Strategic thinking to pick good ICO investments

Lately new ICOs have been coming out with ever faster rate, while new coins without much of functionality (eg shitcoins) have decreased in birth rate which is good. However that still does not mean that every ICO is about to be great success or good investment.

Usually for newbie investor is not that difficult to find low value in so called shitcoins, coins that are just copies of other coins, providing no additional upgrades and most important functionality that environment of technology can be build around.

ICOs however are a bit more difficult to pick becouse usually, especially lately ICOs come with pretty decent presentations and videos which could be easily deceptive to beginners in this market space.

Strategic thinking, "devils advocate" or "spotting Achilles heel" in project

In order to pick soft spots of ICO that one might be interested investing it, one should approach rationalizing situation like general does on battlefield. Using devils advocate tactic means that every feature or process described by ICO developers should be picked apart and rationally judged if there are any weakness in statement. Its very often that in startups (not just cryptos, any market) single soft spot is enough to bring down value of whole project in medium period of time.

It is not about being negative or pesimistic, having doubt about good intent of developers, it is just protecting your own investment by taking in account both sides of equation.

Simple way is to always look on other side of what ever the statement one is reading about ICO, or to do research of statistics that ICO is leaning on.

Examples

1.Hot sector

For example if ICO is in X space, make a quick research of statistics is the X industry or sector rising in use and capital inflows in past few years? It is very easy research to do, and very often a key variable, so many projects (usually not IT related, but somethimes happens in IT space as well) are starting in sector that is slowly in decay for past 2 or 3 years, simply due to lower and lower demand. Make sure that ICO is touching hot space where capital cant wait to push inside.

2.Developers previous projects or experiance

Titles and college degrees are meaningless when it comes to siding team members to their potential, all it matters is do they have previous good projects successfully developed, or at least extensive experiance. When you see only titles bellow team member names its better to do some extra digging, use google to see if you can get some better data on them.

Good general would preffer experianced and proven soldiers before any highly titled ones without anything else but that to prove.

3.Prototype or demo

Simply, if there is no functional demo yet one has to understand that there are a lot more uncertanties in such investment, this is simply fact, unless the team can show with good transparency that their previous projects where huge success.

4.Ask the questions, poor answers could point to red flags

Look at project, write down all soft spots you can find and think of and ask the developers either on social media, or better on forum and wait for their response.

This is where it comes down to extremely important point: quality of answer, answering all of the blind spots.

If developers are unable to clearly answer on all your worries or soft spots, it often points to weak spots of project, which could in future represent major downsides to value of coin or project.

For example, team not adressing marketing properly, team being naive about where to distribute coin or platform or project in general, developers not understanding why their token/ coin distribution or frees are simply not competitive to other projects. There are many examples to list, its important if you are not completly satisfied by answers that developers provide on your questions about their project, consider it as mild red flag.

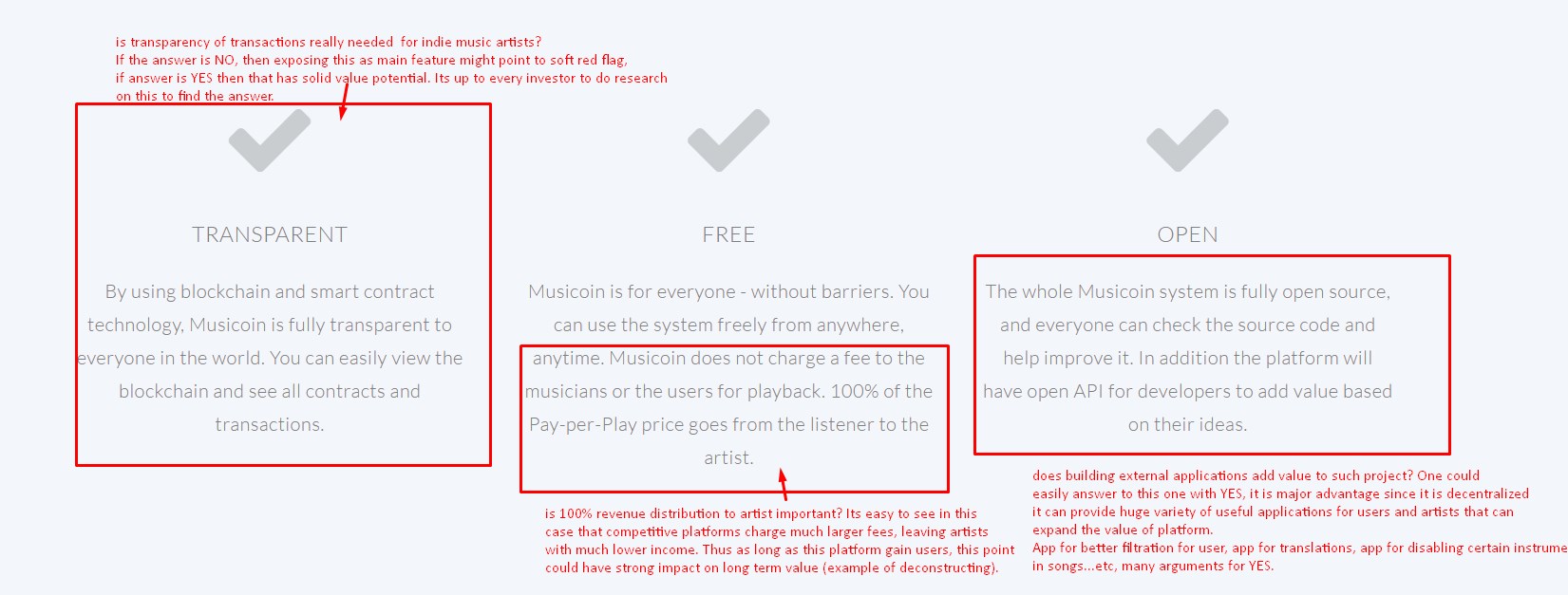

5. Check their main site, look for soft spots

Image bellow is just example of coin, its just to show the way one should be looking at every sentence whether there is true value behind it.

6.Make soft research on any point given by ICO developers

Dont worry, it doesnt take much time, if you are willing to invest decent amount spending hour or two should not be obstracle to obtain better validity of project that one is willing to invest into. The more you are interested to invest into, the more time you should spend on research, and always remember: never put all capital in single ICO.

Good general doesnt put all his hope in single unit on battlefield, but rather has few asymmetric tactics going on at the same time, where importance is diversified across many troops.

Congratulations @janpec10000! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!