What Makes Trading Unique as a Profession? [SPOILER ALERT IT AINT THE MONEY]

No day in trading is satisfying. When you make money, you didn't make enough; when you lose money, you never should have lost money in the first place. That being said, I wouldn't want to live any other way.

There's more than one way to make a buck in this world. Some of these paths lead to something we as a society like to call "financial freedom."

Nothing is more indicative of the American Dream than scaling the summit of business and attaining this much vaunted goal. This dream is becoming ever more a Global Dream, as more and more countries and people come online to the world-wide financial system; getting rich and living a good life are becoming universal goals.

While there are indeed many professions that could ultimately lead to financial freedom in the future, very few, however, allow for freedom along the journey to this goal as well.

Many times, professionals find themselves beholden to a boss, a client, or someone else that controls the power to sign paychecks and affect general well-being. Even though bank accounts may grow, professionals may see their real freedom of thought and action slowly erode as they become more adapted to the culture that sustains them.

These are the proverbial golden handcuffs.

Trading, however, is a different way to make a living. Traders define the game they wish to play and share many things in common with entrepreneurs. This shouldn't come as a surprise: traders need to treat their operations like a business and focus on the bottom line.

This intellectual freedom can come at a burden, however; the shrewd market operator must have the intellectual flexibility to abandon an idea that doesn't work anymore, regardless of how well it has performed in the past or the personal effort already expended supporting the idea.

Unprofitable trading strategies need to be tossed aside just as a successful business divests or abandons unproductive projects and investments.

Stubbornness should never be confused with discipline: sticking to an idea who's time has come and gone is tantamount to being out of control.

This isn't to say a trader is an island, entire of itself. Far from it, traders are free because they are beholden to everyone else in the market.

An Exchange organization provides a bridge to connect all market participants via the act of trading. In being dependent on everyone else in the market in a small way, traders gain an ironic sort of freedom of thought and action. This is the effect of decentralization which can benefit all market participants.

This has the effect of sterilizing some of the need for interpersonal communication... Even if you hate the trader standing across the pit, you can still trade with him, or you can trade with other people around him.

In an electronic market you don't even see who you're trading against. This can create the illusion that the trader is indeed an island. It has the everyday effect of allowing a speculator an unparalleled freedom of thought and the ability to take large intellectual risks without much personal or career risk.

This contrasts heavily with other professions. In the extreme case, a worker's paycheck could be at the discretion of one individual. In this instance, interpersonal communication probably matters more than actual performance. Many workers must actively manage the expectations of a group of taskmasters who control the feeding tubes.

In many firms there is a mismatch between time cycles: e.g. a worker might see a boss everyday but get a yearly performance review. Bullshit can exist for much, much longer in this kind of environment than in the trading floor; PnL is the ultimate clarification and is computed in real-time for traders. This, as it turns out, provides a luxury of certainty that is very rare in this world.

Boy that opening is so true it hurts...

certainly feeling that "cant get no satisfaction" moment today, as one side of the portfolio does a sommersault while the other grinds in place...

I JUST don't like Crypto-traders that much because, they claim to be anti-establishment Crypto rebels and yet 99% worse mentality (GREED) than Wall Street traders.

Yes I've GREED too, I want to make many of people life better by adding value. So Invest in projects/people who has/have the potentional to add more value to peoples life. Proud to be Value-Invester.

Can't wait for more people use DEX (decentralised exchange) and we'll make sure there is much money to be made by being a crypto trader.

I truly believe that most traders will trade nuclear bombs as long as the trade make them money. They care less about what they trade.

I just don't like your mentality and most of them are doing bad and bad things come to you sooner than later.

@nathanmars:

I thought like you some time ago, but then, "Hey! They are greedy, but they are a necessary part of the system, not the best part, of course, you need doctors and they are better, but if you don't have volume of money moving between places you wouldn't have liquidity in this decentralized exchangers."

But "bad things"? I believe there are worst things like big bad people with a nuclear power button, crazy people, you know, the kind of people that thinks that they're better than everybody in this room and in the next room.

Talking about trading is a thing I really like, I myself also have business in the field of making Aceh motif bag. but I still need a lot of capital to make my business become more advanced, but although I do not have the capital I can still be patient, hopefully the future can be better. thank you for sharing your story and providing information. I am very happy to get to know you my friend, all the best for you.

likewise! best of luck in your biz!

patience is tough but as warren buffet said (and i paraphrase) "the most money i ever made was while sitting on my hands"

Why do I keep seeing this word in all the places it doesn't belong?

Great write up! Pretty much sums it up about trading as a profession. The freedom does sometimes come at a hefty price for those who are not fully emotionally disassociated from their trading portfolios.

Do you trade forex/equities as well? And are you more of an algorithm trader or do you trade manually?

before i traded crypto I ran an institutional trading desk that made markets in global fixed income futures, nowadays my time is 100% crypto however

algo's all the way... i started trading manually back in the day... i was not comp sci or anything i just learned to program from the internet in response to the fact that I couldn't get a fill manually anymore, that was 2008 i think...

Great to see established talent from the financial industry on here.

Yeah, almost all trading is now done through algorithms, so being a system(s) trader is key nowadays.

I can't wait to get learning. I've been intimidated to trade. Not quite sure where to begin, but I love the impression you pose here @marketstack..

i started here:

https://en.wikipedia.org/wiki/Reminiscences_of_a_Stock_Operator

first book i ever read on trading

@marketstack thank you thank you thank you!

Thanks @marketstack for sharing this amazing piece on trading!

You just highlighted the most important key in trading.....like me for instance i hate trading though my mum is a trader, i want to be a salary worker.

But as times goes on and maturity set in, i realized that trading is the best work anyone can do, not only it gives immediate feedback/returns, you become a boss of your own who controls his/her time.

Not all traders feel that way, especially the ones that have been burned (and there are many of them). As noted, discipline is huge and probably the most important piece to successful trading. And as @marketstack mentions, it's important to be flexible in your strategies. Too many people get in on good ideas, but never let go, even if the idea tanks. You don't have to go down with the ship.

interesting to hear! thats kind of what i love the most, is the immediacy of the feedback... so many pursuits in life you 1) make a decision then 2) wait and wait and wait and wait for whether or not it was the right thing to do... not so in trading!!!! your decisions smack u right in the face sometimes, other times they make u levitate... LOL

Lol!

You are right....but the gain is much compare to what we lose sometimes.....if am ask to make a choice about my career, i would have chosen the path of trading

Important post. Thanks for sharing your valuable post❤

True talk trading makes you your own boss. And you dont have to leave your house, i take my breakfast and trade binary same time its amazing @joagawu. Greetings from @ayahlistic

I sight you @ayahlistic

Thanks for your nice comment

I know a girl named Gina, from Brandoa, in Portugal, that does other kind of trade.

Interesting to note that you hate trading because your mum trade - I told my daughter, "why not you try trading? You can earn some money so you can pay for college later on." She replied: "why is it always about money with you? I don't want to trade. I want to do other things.."

As a rule, a calling is scholarly and as a rule requires a college degree. It doesn't need to be in scholastics, however. Specialists, attorneys, curators, bookkeepers and modelers all have a calling.

An exchange, then again, is a manual occupation that requires uncommon preparing. Common exchanges incorporate craftsmen, handymen, auto mechanics, flower specialists, beauticians, butchers, bread cooks, and so on.

Furthermore, in the middle of the two, there are specialized and organization occupations, which may require a professional education.

The rest are called untalented employments. These incorporate homestead workers, basic supply representatives, house keepers, janitors, distribution center specialists, telemarketers, retail agents, and so on.

Both require expertise or something to that affect.

Exchange work normally requires manual aptitudes and unique preparing.

A calling typically alludes to occupations that require a ton of preparing, and a formalized accreditation process.

Initially, before needing to end up a TRADER, it regards know the every day exercises of this calling. A dealer is "a distributer" whose part is to give liquidity on the business sectors, they are thusly showcase creators.

i've learned so much in this post. I'm damn near speechless. right now. Hopefully someday ill be able to give such good advice/insight

Different post discussions from different types of business as a trader in this post, why there is more detail in this topic, and ultimately its subject matter activities are so beautifully described which would be good for everyone, in the training of some time possible, or how the money was lost in the organization Haranani has several ways to cut down and the final business of business The goal of life of many people in the World Cup is to become financially successful online. One of the most prominent personalities in the profession of Moni has been supported by the idea of personal effort towards respecting the culture etc. The techniques are well-described. Most of the time, there are similarities between the workers in the workforce. Worker

This comment has received a 0.28 % upvote from @booster thanks to: @isabella69.

I've been a full time trader for last 10+ yrs..

Nice article!

I agree with your statement. I've seen so many traders with stubbornness..

Upvoted & resteemed it!

trade on, trader!

I 've been trading part time for more than 10+ yrs. Never dared to do it full time because I was waiting to see if I could ever earn a decent living from it. I guess I am one of those stubborn people that never learn.

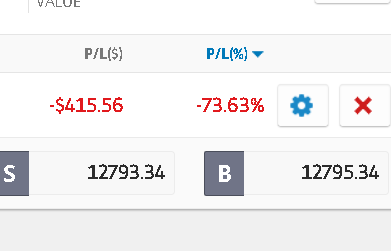

Here's a trade I am still stubborn about. (at Etoro) What do you think? Get out or stay on?

imo if you've already lost that much you might as well keep HODLing until you either lose everything or go back into the black. Key to remember is never to take out a position that you cannot afford to lose. It makes situations like yours much easier to navigate

thanks for the tip. This is a CFD of the german index. I pay fees for each day that I hang on to this position. i should have gone out when I had the chance last week.

Incredible post! I too am a trader/investor, and I couldn't see my self doing anything else in the world besides trading! I'd like to add on to what you said and share a short excerpt from one of my favorite books about investing:

"Most important of all, however, is the fact that investing is fun. It's fun to pit your intellect against that of the vast investment community and to find yourself rewarded with an increase in assets. It's exciting to review your investment returns and to see how they are accumulating at a faster rate than your salary. And it's also stimulating to learn about new ideas for products and services, and innovations in the forms of financial investments. A successful investor is generally a well-rounded individual who puts a natural curiosity and an intellectual interest to work to earn more money."

The excerpt is from A Random Walk Down Wall Street by Burton G. Malkiel

couldn't agree more. its monetizing natural curiosity

people always wonder how traders / investors can work so much... for the right kind of person its not work its fun LOL