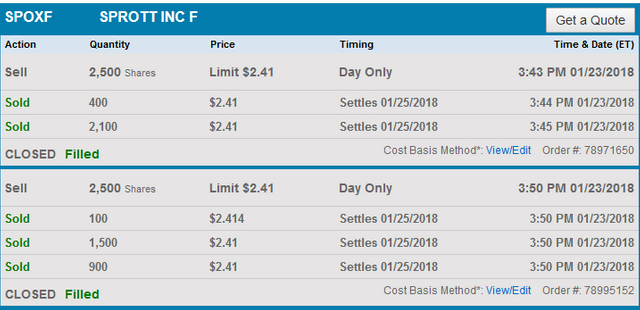

Reducing Position in Sprott (SPOXF)

Sprott (SPOXF) is my largest position. They give broad exposure to the commodities and precious metals markets via their business model and have significantly less downside risk and pay a healthy (over 4% dividend). They are growing. They have healthy insider ownership. I'll do a more thorough write up about why I like the company some time soon. That being said, when your largest position makes a significant move in price, it can be prudent to harvest some gains.

.png)

I intend to keep Sprott as one of my largest positions, but with the recent consolidation in metals prices, I'm happy to have some cash to spend if prices of some of my other holdings become more attractive.

Disclaimer:

I am not a professional financial adviser and cannot legally give investment advice. The purpose of this article is not to get people to invest but simply to share my opinion. The markets are highly volatile and can cause investors to lose money. Do not invest anything in the market that you cannot afford to lose and please do your own research before investing into anything.

I primarily invest in IRA accounts that are not subject to taxes. I would not buy and sell to balance my portfolio as frequently as I do if the transactions were taxable.