Why most traders fail #1

Over next 2 months i will be posting series of articles why most traders fail. It is simply impossible to condense the reasons and factors into single article, let alone single sentence since the number of variables at play is very high. In order to approach it correctly the situation has to be enlightened from correct angles, and every reason has to be further tied with another sets of reasons that are playing behind the scenes and pushing the trader in consistent red number returns.

Since it is not realistic to put single reason on top priority as main set for failure, i will be laying down the reasons without numbering them, in reality it depends a lot on specific person for which reason/variable is really setting them behind the most.

Wrong expectations

Having wrong set of expectations is one major issue that is shared across nearly all beginner and even experianced traders that are still not consistently profitable. Creating trading strategy that does not acknowledge the statistical performance of whatever the trader is trading is going to set for false expectations where trader will be setting him/herself for expectations of market behaviour that most of the time dont happen.

Expectations of trader are formed from many different approaches of how one judges and forms strategy based on the actions taken on market behaviour research. If certain market pattern is researched with wrong tactic, the conclusion that trader will take out of will result in badly formed strategy. End point, this is something that is shared across thousands and thousands of traders, as well as teachers and contributors of theoretical information about technical and fundamental analysis. Over my several years of trading experiance this isnt just something present in beginner traders, its even heavily present in those who teach other traders either trough books, DVDs, or any kind of other lessons. A lesson structured wrongly, will result in creating false expectations for trader who is learning, and the fact is that it is very easy to create such situation .

Both ends of equation

Let me tie this to previous point about expectations, and let me give practical example how someone could be setting beginner trader for false expectations on market behaviour and trading performance which is even more important.

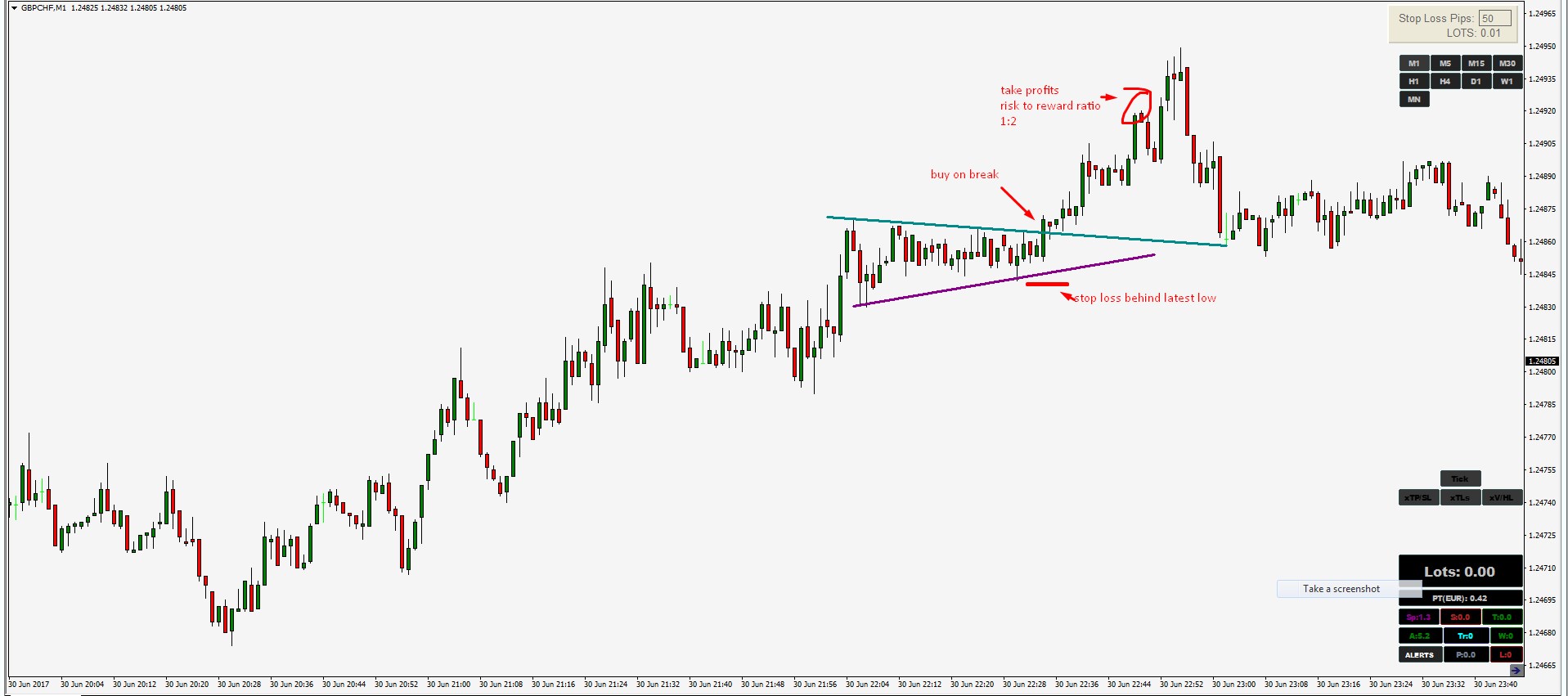

Theoretical approach to flag pattern trading

I could have used hundreds of book and video and forum examples, but let me spare on mistakes of those posters and the readers time, and let me present essentially what it is all about:

Now a trader reading the strategy only from judgment of this picture or from number of few pictures of trades that were all profitable (becouse author perhaps wants to highlight only positive aspect of strategy) is going to result in completly wrong expectations, which will cause trader to :

-not cut loss often becouse one has expectations that most patterns traded should work

-scaling positions often too high becouse trader expects most patterns to actually work in his favour

Which in efficiency turns into what happens to most traders, they simply turn into corner start forming conspirancy theories about how all markets are manipulated, brokers are following them on every step, trying to trip them over, technical patterns dont work becouse somebody else is already taking advantage of it.

Basically all those theories are very common in free trading forms, and all a result of bad expectations of what and how actually technical chart patterns behave in reality.

To put it straightforward, in reality the technical patterns behave much less sucessfully than most traders are setting their expectations with. However that does not mean that one cannot trade them profitably.

Realistic both ends explanation of flag pattern trading to set correct expectation to trader

The realistic approach to set trader for correct way is to present not single, nor 5 or 10 winning examples of patterns with X strategy, but to set 100s, or 1000s of examples both of winning and loosing trades. This is absolutely needed so that trader really sets correct tone in mindset of what to expect.This will then eliminate all irrational concepts that trader is forming due to false approach.

Bellow are two examples of trades and patterns, one was simply winning and the other was losing.

Now take this approach and multiply the amount of examples by 100 and then one is really setting trader for much better expectation of strategy and market behaviour, with my trading strategy i win on avarage 40-50% of trades only, simply becouse that is what real behaviour of technical pattern really is, however the strategy is shaped correctly to still come on top consistently profitable even due to that factor. For anyone who wants to really understand the functionality of technical patterns, simply dont take a book in your hands, take a paper, a pencil, open charts and start doing statistical count of how many of X patterns are behaving along the rules of your strategy. This will break illusion of expectations and set one for realistic tone, afterwards come the next task of adjusting the variables in strategy to come on top green, considering the performance factor of X pattern.

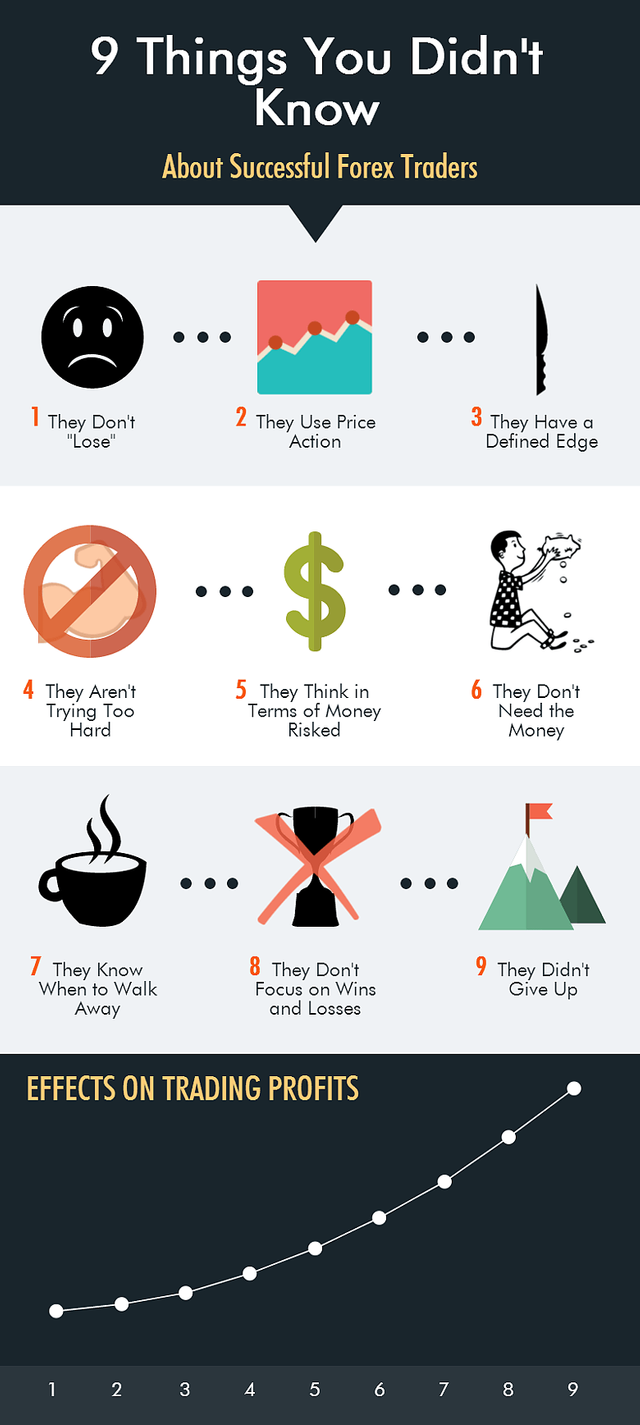

Common behaviour patterns in profitable traders

That is correct, profitable traders do share certain set of decisions in strategy that are common to majority of them, which most of losing traders do exactly the oposite. Not a bit different, but exactly the oposite the polar difference if you will.

All those observations were based from my few years of tracking both groups of traders.

1.Cutting loses fast

Most profitable traders cut loses within very small distance of movement. Most beginner and/or losing traders preffer to use large price distances for stop loses in order to give price "breathing room", or to have lesser statistical chance of being "wrong".

2.Threating individual position with emotional attachment

Most profitable traders have no attachment to position, becouse they know that each entry is just a play, it might or might not work, and there is no real grounding in knowing really for each specific position if it might work with extremely high statistical guarantee. Very common pattern in losing traders is being in position where they "know" price will go in X direction becouse they know very well the asset, or they did very good research, or the structural pattern is very symmetrical. This then leads often to catastrophic position scaling issues and blowing up.

3. Being risk focused instead of profit focused

Focusing on risk first is the priority of every trader, configuring strategy to acknowledge that is important which comes to position scaling and consistency of risk per trade in terms of % of capital. Not understanding this point by default make anyone trading a very dynamic risk based strategy where there will be traders where account is exposed by X amount and other trades where it will be exposed by 5X or 10X. Consistency of risk is needed, otherwise its likely that trader will have emotional attachment to position. Pretty much all consistent traders with expection of 1 that i know of use fixed % of risk, and focus on setting first stop loss and figuring how much they are willing to risk, before they even bother to think about profit taking or figuring where the price might go.

Majority of losing traders do it the other way around, see the structure, and trying to predict the potential profits as they main priority.

There are far more things to list which i will do over more series of post, the main takeaway for anyone trying to be profitable trader is , that all of the listed weaknesses can be fixed if addressed properly.