The Budget Challenge: Living on a Tight budget

Photo Courtesy by: Google image

Hi Steemians! I read a lot of blogs about challenges from our Steemians community. Unfortunately, I did not joined any challenges. This is my first time to joined the challenge in steemit.This post is my official entry on the #thebudgetchallenge posted by @smaeunabs .I really appreciate this kind of challenge since it is involved on how we manage our finances.

During my first year and six months as an employee it was my struggle on how can I manage my finances. I was been an employee since 2015,Just like other employee I failed to managed my finances before, maybe I can consider myself as one of the member of what they called the one day millionaire, I almost Spend my money during payday what is left in my pocket is my budget for food and my Payslip. It was December 2016 when I make my personal audit about my finances it is my one and half years as an employee no savings and no investment had been established.

GOAL = it refer to something that you are going to achieve. In Planning your finances established a goal that is measurable and attainable. For example your Goal at the end of the year is 500,000. You need 41,667/month or 1370/day.

DISCIPLINE = it refers to controlling your behavior. In Planning your finances know your priorities, Identify your wants and needs. Do not spend your money in buying something you like it, buy only if you need it.

COMMITMENT = it refer to a promise to do. In Planning your Finances commitment should be in the heart of the saver. For example you Invest 30% of your income this month, invest another 30% on the following month and so on.. make it a habit.

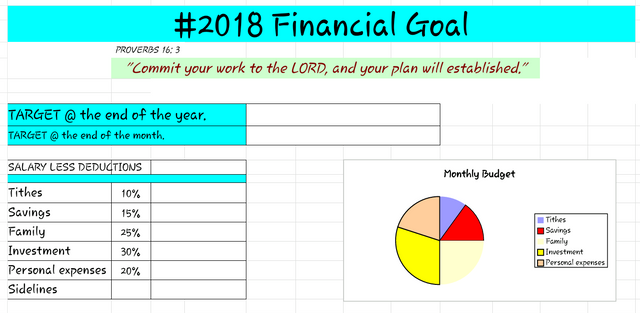

The first step in taking control of your finances is doing a budget plan. It is very important to know on how we sub-divided our money whether you are a big or small earner. Here’s how I manage my finances.

Photo Courtesy by: Google image

Tithe means a tenth or 10 percent,The Bible thus not require us to give any certain percentage, we can give may be more or less than ten percent.2 Corinthians 9:6-7 The point is this. Whoever sows sparingly will also reap sparingly, and whoever sows bountifully will also reap bountifully. Each one must give as he has decided in his heart, not reluctantly or under compulsion, for God loves a cheerful giver. We give a portion of our income to a church to help the ministry. Tithing should be done cheerfully rather than an obligations.

Photo Courtesy by: Google image

A 5 percent of my income serve as my travel fund,10 percent goes to my savings,my savings also serve as my emergency fund, None of us knows what will happen from one day to the next day of our lives,but we can prepare that by saving our money before spending. not all the time we have a Job, not all the time we are abundant. Having a savings can Give us a peace of mind. Save today and you can reap the benefits tomorrow.

Photo Courtesy by: Google image

A 25 percent of my income is allocated to my Family, My parents did not require me to help it is my own decision to help them.

Photo Courtesy by: Google image

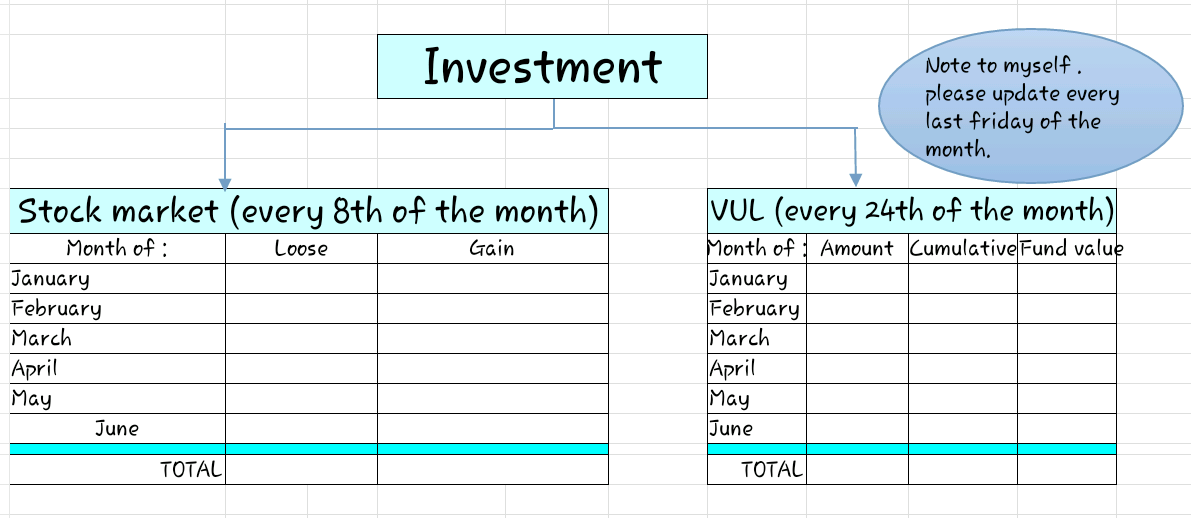

A 3O percent portion of my net income goes to my investment. As an advised of

Some investor Do not put all your eggs in one Basket. As of today I have only two investment. The First is in the Stock market. The stock market are Good investment, although It has a higher Risk but it has also a chance of a higher return.Today investing in stocks has a higher return of investment compare to putting your money in the bank. The second is the VUL (Variable Universal Life) it is a form of cash value insurance that offer both life insurance and investment.

I monitored my investment every end of the month so that I can determine whether I gain or loose from my investment and how much ROI for this month. When I have a monthly monitoring it is easy to established a possible adjustment on the following month.

Photo Courtesy by: Google image

A 20 percent is allocated to my personal expenses,I am Single by status and I’m looking for someone to change that status here (just Kidding) the 20 percent is enough for my expenses since I don’t have any Vices.I’m working here in Cebu, the house rental, electricity and water are free of our Company, Our office is approximately 600 meters from our staff house so i will not to budget on my fare.

Photo Courtesy by: Google image

It is difficult to depend our income only in one sources so I decided to search for other possible income. What I’ve earned on my sidelines 50% goes to my personal expenses and the other 50% goes to my savings. I tried being an affiliate marketer, you bring more traffic in a site once they purchased a product you have been paid though commission. The 2nd is blogging,I really don’t know why I’m here, when my office-mate @smaeunabs introduced this platform to me I was really amazed of the concept aside from possible earning you will learn from the blog of other steemians. The 3rd is,I am a registered civil engineer I used my profession to increase my income I am accepting Making plans, Estimates,or any services related to my profession. if you have a plan making your own dream house you can hire me just leave a comment below.

Budgeting is a critically important part in planning our finances. It is a kind of tool we used for decision making. It is very difficult to established a perfect Budget plan, For me planning our finances require 50% discipline, 30% commitment, 20% Goal. It is not necessary that you have a big/small income before making a budget plan the purpose of budgeting is to determine where you should allocate your money.

I started using this principle last year and it really works for me.

Follow me, @danyopana12

what a nice post danyboy

woooow what a great budget plan dan! hahahaha I actually had a sneak peak of your budget plan a year ago? mao sad to nka encourage nako to make my own, if you have noticed, murag naay pgka same2 atong budget plan thanks to you hahahahaha

Congratulations @danyopana12! You received a personal award!

Click here to view your Board of Honor

Congratulations @danyopana12! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!