Foundation of Successful Trading

It is a known statistic that over 90% of traders fail and I covered the three main reasons why in another educational post found here.

Now that you know the main reasons why traders fail, it's time to lay the foundation for successful trading.

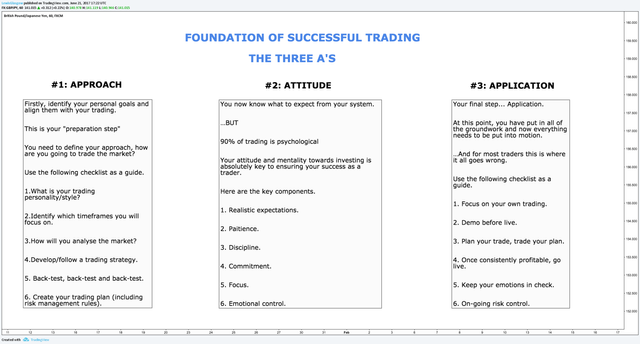

This can be structured and defined by something I call the three A's.

#1: Approach

Firstly, identify your personal goals and align them with your trading.

This is your "preparation step"

You need to define your approach, how are you going to trade the market?

Use the following checklist as a guide.

1. What is your trading personality/style?

2. Identify which timeframes you will focus on.

3. How will you analyse the market?

4. Develop/follow a trading strategy.

5. Back-test, back-test and back-test.

6. Create your trading plan (including risk management rules).

#2: Attitude

You now know what to expect from your system.

…BUT

90% of trading is psychological

Your attitude and mentality towards investing is absolutely key to ensuring your success as a trader.

Here are the key components.

1. Realistic expectations.

2. Patience.

3. Discipline.

4. Commitment.

5. Focus.

6. Emotional control.

#3: Application

Your final step... Application.

At this point, you have put in all of the groundwork and now everything needs to be put into motion.

…And for most traders this is where it all goes wrong.

Use the following checklist as a guide.

1. Focus on your own trading.

2. Demo before live.

3. Plan your trade, trade your plan.

4. Once consistently profitable, go live.

5. Keep your emotions in check.

6. On-going risk control.

Click here to view my original post on TradingView.

Here's to your success!!!

I have always felt very fortunate to have acquired my trading skills from you. This blog contains some of the most powerful lessons I have learned as a trader.

I appreciate that brother, new traders will definitely learn a ton from my articles.

Thanks lewis! as allways great content!

All the bogus accounts just focus on the $ instead of learning the whole process. This is just as important as knowing the actual trades to make.

I always think that you should follow your steps. It is so very important that when people do start trading they do with low leverage and quantities. Trading with real money is very different to virtual money. It is also worth talking about how to hold on to a trade ans not have stop losses too tight to allow for market noise.

I fully agree with you!