The Sunday Crypto Recap -Down the Rabbit Hole 60

With the year coming to a close there’s lots to reflect on. Did price - rocket as hoped -no it did not. Is that a problem for the health of the cryptosphere as a whole - no - not at all. 2020 may also flatter to deceive but in the long-run, there’s much to look forward to.

Picks of the Week

Once again it’s hard to select just a few items to highlight. Perhaps if you only check out one thing it should this top 100 figures in crypto. If you can stretch to two then this thread on Ethereum’s ‘Ice Age’ feature is well worth your time.

BTC as an NFL team - who knew?:

https://twitter.com/AlexIlten/status/1205693922342834178

Dan Hedl refutes ‘Satoshi’s Vision’:

https://twitter.com/danheld/status/1084848063947071488

BTC lows have a trend of some sort (2019 figure yet to be decided):

https://twitter.com/themooncarl/status/1203971458487275520

Blockchain as disruptor across a wide range of sectors:

https://twitter.com/MarshallHayner/status/1204507375757152263

In defense of The Block (recommended):

https://twitter.com/hongkim__/status/1204617082005905411

On Ethereum’s ‘Ice Age’ (highly recommended):

https://twitter.com/udiWertheimer/status/1206684805175398400

From one extreme to the other (recommended;

https://twitter.com/ErikVoorhees/status/1205104637310914565

On central bank and state approaches to digital currencies (highly recommended):

https://twitter.com/SpartanBlack_1/status/1205438393145942016

On value and belief:

https://twitter.com/woonomic/status/1206321498127917056

What is ‘useful’ in life is rarely simple:

https://twitter.com/shl/status/1204799385646665728

Articles

A who’s who of crypto (highly recommended):

https://cryptoweekly.co/100/

Why it’s early days for crypto (recommended):

https://markhelfman.com/2019/12/13/why-nobody-else-cares-about-bitcoin-and-cryptocurrency/

It’s prediction time:

https://www.forbes.com/sites/biserdimitrov/2019/12/11/what-are-the-top-10-blockchain-predictions-for-2020/#73e59554d395

Gas flaring and BTC:

https://www.bloomberg.com/news/articles/2019-12-06/why-bitcoin-mining-is-being-touted-as-a-solution-to-gas-flaring

Binance didn’t become a dominant player through luck (recommended):

https://decrypt.co/11327/the-inside-story-of-binance-explosive-rise-to-power

Comparing Visa and lightning:

https://medium.com/galoymoney/visa-and-lightning-how-do-they-compare-1f4d89bdbbaf

Is KYC/AML really so bad?:

https://medium.com/exmo-official/everybody-is-freaking-out-about-the-5amld-is-mandatory-verification-as-scary-as-it-seems-6ccd2f92bb7d

So that was 2019 (recommended):

https://brukhman.substack.com/p/this-was-a-year-of-steady-infrastructural

Podcast

Larry Cermak of the Block on crypto (highly recommended but skip frequent Ads):

YouTube

A brief review of BTC price action for 2019 (in terms of Elliott wave theory):

2020 looking good for BTC? (highly recommended despite light-hearted style):

Chainlink overview (recommended for research but strong pro Chainlink bias here):

Browser ‘incognito mode’ isn’t as secret as you may think:

A bullish take on gold by a long-time market participant:

Infographics

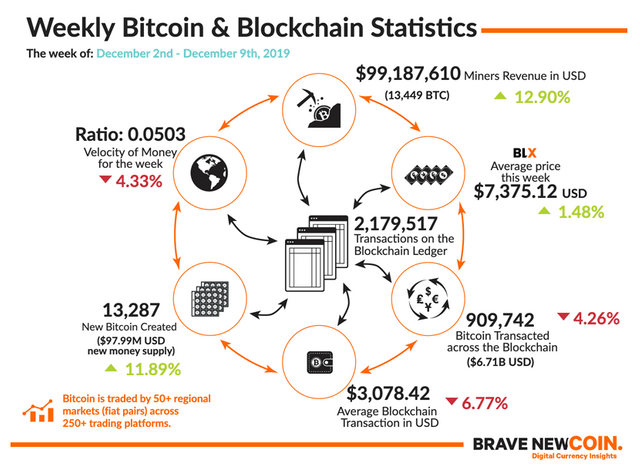

Early December snapshot of key BTC mine related metrics (link also leads to an article on the subject):

https://bravenewcoin.com/insights/bitcoin-price-analysis-miners-squeezed-by-dropping-prices

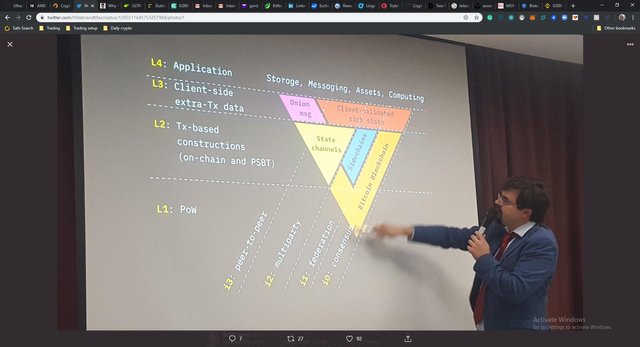

Visualising BTC layers:

https://twitter.com/HillebrandMax/status/1205517645753257984/photo/1

Website / Utility

Excellent resource for tracking BTC mining/network metrics:

https://bravenewcoin.com/data-and-charts/assets/BTC/price

That’s a wrap for yet another fascinating week in crypto. As always, looking forward to your comments and suggestions.

Note on Sources:

Twitter & Reddit (cryptos current meta-brains) / Medium / Trybe / Hackernoon / Whaleshares / TIMM and so on/ YouTube / various podcasts and whatever else I stumble upon. The aim is a useful weekly aggregator of ideas rather than news. Though I try to keep the sources current – I’ll reference these articles and podcasts etc. as I encounter them – they may have been published just a couple of days ago or in some cases quite a bit earlier.