The bitcoin collapses another 37% in November, hovering around 4,000 dollars

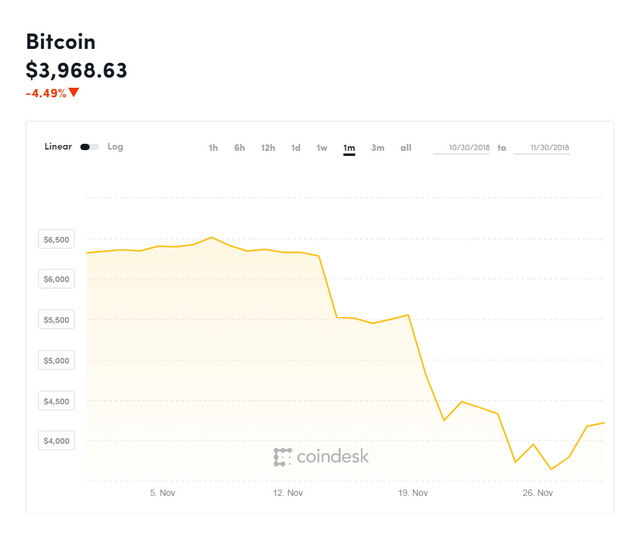

Bitcoin started last month above $ 6,300 but sank 37% over that period, reaching a low of $ 3,878.66 this Friday.

**Bad time for all the unwary who invested in bitcoins trusting that their bubble would never get punctured. ** Earlier this year, the most popular cryptocurrency in the world was around $ 10,000 to change but that joy lasted little: throughout 2018, this digital currency has only plummeted to some of the lowest levels that were remembered in recent times.

And November has not been an exception in this spiral towards the underworld . Bitcoin started last month above $ 6,300 but sank 37% over that period, reaching a low of $ 3,878.66 this Friday.

It is the worst percentage drop experienced by bitcoin since April 2011, when it did the same with 39%, according to data from CoinDesk. And these bad figures mean that the value of the digital currency has already dropped by 70% so far this year and by 80% with respect to its historical maximum, reached at the end of 2017.

**All this caused, in turn, that the total market for cryptocurrencies fell below 70,000 million dollars, according to CoinMarketCap.com. ** In addition to the crash of bitcoin, the second digital currency, XRP, also fell by 18% in November, while Ethereum did the same by 43% in the same period.

**It is the chronicle of a disaster announced , not by us, but by all the authorized voices of finance, academia or regulators. ** Recently, both Goldman Sachs and UBS criticized that this self-denominated currency did not fulfill any of the functions that should be attributed to it. Likewise, in the last year we have known how 40% of all the bitcoins in the world are in the hands of just a thousand people, which has led to complaints from the Mexican government ( of which three public agencies even warned of possible crimes for their use ), the British regulators. the very same Harvard University or the Deutsche Bank.