BBY (Best Buy) Market Watch 9/22/18

Taking a dive into this coming week and what Best Buy stock might have in store for us.

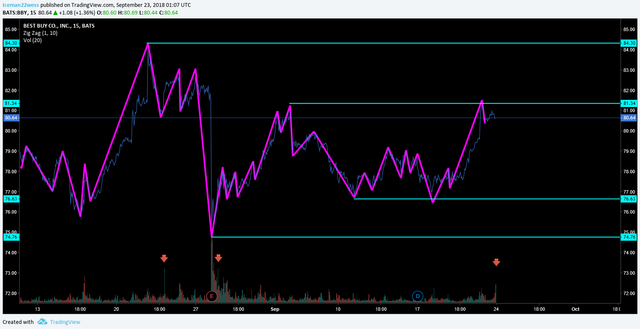

The first thing up is the general structure, a very clear contraction in price volition. I would expect to see even if a bullish trend continues, we should see more consolidation before finding a new support as we prepare for a breakout or breakdown.

The interesting thing here is we can see the price retraced on this last move up considerably more than it has on the last few swings. The last move up retraced all the way back up to it's previous high.

This certainly suggests the the price contraction is coming to an end and the stock is close to making a decision about which direction it would like to go.

Even if the price wants to be extremely bullish, I would expect a healthy consolidation of .382 as it cools off from the move up. This gives me a Monday bias of down even if the trend is going to keep going up.

taking into account volume trends.

Look at where I have marked the red arrows. Huge green bars consistently mark large up moves in price. The last 15 minute bar as we close Friday shows a large spike up in bullish volume even as we are at the resistance. Traders are certainly looking to trade the breakout, but are hoping to not be caught and pushed underwater in the trade as Monday opens up.

Taking a look at the OBV, something very, very interesting has come up.

Here we have a trend line resistance on the OBV that has 3 points of validation, a breakout, and a retest to confirm the breakout. Combine that with the large volume spike at the end of the day, and it seems to be that we indeed have a bullish breakout happening right now.

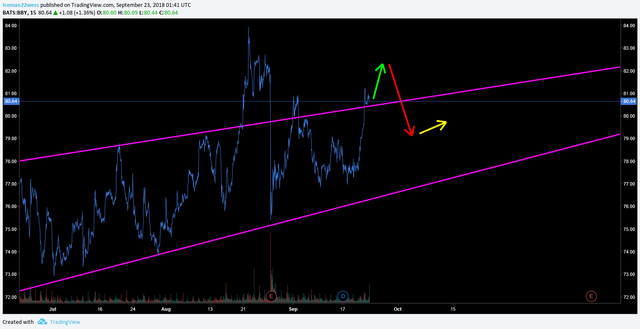

Trying to get more confirmations of a breakout I also see a clear break of a wedge that raises some concerns.

Here I see that breaking this wedge is followed by a quick tumble in price. I see no reason to think that this will not be respected another few weeks as the wedge matures.

This basically gives me the understanding that the price is in the process of a breakout at the moment, but buying this bullish is probably a bad idea as I don't think this will have much momentum to it. However, The ADX is pinching and really suggesting that a pop in price is coming.

So what's the bottom line?

My best idea about what this stock is doing right now is we are currently in a breakout, that has been confirmed, with momentum building that will quickly push the price up. However, the extreme highs can't be held and this pop up in price will quickly be followed by an aggressive dump in price back to the bottom, or half way down back into the wedge. Visually, that would look something like this.

I think the best way to play this is a short position entry at the top of this breakout. You could trade this bullish but I think that the risk/reward is not in your favor, and would be easier to try to time the top, and even if you are off a little, it should be an easy trade with a little patience while waiting for the price to return to the trend average.

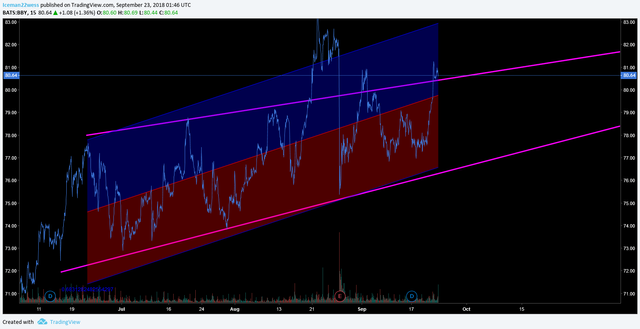

Where to take a short position is a tricky question. My personal plan here is to use regression to trend average with fib retrace to estimate a top. Here is what that looks like.

Regression to trend:

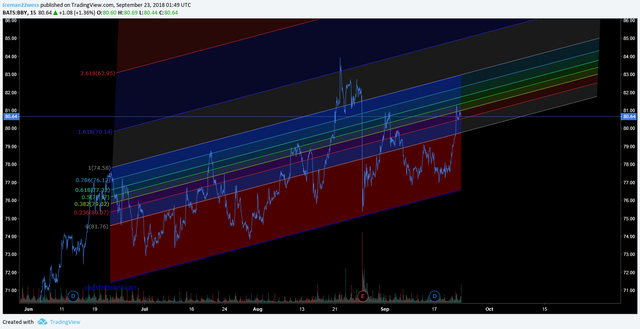

Here you can see the price is in the blue side, suggesting we are "overbought" compared to the trend. Now if I combine that with a fib channel, this provides a great entry short point suggestion.

To me, this confirms what I already thought, which is that I would indeed like to take a short position, but I need to let the stock complete the breakout and attempt the short the top. Shorting around the .618-.886 depending on how aggressive I would like to take this trade is about where I will be looking.

Putting this in numbers is not very easy because it is an ascending wedge, but in general anything close or over the $82 dollar area would be a decent short position entry, with a target close out below $79-80.

Thanks for reading,

-Icee-

Please leave me an upvote and remember this is not trading advice.

I upvoted your post.

Best regards,

@Council

Posted using https://Steeming.com condenser site.

It's amazing post. Great work. 👍@wfuneme👍😊