FIBO EXPANSION

Targeting is the most important element of trading! Without it, it is impossible to assess the ratio of risk and profit, i.e. you cannot draw up a trade plan, which means you cannot open an order! It is especially important to see target zones for those who do not have the ability to constantly monitor the order in order to close it manually at the right time. Are you new to the market or "old man" -

you will be amazed by the simplicity, convenience, accuracy and versatility of targeting by FiboExtension! I use it IN ALL of my trading systems!

You know where the train is going - you can get to the desired place by boarding it at any station. You know where the price is going, you can open a profitable trade almost anywhere. “If I had known the purchase, I would have lived in Sochi,” - this is from the same opera. With the help of the Fibo extension we will always know the "buy-in",

evaluate the potential of the deal and decide whether we need to use the given opportunity or it is better to sit on the fence, out of the market.

Memories from childhood. Once I read a huge number of books on trading and at the same time constantly met advice to evaluate the profitability of a transaction, i.e. determine TP / SL. But the authors apparently believed that I knew how to create such a "trifle" without them, so either they did not explain how to do it, or they said that the goal should be at some of the S / R levels.

I just studied these same levels and drew them with all my might. As a result, the nearest of them, for some reason, always turned out to be very close to the intended entry point and there was no question of a good TP / SL. Moreover, even in history, I have not seen places where TP / SL was at least 1: 1. And the authors seemed to mock and repeat in chorus: “Either 2: 1, or higher,

otherwise you will be immediately kaput. I felt completely dumb and was incredibly angry ...

FIBO EXPANSION TOOL IN TRADING TERMINALS AND TA PROGRAMS

I have not discovered anything new. For example, DiNapoli used something similar and even described it in detail in his book "Trading by Dinapoli Levels" and you can (advise) see how he suffers there with the transfer of the usual "fibo correction" (FC) tool to a new point, while wasting time and quality (accuracy) of construction. It's much easier for us.

All modern technical analysis programs have a much more convenient and accurate tool. In the Metatrader terminal of any version, look at the "Insert / Fibonacci" menu - there is a built-in "Expansion" tool, which I advise you to bring to the "Graphical instruments" panel (unnecessary from the DELETE panel), because sure

that it will be one of your most frequently used tools. Possibly the second in frequency after the timeframe switching buttons. )) How it looks can be seen in the picture of the announcement of the article. Levels 62, 100, 162, 262, 220, 400 are shown, you can also add 500 (560), but for now, for beginners, it is enough to limit themselves to the ones highlighted in bold.

just look at the rest - then they will come in handy.

Types of Fibonacci extension tension (tightness)

The type of tightness is not so much the name of a specific method, but rather a characteristic of price behavior at extreme points (SITUATIONS), at which we set three points of construction of our instrument (see the picture of the announcement). Therefore, we will often assign several "names" to the same FR preload. But don't be alarmed, everything is SO simple

that in this article it would be possible to do with almost no text, just pictures.

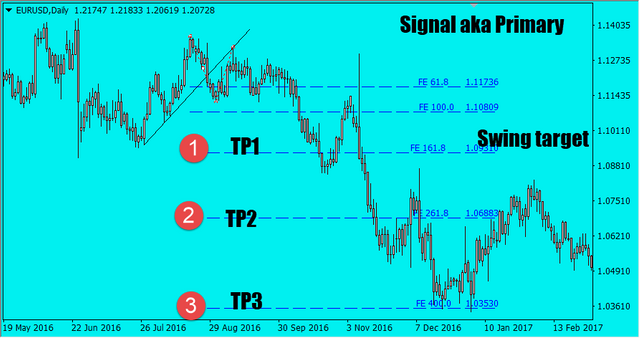

"Primary" fiber expansion preload

Primary is the FIRST possible interference from the start of a trend or movement (wave) that you are entering. Its volume 1 of the construction is always on GMs or GMs (I warned you to open a school dictionary). In this case, it coincides with the signal interference, to which we proceed:

"Signal" fiber extension tension

This is an interference on the SIGNAL. Any signal can be either graphical (breakout or breakout) or indicator. With this tension, p. 3 should be directly on the drawing of the signal configuration, i.e. before a breakout during graphical analysis or on a group of bars that gave an indicator signal.

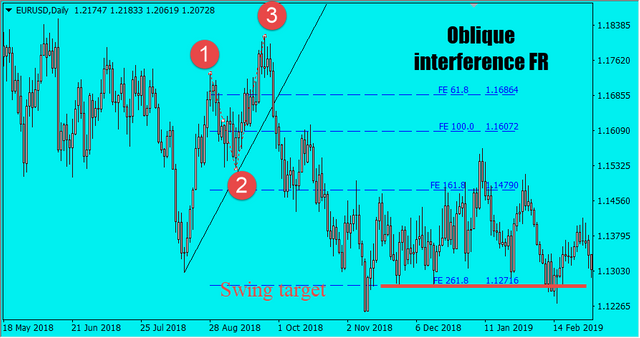

Oblique interference FR

This is an interference in which point 3 is non-standard relative to point 1. Unlike three "straight" pulls (the third is "Push", discussed below), on an oblique pull, when determining a bearish target (down), p. 3 will be higher than p. 1, and vice versa - when determining a bullish target (up), i.e. 3. will be below point 1, as shown in this figure:

This post is for @steemcurator01 @steemcurator02 reading.

Thank!