9/27/18 Market Watch, Quick look at a few stocks

Taking a quick look at stocks for Thursday in what has peaked my interest.

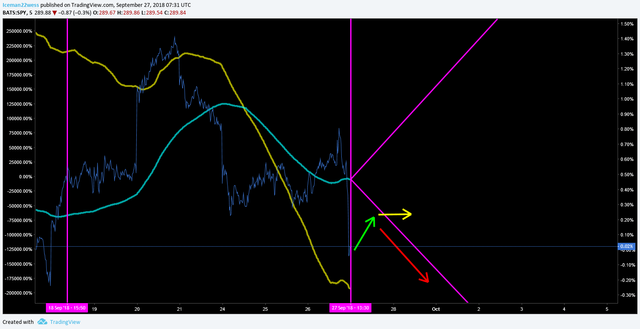

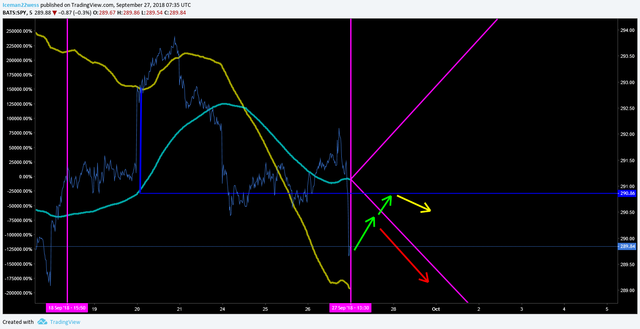

SPY-

Dumped at the end of the trading day on Wednesday, oversold compared to the possible trend down, I expect to see this bounce up before it chooses where it wants to go. I suspect opening bell will see this bounce up from 9:30 to 10 possibly giving a quick early morning trade if it doesn't move up too far during after hours. However, the angle of possible trends is pretty big, so the stock is probably going to be pretty volatile tomorrow as it fights for which trend it wants to follow.

However, if it does bounce, this would be a VERY quick trade < 1$ as I suspect heavy resistance at $290.86. The better trade may be to short the bounce around $290.86

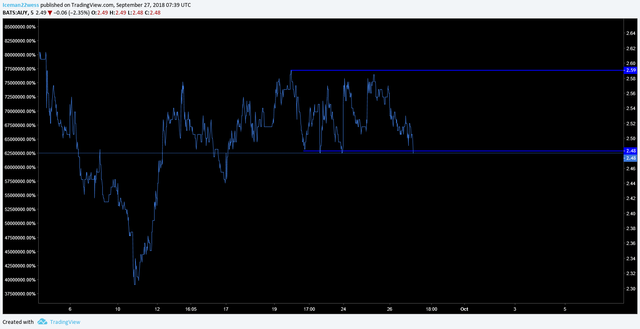

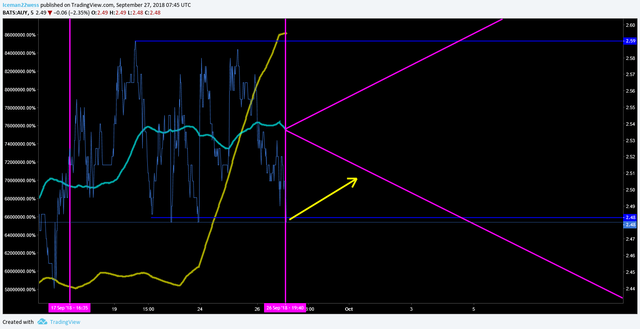

Gold mining stocks are peaking my interest at the moment. With a POSSIBLE short term bottom in on gold and silver, AUY is peaking my interest again.

Reached the bottom of the current channel, may be looking to bounce up here.

However, no volume doesn't show any confirmation that this channel is going to hold the bottom here.

OBV correction path doesn't really make a convincing bullish case either. It suggests we should be moving up 1-3 cents.

With that being said, If this stock moves up 8-10 cents in the morning, this might be a great quick shorting chance. Overall, this is a trade that ismaking a very weak bullish argument and probably isn't worth the risk of trading it. However, gold stocks are important to keep an eye on as 1200 gold price has held very well.

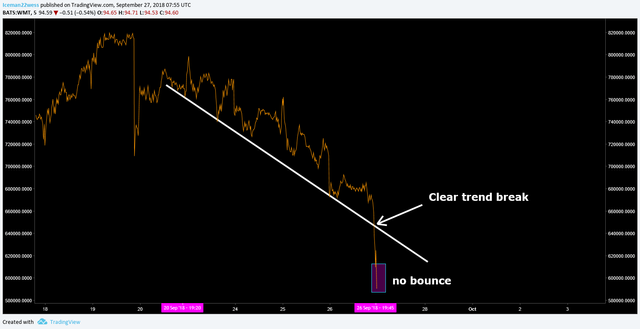

Walmart

Looks very similar to the SPY. Expecting a morning bounce on here.

However, unlike the SPY, Walmart did not have a bounce in volume at the end of the day, really signaling a much weaker bounce then what I would expect in the SPY.

With this strong break of the trend line, going back up is going to be more of a task then it will be for the SPY. This to me is saying that I can expect this lower trend line to be our resistance.

If Walmart has an early morning bounce, I will certainly be interested in shorting this if the OBV is still below the trend line.

Thanks for reading,

-Icee-

Please leave me an upvote and remember this is not trading advice.