The Petro: The salvation for the Venezuelan Dictatoship

Caracas, 9 of December 2017

On Sunday, December 3, Venezuelan President Nicolás Maduro announced the creation of the first national cryptocurrency, "El Petro", in order to find an alternative financing method, backed by the country's oil, gas, gold and diamond reserves. The creation of a cryptocurrency is not a crazy idea, nor is it a unique idea on the part of a government, since countries allied to the Venezuelan government, such as Russia, have announced the creation of their own cryptocurrency in response to the global tendency to emigrate from fiduciary money (FIAT) to that of the cryptocurrencies.

Venezuela is the country with the largest amount of proven oil reserves, this being its main export product contributing 96% of revenues, however from 2010 to 2016, the state oil company PDVSA has reduced its production capacity by 900,000 daily oil barrels in only 6 years represented a productive fall of 30%, therefore decreasing the flow of foreign currency income to the country also aggravated by a sharp drop in oil prices. Despite a significant reduction in national income and a 12% reduction in GDP only in 2017 according to the IMF, the Venezuelan government had not stopped paying its commitments to international creditors until this year.

The Venezuelan government had opted for a 50% decrease in imports of consumer goods only in 2016 to free cash flow for the payment of its commitments, this being one of the many causes of the growing economic crisis that currently exists in the country. Despite a reduction in imports and the poor management of the oil industry and the state's finances have reduced the possibility of continuing to pay the debt, entering a process of partial default according to the rating agency Standard & Poors.

However, the Venezuelan government has continued to search desperately for a way to finance itself since it can not resort to traditional markets, firstly because of the economic sanctions imposed by the US that prevent the transaction of Venezuelan securities in American and European markets in addition to the freezing of assets of high state officials who are accomplices of the dictatorship, in addition to a loss of legitimacy before the markets for entering in a process of default with their commitments not generating confidence before potential investors.

The reasons for the creation of the Petro are clear since it would be a form of non-traditional financing that the government desperately needs to continue in power and prepare for the presidential elections of 2018. Also the mechanism by which they will make fun of foreign sanctions trading value and even market oil with the Petro, obviating the need to use the US dollar in international transactions, avoiding the traditional financial system. Finally, the cryptocurrency market tends to be a money laundering mechanism used by senior government officials who are sanctioned who had risked having their assets frozen by foreign institutions, through the Petro may protect their liquid assets and deal with them without having to worry about reprisals from democratic governments.

The amount of Petros that will circulate is to be defined, unlike fiduciary money, most cryptocurrencies have a finite circulation which protects them from inflation. Venezuela is not strange to inflation since according to the IMF it is predicted an inflation of 652.7% only in 2017, which makes us think, we know what happens when a country can emit infinite amounts of coins as it currently experiences Venezuela.

Will this be the case with Petro?

Inflation in Venezuela has worsened since October of this year when it exceeded 50% per month according to (OGP), being considered a hyperinflation. The Petro could be a partial solution to the problem by replacing the bolivar as currency. One of the biggest problems that cryptocurrencies currently have is popular acceptance, such as bitcoin, which is mainly used as an instrument for reserving value and speculation. Venezuelans are not strangers to dealing with cryptocurrencies, it is a trend that has increased according to the need to safeguard the value of their assets in a hard currency. In this case, if the Petro represents a stable alternative free of inflation, it could become a second currency of national circulation, but even so the problem remains the same, acceptance is fundamental to make it tradable. Although the economic situation worsens the more Venezuelans will have the need to resort to new ways of protecting and trading value. The bolivar will not be displaced by the Petro but it will undoubtedly suffer a greater depreciation since it will not be as desirable as the Petro if it were to become a successful cryptocurrency among Venezuelans.

Will Petro succeed?

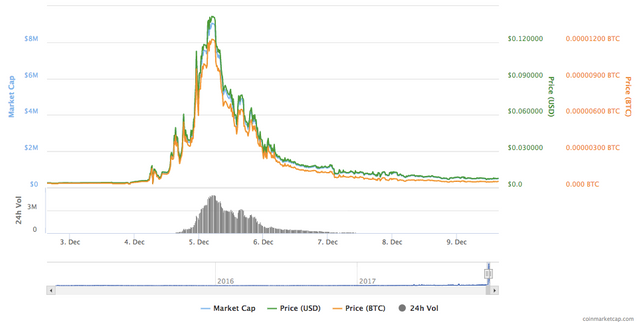

In the eyes of a crypto-investor, the idea of a cryptocurrency backed by the reserves of some of the richest countries in natural resources sounds quite attractive. Although it is pure speculation, a currency like Petro could bring a large number of crypto-investors whose only motivation is to enrich themselves by speculating on their value. As an example we have a cryptocurrency called the Petrodollar (XPD), I would say that they confused it with the Petro although it has been in circulation since 2014. A few hours after the announcement of President Maduro this cryptocurrency received attention as never before in its history managed to grow 4,000% in a day according to Coinmarketcap, although it is normal to see an increase of this magnitude in the market of cryptocurrencies by the application of pump and dump strategies (manipulation of the market), leads us to think that the Petro could receive a similar or better than anticipated acceptance due to its backing of the value in the oil reserves of a country like Venezuela.

(XPD) Graph

(XPD) Graph

The characteristics of Petro will be differentiated from others such as Bitcoin being centralized by the Venezuelan Observatory of Blockchain that will be in charge of monitoring transactions and possibly the identity of those who trade. According to CriptoNoticias, Fritz Wagner the CEO of BitDharma has proposed to the National Constituent Assembly his desire to be part of a cryptocurrency regulation team in Venezuela since there is no law in the country to regulate them or to regulate the miners who have been persecuted and charged for theft of electricity; a regulation would mean having clear rules regarding the legality of cryptocurrencies that would be a positive step in consequence of the creation of Petro.

Taking into account these aspects, we must still see what qualities Petro counts, since it could be an element that can provide economic oxygen to a crippled Venezuelan regime in external financing, a form of bypassing external sanctions as well as a way to launder money from corrupt government officials and finally also a cryptocurrency with which Venezuelans could count if they do not suffer inflation like the bolivar or it could simply be another failure of the Venezuelan government.

@hottopic Reestimit :)