Tether (USDT) Stablecoin Transfer Networks

Find out how USDT operates on Ethereum, Tron, Binance Chain, and more, offering speed, security, and low fees in the crypto world.

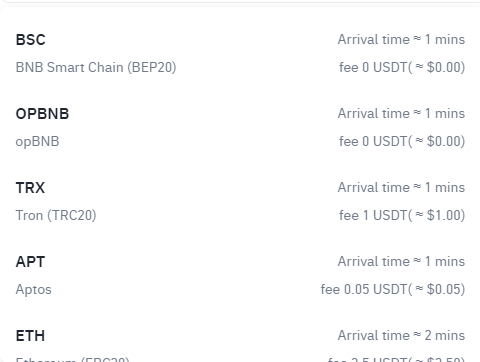

The dollar-pegged stablecoin, Tether (USDT) revolutionized digital transfers by operating on multiple blockchains such as Ethereum, Tron, and Binance Chain. With fees starting at less than $0.01 on networks such as BSC and OPBNB, USDT became the preferred choice for fast and cheap transactions in the crypto ecosystem. We tell you how Tether (USDT) transfer networks work and why it is key in today's market.

Tether (USDT)'s versatility lies in its ability to operate on different blockchains, allowing it to adapt to the needs of users and exchanges / Tradingview

The stablecoin that changed everything

Tether (USDT) is a stablecoin whose value is pegged 1:1 to the US dollar. Issued by the company Tether Limited, this currency became a bridge between fiat money and the crypto world. Its mechanism is simple: for each USDT issued, the company backs the issue with a dollar in reserves. When users return their tokens, Tether "burns" them to maintain price stability.

Why does USDT operate on multiple blockchains?

The versatility of Tether (USDT) lies in its ability to operate on different blockchains, allowing it to adapt to the needs of users and exchanges. This not only facilitates transactions, but also reduces costs and transfer times. Among the most popular transfer networks for Tether (USDT) are:

Ethereum (ERC-20):

Fee: High (can exceed $10 in times of congestion).

Advantage: Wide compatibility with wallets and DeFi applications.

Detail: ERC-20 addresses start with "0x".

BNB Smart Chain (BEP20):

Fee: Extremely low (less than $0.01 per transaction).

Advantage: Connects to BNB Smart Chain wallets and apps and the Binance exchange

Detail: Transactions are very fast.

Tron (TRC-20):

Fee: Relatively low (around $1 per transaction).

Advantage: Ideal for small and frequent transfers.

Detail: Offers speed and scalability.

Solana (SOL):

Fee: Relatively low (similar to Tron).

Advantage: Fast and efficient transactions.

Detail: Although it has faced congestion problems, it has improved its scalability.

OMNI (based on Bitcoin):

Fee: High (due to Bitcoin's low scalability).

Advantage: Maximum security.

USDT: The bridge between fiat money and cryptocurrencies

Tether (USDT) replaces fiat money in most centralized and decentralized exchanges. Its use is essential for trading operations, yield farming and DeFi applications. Furthermore, its stability makes it a key tool for protecting funds during periods of high volatility in the crypto market.

The future of USDT and emerging blockchains

In addition to the transfer networks mentioned, Tether (USDT) is also available on blockchains such as Avalanche (AVAX), Tezos (XTZ), Algorand (ALGO), and Near Protocol (NEAR). These platforms offer new opportunities for fast and cheap transactions, consolidating USDT as the most versatile stablecoin on the market.

Why choose USDT?

Tether (USDT) is not only a stablecoin, but also a one-stop solution for fast, secure, and cheap transfers. Whether on Ethereum, Tron, Binance Chain, or Solana, USDT remains the preferred choice for traders, investors, and developers in the crypto ecosystem. With its presence on more than 10 blockchains, Tether proves that innovation and adaptability are key in the world of decentralized finance.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial, legal or investment advice. Cryptocurrencies are volatile assets; please do your own research before making any financial decisions.

Upvoted! Thank you for supporting witness @jswit.