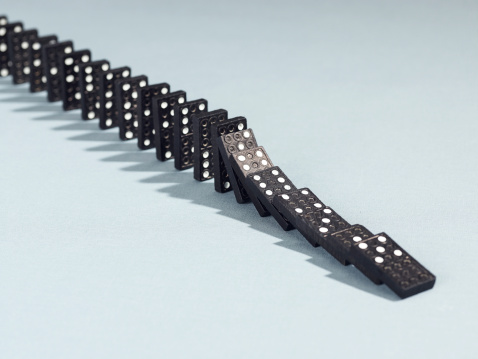

ECONOMY AND DOMINO EFFECT

Source img: http: //noespaisparaeconomistas.blogspot.com/2012/07/siguen-cayendo-fichas-del-domino-murcia.html

The cards are face up. The dice have already been thrown. The first domino token has been pushed and the rest will fall.

The black swan theory is known: an unexpected event that ends up causing unforeseen consequences.

Almost always, for the worse.

The swan this time was the so-called coronavirus, a pandemic that locked millions of people into their homes and paralyzed the planetary economy. These days, the only slogan is to beat the virus.

Soon things change, and the first problem becomes the economy.

When you are confined at home, you cannot go to work. Logical. The company fires you temporarily, and the business may even go down.

And so for millions of people.

Desperate hordes without income, necessarily incur in so-called defaults. And the consequences of our misfortunes affect even those who have dodged bullets.

The tall towers have to fall.

An apocalypse of defaults in the world economy is yet to come; a disaster that will bring down the tower of cards of our financial system. Companies are mega-indebted: Years of stock buybacks and glitzy dividends have given way to declines in value and spending cuts.

Suppression of dividends, layoffs, closings.

1 in 6 companies is a zombie. It remains alive and mired in debt. Debt that the business is unable to pay. These companies will die if they do not receive artificial respiration from free money.

Right now, $ 800 billion could fall from investment bond to junk bond. Investors prepare to lose everything; companies to shut down and workers fear not finding another job.

Thus ends this orgy of cheap money, massive financialization, and share buybacks. Graceful investors have made abundant cash; and also the CEOs who jumped from that ship on the way to sink.

For those of us left on the barge, the only hope is not to drown in the troubled waters. And the thing is quite difficult.

Hypothermia is served and we may not recover.