Technical Analysis Lessons: Candlestick charts

Risk Disclaimer: I am not a financial advisor, trading cryptocurrencies involves high risk. Trade at your own risk. I am not responsible for you losses and profits.

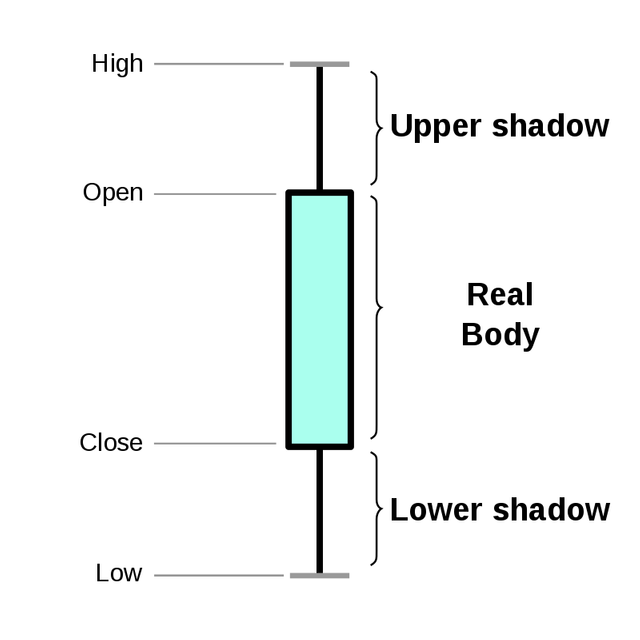

The OHLC:

Candlestick represents the information of the Opening price the High price point, the Low price point and the Closing price of an asset. A single candle on the 5 minute chart represents the 5 minute data of a particular asset, and a single candle on the daily chart represents the price data of a single day. The red candle or the bearish candle shows that the closing price was lower than the opening price. The green candle or the bullish candle shows that the closing price was higher than the opening price. The upper wick represents the highest price point of the candle and the lower wick represents the lowest price points of the particular candle. The candle bodies represents the open and close of the candle. A candle closing is significant meaning that a lot of things can change between the open and the close so a trader must wait for a candle to close when looking for entries in a particular level. The higher the time frame the more significant the candle close becomes.

Candlestick patterns:

There are many candlestick patterns which may not be possible for a person to remember all of their formation. I will only outline the important ones in this lesson.

Doji: A candlestick with little body and huge upper and lower wick. This represents indecision in the market.

Shooting star: A candlestick with little or no body with huge upper wick. This usually represents the top of a trend or price rally.

Hammer: A candlestick with little or no body with huge lower wick. This usually represents the bottom of a trend or price decline.

Note for beginner analyst: I mentioned in the previous lessons, making an entry in the many factors that comes along. For this instance, candlestick patterns like Hammer will be found near support and Shooting star in resistance and so forth. As these patterns caused reversals it may not make sense if it is found in a tight range or consolidation. Thats it for this lesson. If you enjoyed this lesson consider leaving a BTC tip: 19qTMkmH53mJBB4rx7ZcKKz3yGuTM6AACz

Your post was upvoted and resteemed on @crypto.defrag