Why Token Burning Matters and What It Means for BGB

If you have been following the world of cryptocurrency, you’ve probably heard the term "token burning." In simple terms, it’s when a portion of a cryptocurrency’s supply is permanently removed from circulation. This process is generally seen as a positive move, as it creates scarcity, potentially increasing the token's value over time.

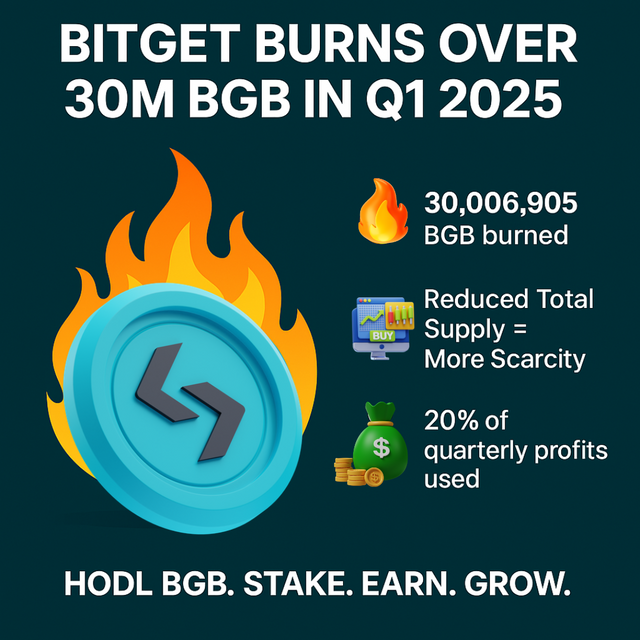

With this in mind, Bitget has just introduced a new quarterly token burn mechanism for its BGB token, starting in Q1 2025. The exchange plans to burn 20% of its profits from its trading and wallet services by repurchasing and removing BGB tokens. The first round of burns will amount to around $120 million worth of tokens.

Over time, Bitget’s goal is to burn up to 40% of BGB's total supply, which could be worth around $6.8 billion. This isn't just about reducing supply; it’s about ensuring that the BGB token remains valuable and relevant in this evolving crypto ecosystem.

In addition, Bitget recently merged its Bitget Wallet Token (BWB) with BGB to simplify and strengthen the overall token structure. This change is part of a bigger effort to make BGB a central and valuable part of their platform.

In the world of crypto, these steps can really impact the future of a token. It’s about creating a sustainable, deflationary model that benefits holders in the long run.