Thousands of coins for one euro - are cheap currencies really that cheap?

Lately it's preferred to invest in cheap cryptocurrencies - but are coins and tokens really cheap under one Euro? How much does the investor receive for his "cheap" investment?

The last few weeks have been heavily influenced by an up and down of the cryptocurrencies. For example, quite young tokens can rise well into the ten largest cryptocurrencies before dropping again by 66%.

One reason for this nervous market situation seems to be young investors who have a special focus on cryptocurrencies and tokens whose unit price is well below that of a bitcoin. Currencies like Ripple, whose share price is currently in the single-digit euro range, are already expensive, and investors seem to be interested in the crypto-equivalent of Pennystock .

Based on emotional arguments, this idea is understandable: Some investors feel small when they can afford only fractions of a bitcoin. Especially with the first investment, which may be in the range of 100 euros, it can be frustrating that you can not even buy a single coin from old-fashioned currencies.

In addition, this focus on micro-currencies is fueled by the hope of making millions through a small investment. "Bitcoin also cost only one euro and rose to over 15,000! That can happen even with Ripple / Cardano / Stellar / NEM / Tron? "

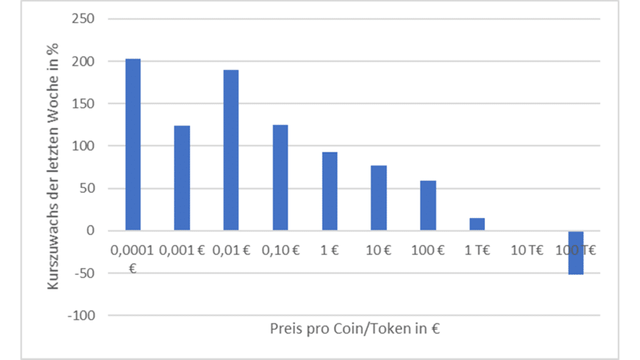

At first glance, the hypothesis that cheap coins are worthwhile, can not be denied. At least in the short term, the price increase behaves antiproportional to the price of a coin:

Shown is the average price increase of the last week depending on the price per coin or token. As a database, the data listed for coinmarketcap.com has been accessed for all coins . In order to check whether this image came about only through the segmentation of the data set, other segmentations of the data set were analyzed, but all come to similar results.

In summary, at least for the last week was: Cheap Coins rise more than expensive coins. However, the investor should ask himself whether these price increases are sustainable or whether the hoped-for profit of 1,000% or more is really possible. How likely is it that a coin experiences such a price increase? To clarify this, it is advisable to consider cheap investment opportunities from two perspectives, which are discussed in the following sections.

What profit can you expect based on the current market capital?

The cryptocurrency ripple is considered as the basis for considering what maximum profit an investor could count on optimistic estimates. Is an increase to 15,000 euros even conceivable? Looking at the network fees - currently at 0.01 XRP - one would speak of transaction fees of 150 euros . Even in comparison to Bitcoin this would be absurd! It can not be ruled out that the fees will be adjusted accordingly. If the XRP rate rises to 15,000 euros, one would speak on the basis of the available supply of a market capital of almost 600 trillion euros. That's about fifty times the money of the European Union !

Cryptocurrencies with very specific application areas should be considered even stricter: Is a market capital of several billion euros really justified for each project? What's more, is there really a sustainable value to be seen when this valuation is in the pure conception phase when only equity tokens are sold on the Ethereum Blockchain?

So, if you want to estimate projects like Steem for the fundamental value, then you can not compare it to the market capital of existing social networks. For projects in the pure concept phase, it should also be considered which role the token will have in the long term.

Are cheap coins really that cheap?

In addition, it should be considered how cheap cheap coins actually are. About 11,000 euros is worth a Bitcoin. With this bitcoin one has 59 ppb (parts per billion) of all existing bitcoins. So you own 59 billionths of the total Bitcoin supplies. That does not sound like much, but applying the same calculation to ripple means you'll own just 10 trillion of your current ripple supply with a ripple.

To compare the prices of all crypto currencies, therefore, is an effective way to ask yourself how expensive it would be to buy a corresponding share of 59ppb of the total coin count. One possibility is the so-called Bitcoin Price Equivalence, or BPE for short. The formula applies here: BPE = Supply der Währung / Supply von Bitcoin * Preis eines Coins der Währung

While BPE's calculation reveals that Bitcoin is more expensive than any other cryptocurrency, Ripple's BPE does not differ dramatically from Bitcoin:

As the table shows, the ten currencies with the BPE are all over € 1,000. So to buy 59 ppb of the entire supply of a cryptocurrency, an investment of at least 1,000 euros is necessary for the currencies shown.

When investing in a cheap coin, therefore, always ask what share the investor buys in the currency and if the underlying project can grow at all as hoped. Cheap does not necessarily mean more!