As Bitcoin Futures Volumes Increase Credit Agencies Look to Downgrade Dealers - @uskudar

This past April, news.Bitcoin.com reported on the Bitcoin futures markets offered by the two derivatives giants Cboe and CME Group and how contract volumes were steadily rising. This month, while BTC-spot prices slide to significant lows, both futures products from these two companies are still seeing increased demand for contracts.

Also Read: A New Cryptocurrency Radio Broadcast Launches on Boston’s FM 104.9

Bitcoin Futures Volumes Continue to Increase

Summer is here and the month of June has been extremely bearish for cryptocurrency markets that have been struggling to grasp just a taste of those all-time highs touched late last year. The most dominant digital asset market held by Bitcoin Core (BTC) has lost over $13,000 USD in value since it touched $19,600 per BTC in mid-December 2017. Most of the crypto bull run last year took place a couple months before the launch of Cboe and CME Group’s futures markets. Immediately after these two markets went live, BTC spot prices tumbled and have been extremely bearish over the past five months since those highs. Besides the first day’s opening volumes, these derivative markets were initially pretty dull with no action and some days there were less than a few hundred contracts per day.

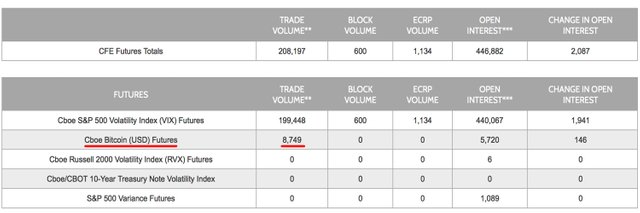

Cboe bitcoin futures volume for June 11, 2018.

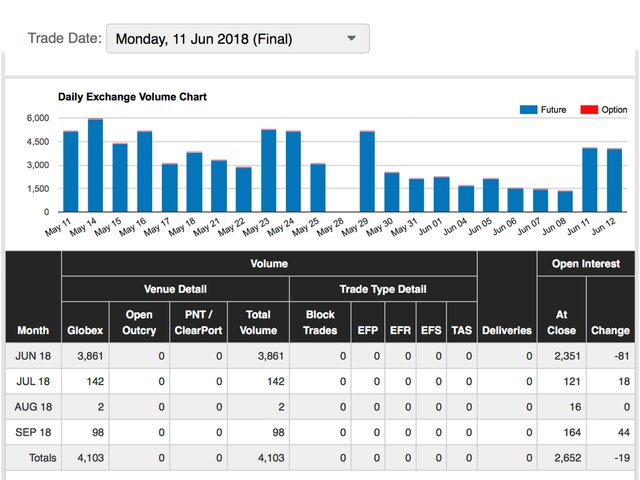

Things have changed since then, as we reported this past April, both marketplaces have seen increased demand for bitcoin futures contracts over the last two months. CME Group’s BTC futures on June 11, after last weekend’s ‘bloody Sunday,’ saw volumes above 3,800 contracts for June expiries, and July contracts are starting to get attention as well. The bitcoin futures forerunner, Cboe, had over 8700 contracts for June 11, which indicates the bloodier the markets are, the more futures are being sold. Since April 25, when Cboe posted 19,000 contracts sold on that specific day, both Cboe and CME Group’s daily derivatives sales have been extremely active.

June 11-12, 2018 CME Group Bitcoin Futures Volumes.

The Three Major Credit Agencies Contemplate Downgrading Businesses Who Clear Bitcoin Futures

Unfortunately, because these contract volumes are gradually increasing clearing houses and financial institutions that handle bitcoin futures may see a credit downgrade. According to a recent report, the three large rating agencies, Fitch, S&P, and Moody’s, are contemplating downgrading banks that clear bitcoin futures. Back in October, 2016, Standard & Poor’s (S&P) Global published a report that detailed blockchain development would affect the credit ratings of banks that dealt with this technology. Then the credit agencies began discussing downgrading financial institutions this past February, if the volatile contract sales started to increase.

Fitch, S&P, and Moody’s give credit ratings to banks for certain criteria and because BTC-based futures are so volatile this adds a lot of ‘risk’ in the eyes of these agencies. If the three agencies move towards a credit rating downgrade, it could affect all clearing members that have exposure to these contracts, not just the banks providing them directly. Downgrades can affect a financial institution’s asset management, and lending requirements significantly. As spot prices drop to significant lows in the cryptocurrency world, many people are looking back in hindsight and wonder if these crypto-based futures products are the root cause of this bearish market. After all, look at what derivatives products did to precious metals markets and the countless other markets before it.

What do you think about the Bitcoin futures markets increasing and the credit agencies contemplating downgrading clearinghouses that deal with these products? Let us know in the comments below.

Images via Shutterstock, Pixabay, Cboe, and CME Group.

Want a comprehensive list of the top 500 cryptocurrencies and see their prices and overall market valuation? Check out Satoshi Pulse for all that hot market action!

The post As Bitcoin Futures Volumes Increase Credit Agencies Look to Downgrade Dealers appeared first on @uskudar.

Telegram: Vip Crypto Signals