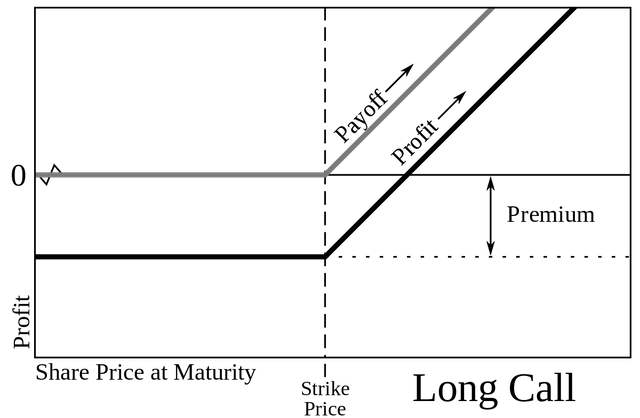

Call option is:

A call alternative, regularly just marked a "call", is a monetary contract between two gatherings, the purchaser and the vender of this kind of choice. ... The vender (or "author") is committed to pitch the item or budgetary instrument to the purchaser if the purchaser so chooses.

(This gives right, but not an obligation, to buy a set quantity)

FYI Put is:

Put or put choice is a securities exchange gadget which gives the proprietor the right, yet not the commitment, to offer an advantage (the fundamental), at a predefined value (the strike), by a foreordained date (the expiry or development) to a given gathering (the dealer of the put). The buy of a put choice is deciphered as a negative assumption about the future estimation of the hidden stock.

Day 1:

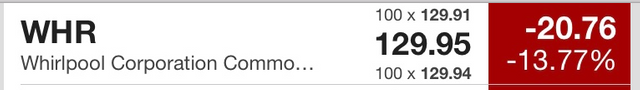

This morning, I woke up to learning that WHR was down -14%. I started to itch, and started digging into as to why that happen. Chief Marc Bitzer said Tuesday on call with Investor told speculators that increasing expenses in crude materials, unit volume decrease and foreign currency volatility contributed to a slump in earnings in the second quarter. The organization said it anticipates that crude material swelling will hit $350 million out of 2018.

Whirlpool Corporation manufactures and markets home appliances and related products. It operates through four segments: North America; Europe, Middle East and Africa; Latin America; and Asia. The company's principal products include laundry appliances, refrigerators and freezers, cooking appliances, dishwashers, mixers, and other small domestic appliances. It also produces hermetic compressors for refrigeration systems. The company markets and distributes its products primarily under the Whirlpool, KitchenAid, Maytag, Consul, Brastemp, Amana, Bauknecht, Jenn-Air, Indesit, and Hotpoint. Whirlpool Corporation sells its products to retailers, distributors, dealers, builders, and other manufacturers. The company was founded in 1898 and is headquartered in Benton Harbor, Michigan.

After doing a bit of digging, I saw that analysts at Credit Suisse lowered the price target on Whirlpool to $175 from $195 after the earnings report. Which is a health price movement from current levels.

Purchased: 2 Contracts

Cost .38*2= $76

Capital Required to Purchase Stock= $26,000

Control 26k with .002% for 59 Days.

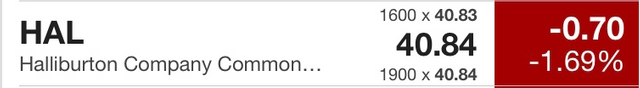

Next, I went for Monday's Biggest Loser: HAL

With this one, I looked for some signals that I personally,

52 Week Range 38.18 - 57.86, It happens to be closer to low, which i like.

Under extraordinary circumstance in which a stock is pounded harder than it merits, setting up a potential long haul (or here and now) section point into a quality value prepared for a skip. Halliburton (HAL) has all the earmarks of being setting up for such a circumstance. This is a solid decision for an oil benefit stock and is our second decision behind contender Schlumberger (SLB) long haul. We as of late were energized by Schlumberger's execution and believe that Halliburton, much like its rivals in the division, will profit longer term from the oil advertise which has been turning positive as it discovers harmony. I think HAL is well setting up for that.

Halliburton Company provides a range of services and products to oil and natural gas companies worldwide. The company's Completion and Production segment offers production enhancement services, including stimulation and sand control services; and cementing services, such as bonding the well, well casing, and casing equipment. It also provides completion tools that offer downhole solutions and services, including well completion products and services, intelligent well completions, liner hanger systems, sand control systems, and service tools; production solutions comprising coiled tubing, hydraulic workover units, and downhole tools; and pipeline and process services, such as pre-commissioning, commissioning, maintenance, and decommissioning. In addition, this segment offers oilfield production and completion chemicals and services; and electrical submersible pumps and progressive cavity pumps, as well as artificial lift services to enhance reservoir and wellbore recovery. The company's Drilling and Evaluation segment provides drilling fluid systems, performance additives, completion fluids, solids control, specialized testing equipment, and waste management services; and drilling systems and services. It also offers wireline and perforating services, including open-hole logging, and cased-hole and slickline; and drill bits and services comprising roller cone rock bits, fixed cutter bits, hole enlargement, and related downhole tools and services, as well as coring equipment and services. In addition, this segment provides integrated exploration, drilling, and production software, as well as related professional and data management services; testing and subsea services, such as acquisition and analysis of reservoir information and optimization solutions; and project management, consulting, integrated asset management, and well control and prevention services. Halliburton Company was founded in 1919 and is based in Houston, Texas.

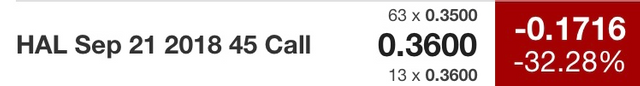

Purchased: 2 Contracts

Cost .40*2= $80

Capital Required to Purchase Stock= $8,000

Control 8k with 1% for 59 Days.

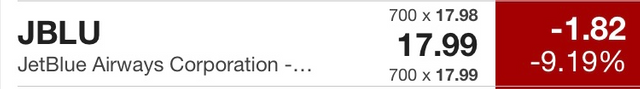

Lastly, on a day when CEO Robin Hayes said the airline is "not wedded" to growing for the sake of doing so but said it is picking markets where it has performed well.

During the second quarter, JetBlue's unit revenue declined 1.2% year over year, due to a 3.75-percentage-point headwind from the timing of Easter and a credit card program bonus received in the year-earlier period. Meanwhile, its average fuel price rocketed higher from $1.61 per gallon to $2.28 per gallon.

I had to add some budget airline action in my folder. For this one, I did it for the love of JetBlue. I have made serious cash from this one before. Even though negative outlook to be taking over this stock. I am Positive that any fall oil price will directly influence this stock as 50% of company expense is due to fuel.

Purchased: 3 Contracts

Cost .22*3= $76

Capital Required to Purchase Stock= $5,400

Control 5.4k with 1.4% for 150 Days.

Total Purchased: 7 Contracts

Cost = $232

Capital Required to Purchase Stock= $39.4k

Control 39.4k for .05% of average of 75 days.

If you have any recommendation as to what I should add into the folder, comment below.

In the future I will Host contests under here.

At what platform you are doing this? I mean can you share the URL i.e. where we can join you as said in the post?

This platform is TD banks. I dont know where you are in the world. TD bank and access is available to USA and Canada's citizens.

Thanks for help buddy, I hope this is the one you are talking about https://www.tdbank.com/

correct

Thanks for the confirmation :)