Delivery delays and Antminer A3 mining Siacoin earnings

So, I ordered the miner on Jan 18th from Cambodia as I was traveling. It arrived in the US around Jan 25th via a DHL shipment (several days earlier than expected). Only problem, someone using the initials "SDA" signed for the package in the US while I was still in Asia. DHL in Thailand couldn't really help me out and advised me to check with DHL in the US. I tried to keep my cool and not sweat it (as I couldn't do much about it anyway - no shipping company is going to care about your lost earnings with a miner).

Long story short, somehow the box was still on my porch (even though I never signed for it) and I let DHL know that everything was good. Ironically, I had to sign for the power supplies that came a few days later. So why would I not have to sign for something worth more than 20x a power supply and why did they leave it on my front porch?

Needless to say, I completely missed out on the $500+ mining days by not receiving the power supply at the same time. By the time I began mining, the difficulty was already up around 11TH and managed to pull down around 1,000 SC.

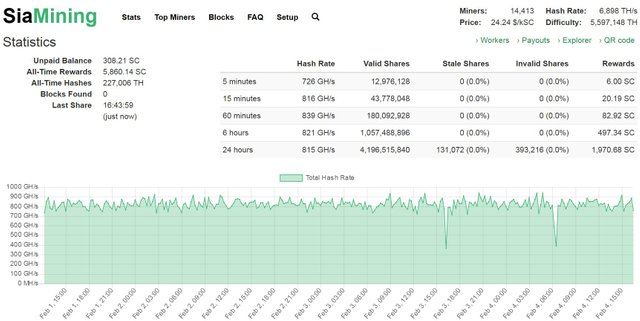

So, it's now been about 4 days since I've had the machine up and running. The difficulty has dropped significantly (that's another story), but I topped out at 2,050SC yesterday and currently, it's looking like 1,970 SC for the last 24hrs.

The difficulty is now sitting at 5.6TH (nearly a 50% drop) hence the increased earnings. Hopefully, this will continue for at least this month before the March shipment start going out. To calculate one's daily ROI in USD is a bit foolish, but it's been wavering between $30-55 it seems. I have no intention of selling these coins during the BTC downturn.

Should you buy an A3?

Probably not at this point even though they are greatly discounted down to $980 (not including shipping and a power supply) - shipping is not exactly economical. Initially, I bought the miner with the intention of selling it. It's no where near as loud as an S9 so that's a plus. I would expect the earnings to drop down to around 500SC/day once those other miners come online - no way of knowing just how many there will be either. I'm heating a greenhouse with it currently so I would've been running an oil heater in there anyway. It's nearly 70F in there and about 25F outside. It would be great if there will one day be another coin that uses the Blake2b algo in the future, but not going to hold my breath.

Those that bought the Obelisk are really up a creek as those miners aren't due to ship until August 2018. Ouch.

I could have purchased around 80,000 SC for what I put into the miner/shipping. Was it a good purchase, only time will truly tell. I'm not worried about it as I could have easily lost the same amount during a single trade. I look at it as a sort of slow savings that is somewhat locked down (out of my reach).

Recommendation:

Keep an eye on DGD (DigixDAO) and the yet to be released coin DGX (backed by 1 gram of gold) based in Singapore. For more info on this project check out https://digix.global/

Thanks for the info on the last paragraph. I'll check out the DGD and DGX ASAP.

Your post is a reminder to me that 'consistency' is key in reducing the difficulty associated with anything. This is evident in the fact that your mining difficulties dropped by 50% because you kept at it without wavering.

Finally, I pray you rectify the signature issue with DHL soonest.

Peace ✌

still not sure who signed for it, but I got it so I guess that's all that matters. DGD is down a lot over the last 12 hours - wish I had most dry powder to load up. There's also a good blog with a lot of other gold type/backed coins - but DGD is already on Binance so it seems to have a first mover advantage (even w/o having launched DGX yet). http://www.goldscape.net/gold-blog/gold-backed-cryptocurrency/

the vincentb effect

upvoted, commented, and followed