TenX – what I like, what I don't like, and why I am still investing (and why an ICO is not an IPO)

For everybody that doesn't know TenX or an ICO (Initial Coin Offer) you could sum it up like this.

TenX is a fintec that has the vision to make crypto currency (Bitcoin / Ether / etc.) as easily expendable as fiat.

To describe an ICO, let's look at traditional ways of getting financed to grow a business:

-) Get money from the bank

-) Find a venture capitalist that funds you

-) Do an IPO (Initial Public Offering) and give every shareholder a stake in your company

-) Issue some bonds (borrow the money not from a bank but from the market and pay it back with interest)

OR

-) You find a new way of sharing some value with investors and get some funding that way.

That is what the TenX ICO did. Technically speaking, they combined the venture capitalist approach with an ICO. TenX sold TOKENS that allow the token holder to participate in some of the future earnings of TenX.

TenX is going to give 0,5% of the turnover TenX customers are producing when they are spending crypto with their TenX Visa or Mastercard to the token holders.

That's a new way of letting an investor participate in your company. I really like that. If that would be everything TenX is planning to do in the future, I would say, an ICO is like an IPO with shares that have no voting rights and a fixed dividend connected to them.

Unfortunately for token holders, they don't own a part of the company, nor do they have a fixed dividend of all the future products TenX is going to offer. They only get their share out of consumers spending crypto with their TenX credit card. That's still a compelling offer, but TenX has the potential to be a lot more. But I will get to that in a moment.

For now let's have a look at what made this ICO different to other ICOs. In some way, with an ICO you have the chance of becoming a venture capitalist.

There are ICOs where people collect a shit load of money and they don't have a product. All they have is an idea and a vague road map.

TenX did its homework before the ICO. They have a working product, they got some initial funding, and they are ready to grow. Compared to other ICOs, where companies were only selling an idea and a road map – the TenX ICO was light years ahead.

So it's only fair that they collect some money from the market, or to put it in other words, a bet in TenX, in comparison to most ICOs out there, is a safer bet.

TenX raised 245.832,00 ETH with their ICO.

1 ETH was worth 390 USD mid June and currently sells for 226 USD. Depending on the future development of Ether and how much and when TenX is going to exchange to fiat they could be worth 95 Million or a lot more. But they are at least worth 55 Million USD.

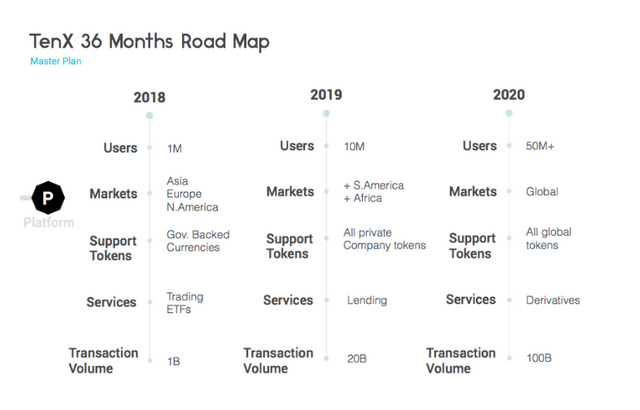

That amount of money opens a lot of doors! And it's going to be interesting to see in which direction TenX is going to develop. If you look at their white paper ( https://www.tenx.tech/whitepaper/tenx_whitepaper_final.pdf ), their Roadmap for the next 36 months looks super ambitious.

They are going to get a banking license, they are going to Trade ETFs, they are going to get in the lending business, they will offer derivatives …. well that sounds more like a “traditional” bank – than a crypt credit card, doesn't it? But it is also raising a question. Where is the value in that for somebody that is investing in the TenX token?

Remember, if you hold a token you get a share in the existing business model (people spending crypto with their credit card) not of the lending or trading ETF.

Let's have a look at what the token holders got in exchange for their 245.832,00 ETH

TenX issued 205.218.255,95 TOKENS.

1 PAY Token gets you ->

(card turnover * 0,5%) / 205.218.255,95 = cared turnover * 0,0000000024364 %

It all comes down to the question of how much card turnover we can expect in the future. Let's say the white paper is correct. Is the turnover in the white paper with or without the “traditional” banking businesses? I checked in the slack channel of TenX (by the way they do an extraordinarily good job staying in contact with the token holders and their users) the turnover is without the additional businesses the traditional banking will add to the company.

So let's crush the numbers. Let's say you got in somewhere between the price of the token presale and the token sale and you bought 1.000,00 Token for 800 USD. (By the way, today you could buy the same amount for 700 USD or even less.)

1 Billion turnover means you get 24 USD in interests, that's 3,05 %. But wait. I forgot to mention something. If you hold your tokens on an exchange, you don't get any interests at all. But that's fair because if you are only trading, you make your money with trading. But that means the more people who are trading, the better your returns will be for people who are holding their tokens.

1.000.000.000,00 USD turnover is not as a big of a number. 1 Million customers with an average monthly spending of 83,33 USD will do the trick.

If you bet on the crypto market growing and more and more money getting into the market over time, that should be a safe bet. Especially because TenX is not Bitcoin. It's crypto, so over time you will be able to spend all the crypto currencies there are.

But beginning with 2019 the road map explodes .. 20 Billion in turnover, lending money (and therefore being a “traditional” bank). That much growth in such a short time is high risk. Especially if you keep in mind HOW SMALL the current TenX team is. There is a book that pops to mind “DELIVERING HAPPINESS„ by Tony Hsieh, the founder of Zappos. He talks about the first companies he founded, the rapid growth some of them had, and the hard lessons he learned out of too much growth, too fast. Then he tells how he solved that problem when he founded Zappos. To make it short, there are still a lot of challenges ahead of the TenX Team, and establishing and maintaining the right company culture with that much growth ahead of them is only one. But that's good, that's the reason its called an investment and for that, you get your returns.

But how much of that risk is really necessary if you only participate in the returns of the card transactions? If TenX starts, for example, to lend people money, it adds risk but little benefit to a token holder.

Even worse, it's not their area of expertise. TenX has with technologies like COMIT a technological advantage in the crypto world. As mentioned before, the ICO let's you participate in the future earnings of ONE product of TenX. You don't hold a share in the company and get dividends. Not only would we as token holders not get a share of the revenue produced in that field, there is also the chance that TenX loses focus. There is this quote from Steve Jobs that pops into mind, “The hard thing is not saying yes to a good idea, the hard thing is turning down the 999 other ideas so you can focus on the one you are doing.”

But if TenX masters that challenge and stays true to its road map and creates a turnover of 20 Billion (by 2019), you would get a return of investment of 60% (if no tokens would be trading on exchanges at the time the interest pays out). Also at this point, TenX would buy tokens worth 20 million every year at the exchanges and give them back to the customers that use the TenX card, which should drive up the price of tokens.

Until then, it's a long road ahead. The founders are the kind of entrepreneurs you like to invest in (read their book, watch the interviews they are giving, listen to the podcasts they are participating in, you can learn a lot about a person that way) – BUT the road ahead is still long. I hold TenX Tokens, I will buy more, and I believe in the company. But I am not a shareholder so I only can hope that TenX will stay on track with what earns me money, and avoids unnecessary risks. Especially in growing not too fast or focusing on areas of businesses they have no unique selling point and/or don't add any value to me as a PAY token holder.

If you liked the post, you can drop me a PAY token (or Ether so I can buy myself more PAY ; ) : 0xb1CeD1F256b9d5088eecE9b9D8ba08CF1976D109

hi bro, i want to get some tenx coins, can you tell me some good wallet for tenx. I couldn't find a walle for tenx itself. Thanks