History Of Money

Cryptocurrency and blockchain came about as an offshoot of the evolution of money. This evolution began mainly from commodity money, then metallic money, paper money, bank money and finally virtual currency.

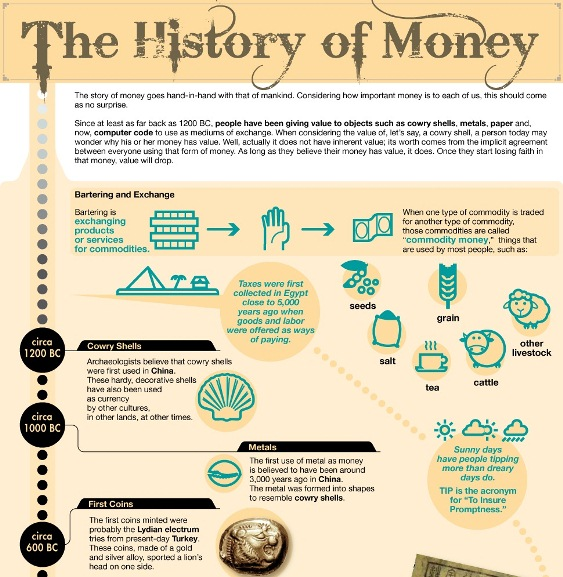

Commodity Money

At the dawn of humanity, bartering was used in lieu of money to buy goods. One of the earliest forms of barter trading was with the use of cattle, sheep vegetables and grains. It was a system they all could resonate with; a system that met the immediate needs of the bartering parties. Later in the future, the bartering progressed from the exchange of food materials to weapons and tools.

Coins and Currency

In 600 B.C., Alyattes, Lydia’s King minted the first official currency. The coins were made from electrum, a mixture of silver and gold and stamped with pictures that acted as the currency denominations. With this innovation, Lydia led all fronts of foreign and local trades.

Virtual Currency

Bitcoin, invented in 2009 by the pseudonymous Satoshi Nakamoto, became the gold standard, so to speak, for virtual currencies. Virtual currencies have no physical coinage. The appeal of virtual currency is in the fact that it offers the promise of lower transaction fees than traditional online payment mechanisms and is operated by a decentralized authority, unlike government-issued currencies.

Asian Cutlery

Around 1100 B.C., the Chinese moved from using tools and weapons as a medium of exchange to using similar replacements of the same tools cast in bronze. They were the first to use recognizable coins made from bronze.

Paper Money

Around 700 B.C., the Chinese moved from coins to paper money. While in some parts of Europe, coins were still being used, other precious materials were gotten from the Colonial state. Meanwhile, at the time, paper money increased International trades in Europe.

Mobile Payments

Mobile payments are money rendered for a product or service through a portable electronic device such as a cell phone, smartphone or tablet. Mobile payment technology can also be used to send money to friends or family members. Increasingly, services like Apple Pay and Samsung Pay are vying for retailers to accept their platforms for point-of-sale payments.

Next week, we will be examining the blockchain technology and how blockchain transactions work. Stay tuned!