Basics for Cryptotrading: 1 - Candle Sticks

Candlesticks; How do they look?

Candlesticks are used very often, and if you know what they mean, you might be able to use them in your advantage while trading, as they tell you all kind of different things. If you open Poloniex, Bittrex, Binance or any other Cryptomarket, you will see a picture like this:

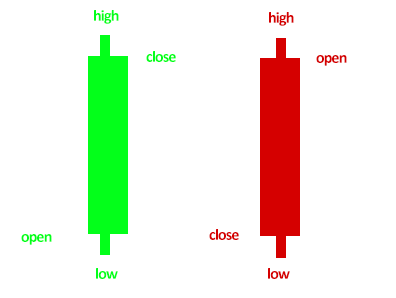

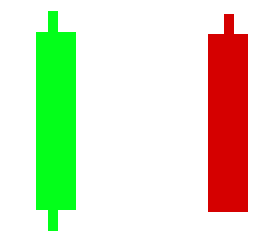

This is the start. You will have to keep in mind that a candlestick always shows a timeframe. Which timeframe has to do with your settings, as you can change these on every chart. The color of the candlestick shows if in that specific timeframe the price went up or down. Obviously green is up, red is down.

The line on top and below the candle shows the high and low in the timeframe you have set. A green candlestick opens low and closes high, a downtrend candle opens high and closes low; like shown here.

What do candlesticks tell us?

There are three things a candlestick can show us; Continuation, Reversal and Doubt.

Continuation

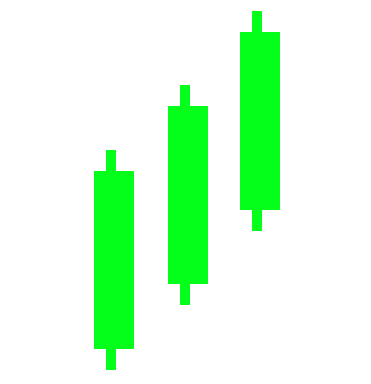

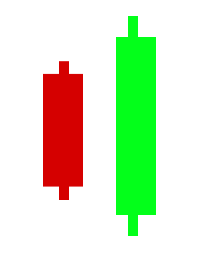

These candlesticks show us the trend continuing:

A bullish continuation bar is a strong indication that the trend will continue. After a bullish continuation bar, chances are that the price will move in the same upworth direction. The candlestick is stronger when the close is closer to the highest point of the bar and the open is closer to the lowest point of the bar.

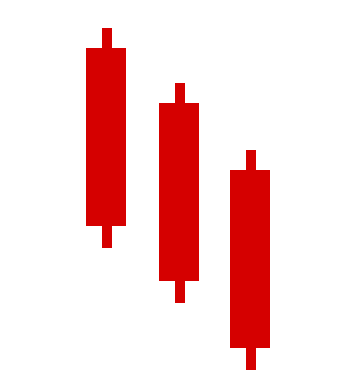

Bars that show a Reversal

For a start there are three different bars showing a reversal.

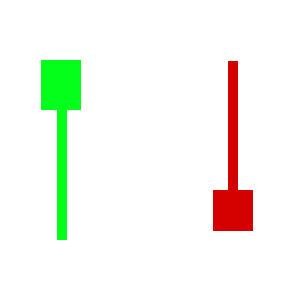

The High or the Low test

A high test will show the open and the close at the bottom of a candel stick, even when the high was high in this timeframe. In this case the color does not matter, it shows that the buyers have failed to keep buying power in an upworth trend. For a good upworth trend the high and the low have to be below 1/3 of the candlestick/bar. For the low test it is totally the opposit.

In this case the upworth trend the push has been refused and the trend is likely to go down.

Train Tracks en Tower top

The Train Tracks will show two sticks that refuse the upworth trend. With a train track it is important that the bars are approximately symmetrical to each other and that the high and lows are equal to each other. In the end you can compare a Train Track with a high test, on the other hand you have a Tower top, which can be compared with a low test, which might result in a market going up.

Bullish / Bearish engulfing bar

The reversal can be easily seen with two bars with the first candlestick showing a downtrend. This bar is followed by a candlestick that clearly refuses the downtrend of the first candlebar. The high and low of the second bar must break the high and low of the first bar and it must be a bullish bar. A Bearish Engulfing bar is just the opposite and the sellers take over from the buyers, after which the price drops.

Bars That show doubt

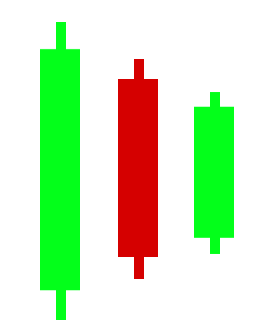

When talking about doubt you have 2 kind of sticks showing that. For a start you have the inside bar, and on the other hand you have a Doji.

Inside bar

Inside bars fit in to the high and the low of the previous bars. These bars often show a sign of doubt. The color of the bars does not matter, and it looks like nobody knows which way the coin will flip. After these inside bars you often can expect a big up or down. Somethimes you will even see a double inside bar, like shown bellow.

Doji

A Doji bar looks like a cross and has the open and close next to eachother. This shows some kind of fight between the buyers and sellers, without showing a clear winner. Price can either go up or down after this candle.

Good luck with the first steps!

good post

I would be happy if you @gindor follow me and upvote

https://steemit.com/smartphonephotography/@nourtawfiq/beautiful-flowers

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Gindor from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.