One secret to investing like a whale - Icebergs...

What do Icebergs have to do with trading?

In today's financial markets, traders use a variety of strategies to execute their trades efficiently and effectively. One of the strategies gaining popularity is the use of iceberg orders, which are used to buy or sell large blocks of shares in smaller markets without revealing the full size of the order. This editorial will explore the strategy of using iceberg orders in small markets and the benefits and risks associated with it.

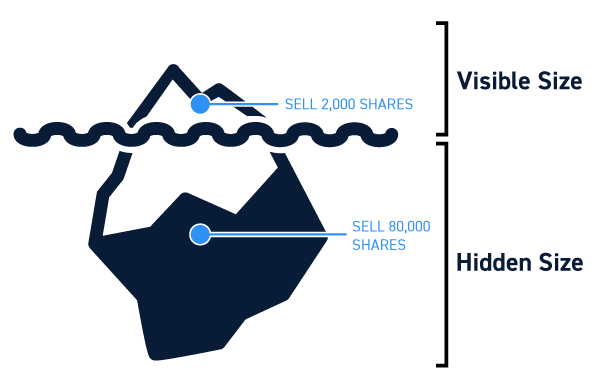

An iceberg order is a type of order that conceals the full size of the order from the market. Instead, the order is divided into smaller, visible parts that are executed over time. For example, a trader may want to buy 100,000 shares of a particular stock but only wants to show an order of 1,000 shares at a time. The trader can use an iceberg order to break up the large order into smaller, visible parts while keeping the remaining, hidden portion of the order concealed.

Using iceberg orders in small markets can be a useful strategy for traders looking to execute large orders without significantly impacting the price of the security. In smaller markets, large orders can have a more significant impact on the price due to lower liquidity and trading volume. By using iceberg orders, traders can reduce the impact of their trades on the market and minimize slippage.

However, using iceberg orders in small markets also carries some risks. For example, traders may miss out on better prices or more favorable market conditions by executing their trades slowly over time. Additionally, other traders may catch on to the use of iceberg orders and use them to their advantage, potentially causing prices to move against the trader.

In conclusion, the use of iceberg orders in small markets can be an effective strategy for traders looking to execute large orders without impacting the market. However, it is essential to weigh the benefits and risks carefully and consider the specific market conditions before employing this strategy. As with any trading strategy, careful planning, risk management, and a thorough understanding of market dynamics are critical to success.