Revolutionizing Finance: Innovations in Automated Trading 💡

Automate Trading Through Computer Programs

Trading automation is transforming how financial markets operate by allowing computers to make trading decisions based on pre-set criteria. These systems, often called algorithmic trading or algo-trading, utilize complex mathematical models to execute trades with minimal human intervention.

How It Works:

Algorithm Design: A trading strategy is translated into a set of rules that can be programmed into a computer.

Market Data: The system continuously monitors market data in real time.

Trade Execution: When the data matches the pre-set criteria, the system automatically executes trades.

Key Characteristics:

No Room for Human Error: By eliminating human emotion and error, trading automation ensures that trades are executed exactly as planned.

Precision and Speed: Algorithms can process and react to market conditions in milliseconds, much faster than any human could.

Scalability: Automated systems can handle multiple markets and asset classes simultaneously.

Examples of Automated Trading 📊

Moving Average Crossovers

One common automated trading strategy involves moving average crossovers. This strategy uses two moving averages: a short-term and a long-term one. When the short-term average crosses above the long-term average, a buy signal is generated. Conversely, when it crosses below, a sell signal is triggered.

Illustration:

Long Position: When the 50-day moving average crosses above the 200-day moving average.

Short Position: When the 50-day moving average crosses below the 200-day moving average.

Rule-Based Systems and Chart Patterns

Automated trading can also be guided by predefined rules based on chart patterns. For instance, algorithms can be programmed to recognize formations like head and shoulders, triangles, or flags, and execute trades based on these patterns.

Example Patterns:

Head and Shoulders: A pattern that indicates a trend reversal.

Triangles: Patterns that typically indicate a continuation of the current trend.

Artificial Intelligence in Trading

Artificial Intelligence (AI) is at the forefront of trading innovation. AI-driven systems can learn from vast amounts of data, adapt to new market conditions, and improve their decision-making processes over time.

Applications:

Machine Learning: Algorithms that learn from historical data to predict future market movements.

Natural Language Processing: Systems that analyze news and social media to gauge market sentiment.

Benefits of Automated Trading 📈

Frees Up Time and Eliminates Stress

Automated trading allows traders to set up their strategies and let the system handle the rest. This can save countless hours of monitoring markets and executing trades manually.

Advantages:

Less Time-Consuming: Set it and forget it; the system handles the work.

Stress Reduction: Eliminates the emotional stress of manual trading.

Ensures Precise Execution and Risk Management

Automated systems ensure that trades are executed with precision. They can be programmed to include stop-loss and take-profit levels, which helps in managing risk effectively.

Risk Management Tools:

Stop-loss orders: Automatically sell a security when it reaches a certain price to limit losses.

Take-Profit Orders: Automatically sell a security when it reaches a predetermined profit level.

Provides Automated Market Analysis and Monitoring

These systems can continuously analyze the market and monitor multiple assets, identifying opportunities or risks without needing human intervention.

Features:

24/7 Monitoring: The system never sleeps, keeping a constant watch on the market.

Real-Time Analysis: Quickly processes and reacts to market changes.

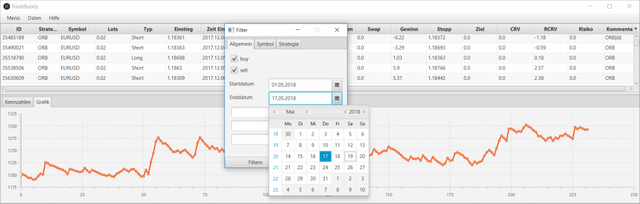

Offers Statistical Security Through Backtesting

Before deploying an automated strategy, it can be backtested against historical data to evaluate its effectiveness. This process provides valuable insights and confidence in the strategy.

Backtesting Benefits:

Historical Performance: Assess how a strategy would have performed in the past.

Optimization: Fine-tune strategies based on backtest results.

Open and Manage Trades Automatically

The core benefit of automated trading is its ability to open, manage, and close trades without human intervention. This ensures that trades are executed according to the strategy, regardless of external factors.

Automatic Functions:

Order Placement: Automatically places buy or sell orders.

Position Management: Manages open positions according to set rules.

Conclusion

Automated trading represents a significant leap forward in trading technology, offering precise, emotion-free, and efficient ways to trade. With the ability to handle complex strategies and adapt to ever-changing market conditions, automated trading systems are becoming indispensable tools for both professional traders and individual investors alike.

Would you be interested in taking a MetaTrader 5 Programming Masterclass? I highly recommend it. Click here