Was that a STEEM Crash or an SBD Shortage?!

For those of you astute enough to notice, the recent move in STEEM versus SBD the past day offers a unique opportunity to understand the diametrically opposed nature and relationship between assets and currency in a way that isn't always quite as apparent in "real world" market crashes.

For example, when people start panicking over a stock market crash, where all assets seem to be tossed out regardless of any consideration of its true underlying value, what's really going on. Is it that the asset is losing inherent value, so much as it may be losing value versus the "currency" asset in which it is currently being valued. If the DOW drops by 50% overnight, is it because of a change in corporate profitability, or because overnight, there may have suddenly been a run on dollars (ie. a dollar shortage), to the point that those dollars have (even if only temporarily) become much more valuable than the assets benchmarked against them.

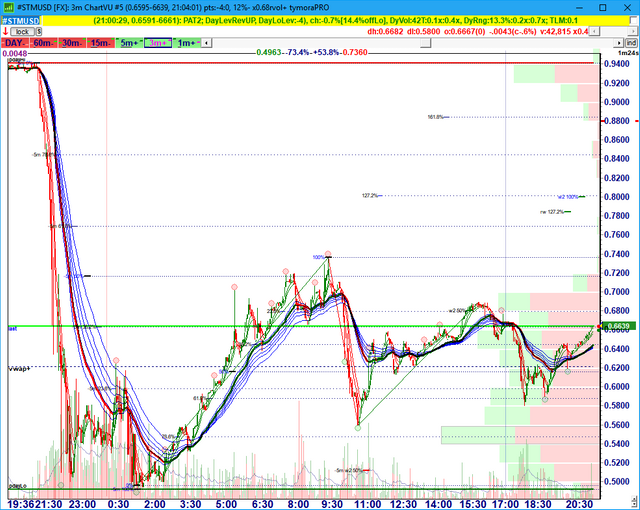

(this is actually a chart of STEEM / SBD)

This is exactly the type of scenario we've been currently witnessing with the STEEM versus SBD market. At first, people were very confused that STEEM dropped nearly 50% in short order on the internal market last night. However, when looking elsewhere, STEEM was trading well over a dollar, and SBD was trading over 3:1 (and at one point, over 4:1!) versus an actual US Dollar!

WhaleBoT - 11/22 at 9:51 PM: STEEM=1.08 USD, up 5% :: SBD=3.02 USD, up 74% :: BTS=0.1482 USD [cmc] <-- (cmc is coinmarketcap.com)

WhaleBoT - 11/22 at 10:01 PM: STEEM=1.15 USD, down 4% :: SBD=2.29 USD, up 18% :: BTS=0.1483 USD [cmc]

WhaleBoT - 11/22 at 10:06 PM: STEEM=1.11 USD, down 4% :: SBD=2.14 USD, down 7% :: BTS=0.1486 USD [cmc]

So what we were actually witnessing on the STEEM market was a crash of STEEM versus the STEEM DOLLAR pseudo-asset/currency, and unrelated to any other outside currency or asset. That's one of the trickiest things for many people to understand in this day and age, and it's something that relates to pricing on all assets versus every currency across the globe. It's also a key factor in why so many tend to underestimate the complexity involved in "forecasting" price movements. For example, while gold at times may be a good investment for an American with U.S. dollars, it may be a terrible investment for a Swiss citizen buying gold versus the Swiss Franc. At other times, this "picture" may be reversed.

If gold begins making progress against nearly all major currencies (and versus other assets) across the board, then a true rally may be underway. If people lose confidence in a particular fiat currency (or any currency for that matter), nearly all tangible assets (and likely the more well-adopted intangible crypto-type assets as well) will rise against it in varying degrees.

Link: Gold Better in Euros than Dollars? | Armstrong Economics

In this case, for those with some "cash" (ie. SBD) on the sidelines, such "market panics" can make for great trading opportunities. It's hard to say exactly what triggered this particular move, but it's likely related to some "whale" who recognized the relative low-float nature of SBD on the various crypto exchanges, and decided to orchestrate a "pump" around it.

"The world is full of constrained counterparties, who must act based on something other than price, and the actions of those counterparties may create phenomenal opportunities for investors who know where to look." -- Joel Greenblatt

Perhaps they were also aware of a growing short interest in SBD on those exchanges that allow margin-based trading, which could additionally "fuel the fire" for those scrambling to cover shorts on an asset that should rarely be worth much more than a single US Dollar each. Regardless of how the "shortage" materialized, when traders are forced to cover positions, and other traders pile in to "short" the outrageous move too early, great opportunities await those patient and astute enough to take advantage of the situation.

"I learned that traders' income is not the bid-offer spread, but the micro-squeezes that take place. Markets move from squeezes to squeezes. Traders make money on stop losses and other free options." -- Nassim Taleb

In this case, you know that eventually SBD will revert back to around $1 USD each, through additional "printing" of SBD through STEEMIT posts (it's worth it again not to "Power UP" right now, btw!), as well as arbitrage by SBD holders selling their SBD and "locking in" the ephemeral premium against other USD-pegged assets such as BitUSD on bitshares or USDT on bittrex. Perhaps an even easier way is simply to swap SBD out for STEEM on the internal market, as I did around the low 0.50's versus SBD.

You'll also be well served to study the price action that unfolded throughout this event. Also, when analyzing the charts, don't focus so much on the patterns on the charts themselves, as opposed to what may have actually been going through traders' minds at the time to create those illusory "patterns" in the first place. For those familiar with my trading platform tymoraPRO tradeSCAN, you can actually play back the whole market, practice trade, and watch the STM/SBD trading unfold through the backtesting / RePLAY feature of the platform.

For example, notice that when STEEM was trading around 50c the first time, SBD was trading over a 4:1 premium. For the next few hours, there were two primary waves of buying where a good deal of STEEM accumulation was taking place in the mid-50's range.

However, markets can't make it that easy for traders to "pick a bottom"! So, soon after STEEM hit a short-term high of 0.62, STEEM reasserted its larger time frame move (and SBD attempted another spike / short squeeze). STEEM tanked again almost straight down to hit a new low of 0.4920 STEEM/SBD before finally scaring most people out of their positions. It was in this last violent leg to new lows that I converted most of our SBD to STEEM. You may have also noticed that this time around, despite trading lower, the SBD spike on bittrex was much weaker than the first time around.

For the rest of the morning until around 9:15am ET, STEEM slowly and steadily crawled its way back to around 74c before violently retracing about 70% of that move and once again shaking out most of those who managed to "get on board".

(3 minute chart, also notice the symmetry between thrusts, as well as the percentages of the pullbacks. Also be aware of the "fractal" nature of all charts. Larger time frame pullbacks steamroll right through any price action on the smaller timeframes. It's also why you must stay aware of critical price levels on the larger timeframes)

In Conclusion...

I hope there were a few tidbits of useful wisdom that I was able to convey in this post. Trading such events is never easy, and emotions can easily take over. That's why preparation, experience, and patience are such critical elements in successfully trading through these kinds of events. For those traders who play their cards right, days like this can make someone's year. For those caught with their pants down, they may be more likely to find a margin call and a bowl-full of puke in their future. Also remember never to play around with more money than you're willing to lose, or else you'll inevitably be one of those panicking out right at the bottom of that second panic leg down, and right before the slow and steady rise back to lucrative profitability.

Now, if only I hadn't overslept this morning and taken the opportunity to sell some of my newly acquired STEEM over 70c (around the 50% retracement level from 94c to 49c), for a nice rinse & repeat, I'd be happy as a fat little piglet! But, it's all good... I'm still sitting on a great deal, and SBD is still trading over 1.5:1 USD.

Also remember to now select 50/50 for your new posts so that you can (hopefully, in a week from now) once again take advantage of the premium while it lasts! :)

thanks for explaining

@themarkymark messaged me that this move may have been triggered by a Korean exchange that recently added STEEM and SBD to their trading roster, although those who started trading it over there didn't quite seem to understand (or should I say, still don't fully understand) the difference between the two assets. I also found this post by @dksart on the subject as well:

Link: Korean Exchange UpBit.com Causes A Price Spike In SBD Making SBD Twice The Value Of STEEM

This was a very STEEMy synopsis @alexpmorris! Thanks again for the heads up on the opportunity I almost missed yesterday :D ... and yes, I wish I hadn't powered up my last post...

well, just glad I can help (somewhat) better finance all those yummy delectables you've been cooking up! lol

You are way ahead of the curve with this SBD/steem. Not only were you one of the first comments to @alexpmorris post but you also partake in the SBD/steem trades last night. Hot and smart.

I totally slept over it all happening and was told by a friend :D

This helped me understand better how it works as I am not really focusing on the techy side, I knew that SBD is always supposed to be 1$ worth, but now I have a vague understanding of why as well :)

you may have noticed the "raid" is going on again even as we speak, seems they like the weekends to make their assault on SBD, as SBD is still currently trading at nearly US$2.50 each (and nearly $3/each around when you posted your comment)!

Oh, I should have kept my SBD instead of selling it all in STEEM :D

Just wanted to share a few more charts from a second smaller SBD pump that took place Friday night, that unfolded in similar fashion to the one a few days prior...

Quality write up here, probably you can do a follow up post analyzing the dynamics SBD vs Steem and how market sentiments affect the pricing

Thanks for the kind words Daudz. Most pricing tends to be rather arbitrary and based on people's own framework and ideas of what's "valuable". Things that I think should cost a fortune, others toss out like yesterday's trash. And items that should sell for almost nothing, are often sold for small fortunes (think... "coveted" brand-name products).

If people see prices going up or staying around a certain level for long enough, even if it makes no sense whatsoever, it becomes a "self-fulfilling prophesy" as people start accepting the illusion for reality and a recursive "feedback loop" unfolds, until the inevitable "price shock" comes along and forces everyone back to reality...

Link: Understanding George Soros' Theory of Reflexivity in Markets

Dear @alexpmorris,

Thank you for this post, I found it very interesting.

I wrote a post about why we don't want to power up, rather that it was better to go 50/50... that was before this happened! @ironshield

https://steemit.com/steem/@ironshield/steemit-thoughts-should-we-be-powering-up-100-on-every-post

I am interested why you say not use power up the steems? Assumption by doing this is so that SBD/steem falls back in line and exchange back into more SBD. But how long would this take, days, weeks, or even months? Interested in your insights. Thanks.

It takes as long as it takes, like in any market, sometimes assets can remain incorrectly priced for years. That's why sometimes companies that are way undervalued are outright taken over, in order to "release" and "free up" that latent value. Of course, the easier it is to "arb" out the pricing misalignment, the faster prices should fall back in line (ie. keep dumping all the SBD you can get your hands on in exchange for BitUSD until the spread tightens).

As for why it's better not to power up in such cases, this thread on one of my past posts may help further clarify the topic for you...

Link: DON'T POWER UP YOUR POSTS WHEN SBD IS WORTH MORE THAN USD

I am a new member and I really appreciate this post.

It's hard when starting out on steemit understanding the difference between STEEM and SBD. Reading through was really helpful for me. Thank you, I will be back to learn more.

I HAVE YOUR VOTE PLEASE VOTE MY PLEASE, ....