OneLuckyFlip’s Crypto Trading Tips and Tricks: Placing sell order on a Low Volume Coin

INTRODUCTION

Audience: Novice cryptocurrency traders

Have you ever had an order unfulfilled by only a few satoshis, and now are sitting waiting for the next bounce? This could happen quite often on a low volume coin. Here are three tips using LEVEL 2 data that have helped increased my chances of completing a quick sell while keeping good returns on low volume coins.

EBST/BTC BUY

Let’s say you complete this trade with EBST/BTC

• as price is 20% below recent strong base,

• and the coin is priced at it’s lowest in 10 days.

The daily activity of this coin has dropped to an average of 20-30 BTC, and you noticed that the latest bounce back was very weak. You decide then you want to sell most of your position quick.

1. EVALUATE RECENT REPEATED PRICE TOPS

First, use chart history in Coinigy to review most recent price tops followed by a quick dip. Start with a couple of days back using 1 hour chart, and if necessary go out further in the past. The idea is to figure out a good selling point BELOW these tops. At price top of 3875 – 3900 satoshis, I would put my selling range between 3700-3850 satoshis.

RECENT TOP PRICE ANALYSIS

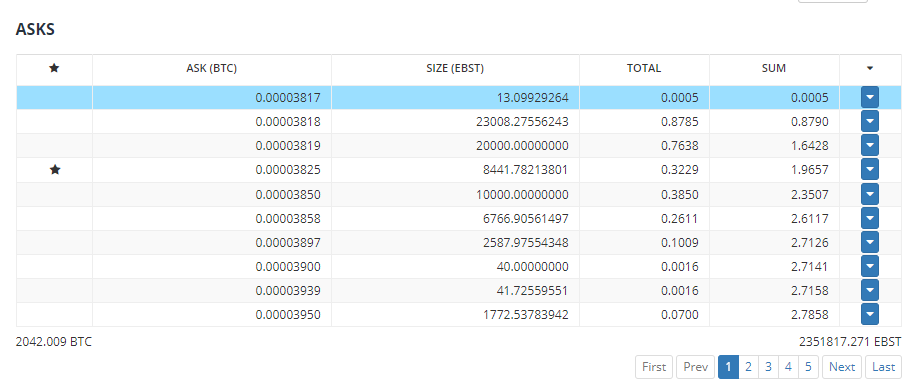

2. EVALUATE SELLING WALL PRICE POINTS IN ASK ORDER BOOK

Next, check for price points where big orders are at in the exchange ASK order book (level 2 data). Sometimes these are referred to as "walls" as these prices prevent value of the coin from moving up. You can use coinigy to evaluate, but it is best to log in to your exchange of choice to get the most up-to-date numbers.

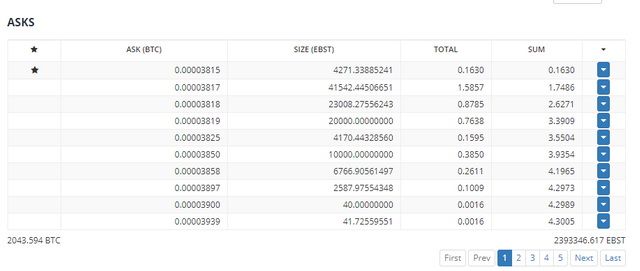

In chart below, the big order price points start at 3818, so then I have moved my order from 3825 to 3815 so I am not wedged in between the price “walls” while still be within my selling price range.

**NOTE: Walls are typically considered to be MUCH bigger than the example, but for educational purpose here I'm going to refer whatever price that stunts growth as seller wall.

MY SELL ORDER WEDGED BETWEEN WALL ORIGINALLY

MY SELL ORDER BELOW, AFTER MOVING

3. CONSIDER MOVING YOUR ORDER AT THE TOP OF THE LIST

If the price at top of the ASK order book is within your selling range, go ahead and have your order priced there or make one slightly below so you would be the first to complete once a taker buyer comes in. At price of 3815, I am already at the top of the list.

ORDER COMPLETE

Once the sell order has been strategically place, just wait for your order to complete.

ORDER MISSED, THEN COMPLETE

Notice a couple of points on the graph above.

• A rebound happened up to the "wall" after my buy completed. Remember when I had my order wedged between the big orders in the 'before' chart? That’s why I missed out on getting the sell completed. If I had the price placed below in the first place, I would have had a less than 1 hour sell!

• Upon making the adjustments though, the price hit again, and this time my order completed for nice 9% gain.

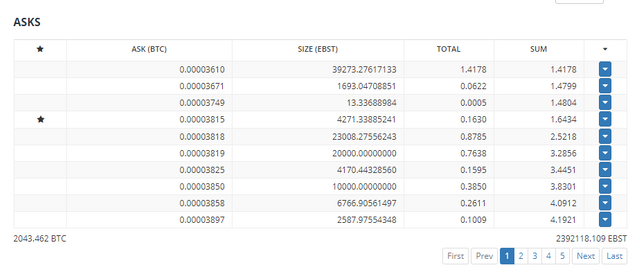

OTHER CONSIDERATIONS

• Sell order completions will take time because activity is low so be patient.

• Other orders may pop up ahead of you while you wait that could make another wall. Remember to not panic and NOT move your order ahead of this wall. Keep your ground and stick to your price range. Here below if I decided to move my order over this wall priced at 3610 I would have lost out on my gains.

NEW BIG ORDERS FORMED OVER TIME

DISCLAIMER AND CREDIT

Nothing here is meant as financial advice. This is just a strategy that I'm using as a cryptocurrency day trader. Please seek a duly licensed professional for any financial advice. Never forget, cryptocurrency trading is extremely risky and never invest more than you can afford to lose!

Thanks for visiting my blog and happy trading everyone. Let me know if you have any suggestions or questions in the comments section!

Congratulations @oneluckyflip! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPThis is an informative post with crucial information that I wish I had as a new trader, knowing how to maneuver walls will save you a lot of headaches.

Hello @oneluckyflip

You adjusted your sell order from 3825 to 3815. You also reduced your quantity by approximately 51%, from 8441.78213801 to 4271.33885241. What about the difference? What did you do with the remaining 4170.443286 EBST coin? Hope to hear from you soon.

Can I please get involved in the group chat??