Trading the short squeeze

Markets tend to move in drastic ways day in and day out, some days are more volatile and some are less, some price moves are slow but persistent and some are quick and agressive. Generally the strongest moves come from the situation where many market participants are condensed and positioned on one side of trade which gets squeezed and liquidated/rotated. Short squeeze is well known pattern in equity markets, however it does also appear in most other liquid markets such as forex.

My trading of short squeeze is mainly focused on low cap equities that are trading between 1-5 USD per share price, those are usually stocks that are heavily shorted due to bad fundamentals that company is projecting (large debt, overall weak balance sheet of company) which leads to concentrated short positions, especially if price over long period of time does not move far to the downside (for example price trading around same USD price level for several months).

Best way on trading the short squeeze is to focous on down-trending stocks that have slow peaced down trend on daily chart. Then the key trigger for entry is either a news catalyst (little positive news for company) or my preffered way which is technical bottom where price breaks all the key supply levels and then creates the squeeze where shorts start to cover their positions.

Example of short squeeze on GLBS.

Notice few key characteristics that project a likely squeeze on GLBS:

-price of equity under 5 USD

-slow long standing down trend

-price breaks all key supply (highs) levels on strong momentum

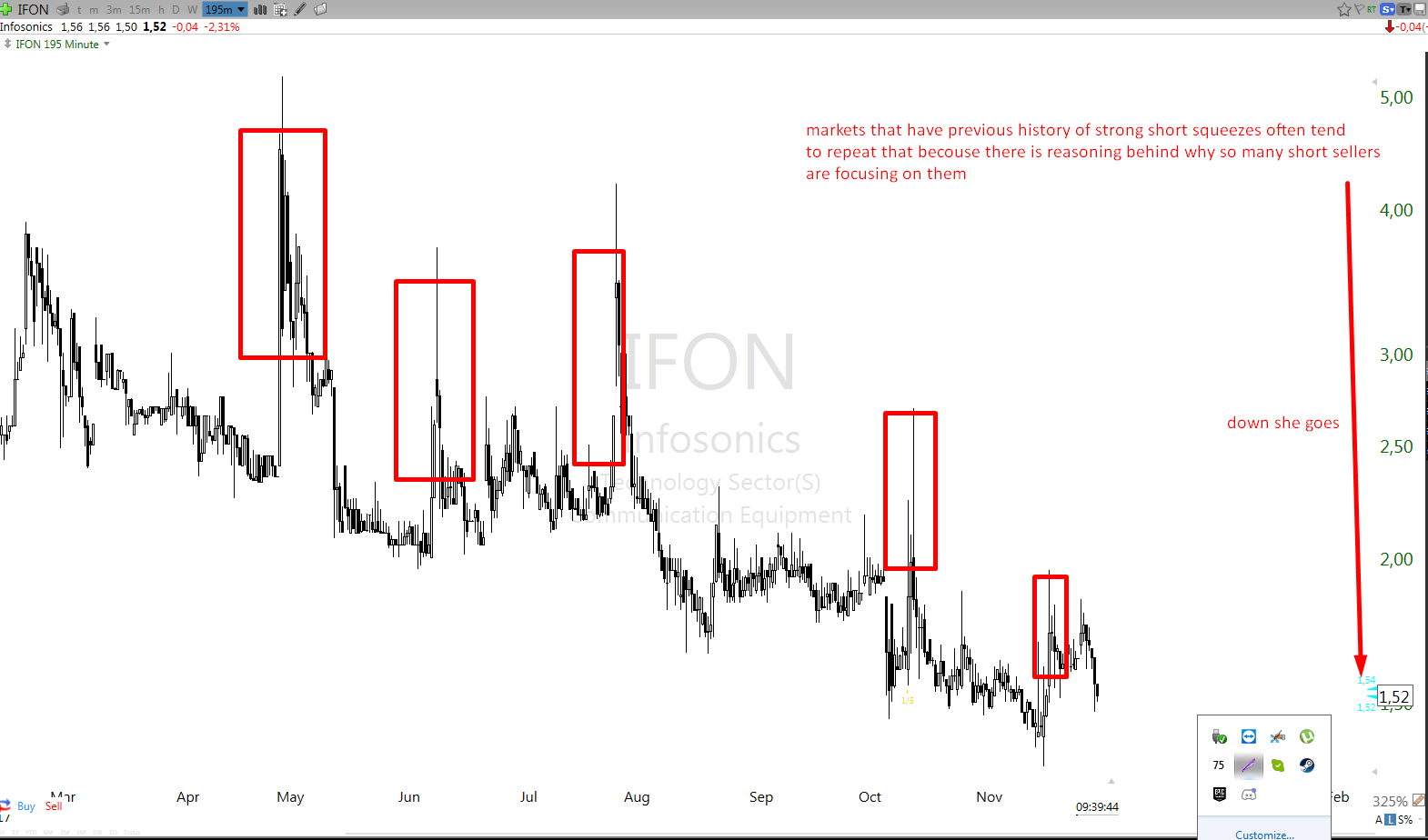

Once short squeeze.....always short squeeze. Instrument that has history of short squeeze spikes, is very likely to have same pattern repeated somewhen in the future. Most of such companies do not solve long term problems with their balance sheets, which leads to same behaviour of such stock.

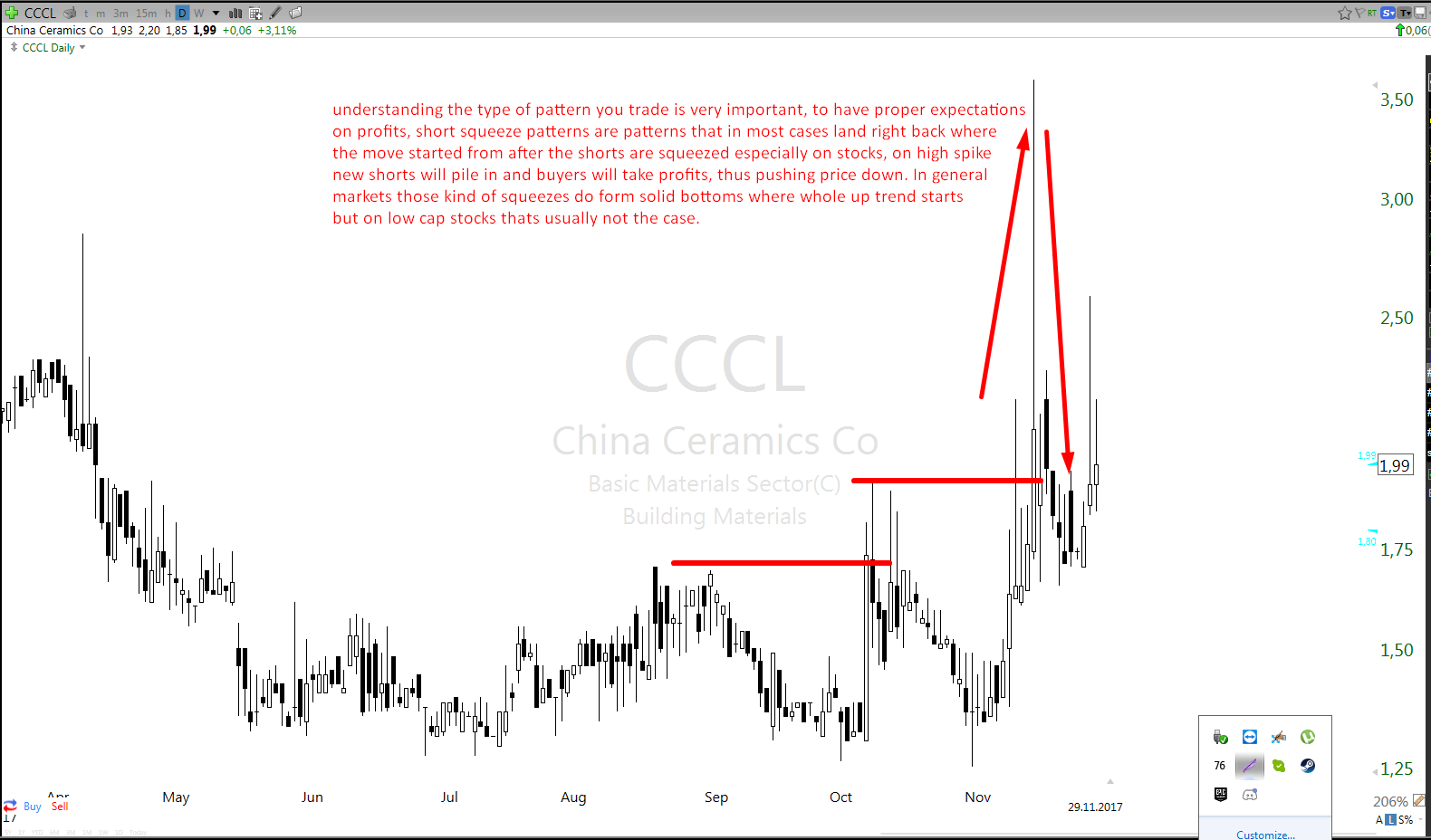

Important note to get is that most short squeezes will end up completly correcting, spike up and spike down. This means that short squeeze can be traded in both ways, going long and going short as long as trader has good timing. Buying the bottoming process once the supply is taken out, and shorting the top of the spike once bearish rejection begins (usually wait for strong red candle on h1 chart).