Price Action Trading -- Support & Level of resistance will be the best levels to operate on your chart

Listed below are 4 things you got to know:

Support & Resistance

Previous Support converts Resistance

Active Support & Resistance

Trending & Retracement move

Let's begin.

Support & Resistance

Support - A location on the graph, with potential buying pressure, to thrust the purchase price higher.

Resistance - A location on the graph, with potential offering pressure, to motivate price lower.

Here're a few cases:

support and resistancesupportresistance

Remember...

...Support & Level of resistance is not really a single range, but a location on the chart

Next...

If price breaks below support, prior support becomes level of resistance.

If price breaks above level of resistance, previous amount of resistance becomes support.

Now:

You've just learned what exactly are Support & Level of resistance, and their role reversal with each other.

They are "static" Support & Amount of resistance, where their areas are set on the graph.

But wait... that isn't all.

Active Support & Resistance

Because Support & Level of resistance can move along with price, to create Active Support & Level of resistance.

Active support occurs within an uptrend and active amount of resistance in a downtrend.

They could be determined using moving averages. (I take advantage of 20 & 50 EMA).

You're pondering:

Rayner, will there be anything special about 20 & 50 EMA?

The answer is no. I make use of it because it suits my trading style. Eventually you will need to find something that best suits you.

Indicators are simply just trading tools. It's how you utilize them that produce a difference.

Impulse & Corrective move

Here's what After all:

Impulse move - "Longer lower leg" on the graph, which tips the course of the craze. Candlestick size is usually much larger, signalling momentum behind the move.

Corrective move - "Shorter" knee on the graph, which is against the existing tendency. Candlestick size is usually smaller because of dealers taking earnings, without strong offering pressure.

If you wish to find out more, go read Impulse & Corrective move compiled by Chris Capre.

Here's a hint for you...

You can operate pullback over a corrective move, and breakout on the impulse move.

Based on your trading style, both techniques let you can get on board the pattern.

Now, let's move onto to another section...

The 4 levels of the market segments every serious investor must know

The marketplaces are always changing. It steps from an interval of a style to a variety, and range to pattern.

You may break it down further into 4 levels:

Accumulation

Advancing

Distribution

Declining

Stage 1: Deposition phase

Build up usually occurs following a semester in prices and appears like a loan consolidation period.

Characteristics of build up phase:

It usually occurs when prices have dropped during the last six months or more

It appears like long amount of consolidation throughout a downtrend

The 200-day moving average will flatten out after a cost decline

Price will whip backwards and forwards about the 200-day moving average

Stage 2: Improving phase

After price breaks from the accumulation stage, it switches into an advancing period (an uptrend).

Characteristics of evolving phase:

It usually occurs after price breaks out of build up phase

Price forms some higher highs and higher lows

Short-term moving averages are above long-term moving averages (e.g. 50 above 200-day ma)

The 200-day moving average is directing higher

Price is above the 200-day moving average

Stage 3: Syndication phase

Syndication usually occurs after a growth in prices and appears like a loan consolidation period.

Characteristics of syndication phase:

It usually occurs when prices have increased during the last six months or more

It appears like long amount of loan consolidation during an uptrend

The 200-day moving average will flatten out after a cost decline

Price will whip backwards and forwards surrounding the 200-day moving average

Level 4: Declining phase

After price reduces of the circulation phase, it switches into a declining stage (a downtrend) and involves lower highs and lows.

This is actually the stage where stock traders who do not slice their damage become long-term shareholders.

Characteristics of declining period:

It usually occurs after price breaks out of syndication phase

Price forms some lower highs and lower lows

Short-term moving averages are below permanent moving averages (e.g. 50 below 200-day ma)

The 200-day moving average is directing lower

Price is below the 200-day moving average

So, you've learned what exactly are the 4 levels of the marketplace, and the main element characteristics to consider.

Now, let's move onto another section...

How to inform when the marketplace is trending

There are a famous Wall Road saying that moves like this...

Question: What's the tendency of the marketplace?

Answer: What's your time body?

You're thinking:

Exactly what does it mean?

This implies there are developments on different time casings. You could have a downtrend on five minutes graph and an uptrend over a daily chart.

So, you've comprehended that fads can exist in several time frames.

Now... let's understand how to identify a pattern objectively.

You can find two methods for you to go about it:

Framework of the markets

Moving average

Framework of the markets

The marketplace is within an uptrend when there's group of higher highs and higher lows.

Furthermore, in a downtrend, there's some lower highs and lower lows.

Moving average

Alternatively, you may use a moving average to explain the trend.

Here's ways to do it:

20 ma - Short-term trend

100 ma - Medium-term trend

200 ma - Lasting trend

If 20 ma is directing higher, and the purchase price is above it, then your short term craze is up.

If 100 ma is directing higher, and the purchase price is above it, then your medium-term craze is up.

If 200 ma is directing higher, and the purchase price is above it, then your long-term craze is up.

If you wish to find out more, go watch working out video below:

Now, let's understand how to identify a variety market...

How to notify when the marketplace is ranging

A variety market is included between Support & Level of resistance.

Now, prior to the light bulb in your mind should go off with "buy low and sell high", I'd like you to start to see the simple fact of trade range marketplaces.

Because in real life, you get versions like:

Range expansion

Range contraction

Range expansion

This occurs when the marketplace does a phony breakout and investments back into the number. Thus extending the "space" between Support & Amount of resistance.

Selling at level of resistance would get you halted out, as price breaks above the amount of resistance, only to operate back to the range.

This occurs when the marketplace enters an interval of low volatility, usually credited with an impending major information release.

Seeking to "buy low sell high" would put you on the sidelines as the marketplaces gone into a tighter loan consolidation.

Individually, I find range enlargement and contraction one of the hardest marketplaces to operate, and I stay from it.

Now, let's move onto something interesting...

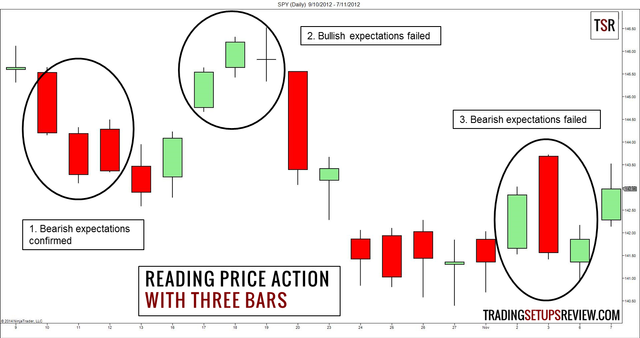

How to browse the price action of any marketplaces (and determine the durability and weakness of computer)

Here are the items I consider:

Slope of impulse techniques getting flatter

Candlestick bodies becoming smaller and smaller on impulse move

Slope of corrective move getting steeper

Candlestick body getting bigger on corrective move

Slope of impulse goes getting flatter

Here're a few illustrations to walk you through...

a - Impulse move higher which appears normal within an uptrend

b - Corrective move lower, but candlestick physiques size are increasing in comparison to earlier corrective move. That is something unusual

c - Impulse move which is temporary. Possible complicated pullback establishing

d - Corrective move examined the prior low

e - Impulse move higher that ought to lead to the resumption of trend

f - A wrong breakout. The corrective move has large bodied candle lights and gets steeper. This won't look good

g - A weakened try out by the bulls to gain back control

Overall:

The uptrend gets weak. Support will come in around 175 which really is a strong type of defence for the bulls.

I will turn to long or stick to the sidelines. No shorting at this time.

A rest and close below 175 would be bearish with the conclusion of a mind & shoulders design. If it happens, I'll turn to short or stick to the sidelines.

a - Impulse move lower with an enormous spike down (possibly scheduled to reports event). Price remains trading towards the reduced

b - Corrective pullback with small bodied candle lights, which appears normal in a downtrend

c - Vulnerable impulse move lower. Where does the retailers go?

d - Strong corrective move higher with large bodied candle lights. The style is possibly over and may transit into a variety market

e - Sellers arrived in and attempted to motivate price lower. If it breaks below the prior low, the tendency could resume. Nonetheless it couldn't

f - Bulls taking control once again at attempt towards resistance area

Overall:

Bulls and bears are in equilibrium at this time as both bullish and bearish candle lights are of similar size.

I'll turn to short or stick to the medial side. No longs at this time.

If price breaks above the level of resistance area at 0.6900, then I'll look for longs or stick to the side.

a - Impulse move higher which broke and close above amount of resistance. Candle systems are large exhibiting strong bullish momentum. Anticipating the trend to keep

b - Incorrect breakout as price deals back into the number. Candle physiques are large displaying strong bearish momentum. It generally does not look good here. The final type of defence will come in at 91.00 support area

c - A vulnerable look at by the bulls to force the purchase price higher. The tiny bodied candle lights show having less durability by the bulls

d - Bears regain control and thrust price lower, breaking 91.00 support (this can be an impulse move lower). Large bodied candle lights show symptoms of power by the bears

e - A fragile make an effort by the bulls to thrust the purchase price higher. Again it shows insufficient power, with small bodied candle lights and flatter slope

f - One bearish candlestick wiped out increases in size of the previous 14 candle lights, with prior support now switched resistance

Overall:

The bears are plainly in charge now and I'm seeking to short or stick to the attributes. No dreams about me at this time.

For even more readings, I would suggest the works of Lance Beggs.

Now, let's move onto this issue of candlesticks...

Stop memorising candlestick habits, you only need to find out these 4 things

They are:

Wick

Amount of the wick

Size of your body

Close of the candle

Wick

The wick of the candlestick presents price rejection. In the event that you see a much longer wick, it symbolizes increased price rejection.

Amount of the wick

In general...

When you see wicks "flying" around your graphs, you're probably in a "choppy" condition (usually in a variety market).

So when you get little to no wicks, you're probably in a "cleaner" condition (usually in a solid trending market).

Size of the candle

The simplest way to recognize momentum in the marketplaces is, to check out how big is the body.

A big body shows better momentum, and a tiny body shows too little momentum.

Close of your body

To recognize who's currently in charge, you'd want to see where in fact the candle closes.

If it closes near to the highs, the bulls are in charge.

If it closes near to the middle, the marketplace is undecided.

indecision

So, are you pumped right now?

Because you are going to learn something awesome...

Advanced candlestick knowledge (that no one discusses)

I used to get thrilled when I place a candlestick routine i memorised.

"Look, a filming star! The marketplace is proceeding lower for certain!"

And it rallied 300 items.

Now...

Rather than "copy-pasting" what specific candlestick means, I'll go further into it.

I'll clarify for you how never to operate them, how to operate them, and other modifications of it.

Some tips about what you"ll learn:

Pinbar

Inside bar

Increasing three method

Wide variety candles

Slim range candles

Pinbar

A Pinbar is a reversal structure, that was first unveiled by Victor Sperandeo, in his publication, Trader Vic: Ways of a Wall Block Master.

The main element takeaway relating to this routine is price rejection.

Bullish Pinbar - A little bodied candlestick with an extended lower wick, exhibiting rejection of lower prices.

Bearish Pinbar - A little bodied candlestick with an extended upper wick, displaying rejection of higher prices.

Now:

Because you visit a bearish Pinbar, doesn't signify price will trade lower.

In fact, it is almost always simply a retracement in just a trend.

Usually do not "blindly" go brief when you visit a bearish Pinbar or go long when you visit a bullish Pinbar.

Chances are, from the retracement inside a trend.

Within an uptrend, only trade bullish Pinbar at a location of support

In a very downtrend, only operate bearish Pinbar at a location of resistance

Pursuing these simple guidelines, you'll greatly raise the probability of your trade training.

Recall:

The Pinbar shows price rejection on the graphs.

But, there are several ways showing price rejection, and it might not exactly come by means of Pinbar.

If you believe about any of it, Pinbar is really an Engulfing style on less time frame.

Remember...

Price rejection will come in many varieties. You should give attention to price, not the routine.

It could be both a continuation and reversal routine (I'll give attention to continuation design).

The main element takeaway concerning this structure is low volatility. Thus, you can get an accessibility with tight halts on this structure (and transform your risk to compensate).

Inside club - Small candlestick contained within the prior pub highs and lows

How never to trade it?

Most investors would operate the respite of the within bar, hoping to fully capture a quick earnings.

But...

Within a choppy market, having less momentum usually leads to many loss (so it is better to avoid choppy marketplaces).

The very best Inside club setups take place when:

Price breaks out of a variety with strong momentum

It's a solid trending market

Trading in direction of the trend

Here's what After all...

inside club with tendency1inside pub with craze2

Another variant of the within pub is coined the "Fakey", by Nial Fuller.

It's when the within pub breaks out in a single direction, and then invert and close in the contrary course (otherwise known as a wrong breakout).

Moving on...

Growing three method

This pattern was initially launched by Steve Nison, in his publication, Japanese Candlestick Charting Techniques.

The main notion of this style is pattern continuation.

Increasing three method - That is a bullish development continuation move, with three bearish candle lights as a retracement within an existing trend. A bearish candlestick closes lower, signalling the bears are back control.

Dropping three method - That is a bearish craze continuation move, with three bullish candle lights as a retracement within an existing trend. A bullish candlestick closes higher, signalling the bulls are back control.

By looking forward to this precise structure to occur, you will not get many trading setups (pursuing a precise 3 candle lights pullback).

So... how many other patterns is it possible to trade?

If you believe about any of it, another variation of the routine is the flag or pennant development.

Next...

Wide variety candles

A variety candle is developed due to the imbalance of buying/advertising pressure.

This symbolizes "hidden" Support & Amount of resistance in the market segments (known as Resource & Demand by Sam Seiden)

There are merchants who swear by Resource & Demand, plus some who have the desired effect, with Support & Level of resistance.

You do not want to operate them in isolation, but utilize them with other technological tools, that add confluence to your deals.

Price action trading strategy -- Small range candles

When there is an abrupt range growth in market that is trading narrowly, individual nature is to diminish that price move.

If you get range enlargement, the marketplace is mailing you an extremely loud, clear indication that the marketplace is getting prepared to move around in the direction of this growth. - Paul Tudor Jones

You're questioning:

Exactly what does it mean?

To put it simply, when you get group of narrow range candle lights (volatility contraction), incomparable an explosive move. (These conclusions can be validated by the works of Adam Grimes, Tony Crabel, and Tag Minervini.)

So, what's the ultimate way to enter such deals?

You can turn to trade the original breakout or the pullback following the breakout.

The very last thing you'd wish to accomplish is trade from the breakout.

Let's move ahead...

A cost action trading strategy that works

Here's what you must do:

Mark your regions of Support & Level of resistance (SR)

Await a directional transfer to SR

Await price rejection at SR

Enter on another candlestick with stop reduction beyond the golf swing high/low

Take income at the swing action high/low

- Mark your regions of Support & Resistance

recognise your support & resistance

- Await a directional transfer to Support or Level of resistance area

directional move

- Await price rejection at Support or Amount of resistance area

price rejection2

- Enter on next candlestick with stop damage above the golf swing high

accessibility and stops

- Take earnings at the swing action low

You may consider taking half your situation off at the nearest swing action low, and the rest of the at the further swing action low.

This will depend on your trade management.

take profits

That is important...

You need to understand the trading strategy isn't the ultimate goal.

In fact, you are going to have both winners and losers. And the thing that could keep you in this game is proper risk management. My advice is to associated risk only 1% of your bank account on each trade.

Congratulations @miprimerbitcoin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPEste Post ha recibido un Upvote desde la cuenta del King: @dineroconopcion, El cual es un Grupo de Soporte mantenido por @wilbertphysique, @yoenelmundo y 5 personas mas que quieren ayudarte a llegar hacer un Top Autor En Steemit sin tener que invertir en Steem Power. Te Gustaria Ser Parte De Este Projecto?

This Post has been Upvote from the King's Account: @dineroconopcion, It's a Support Group run by @wilbertphysique, @yoenelmundo, and 5 other people that want to help you be a Top Steemit Author without having to invest into Steem Power. Would You Like To Be Part of this Project?

This post has been ranked within the top 25 most undervalued posts in the first half of Jul 29. We estimate that this post is undervalued by $18.97 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jul 29 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Congratulations @miprimerbitcoin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @miprimerbitcoin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @miprimerbitcoin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @miprimerbitcoin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @miprimerbitcoin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @miprimerbitcoin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @miprimerbitcoin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP