The Best Personal Finance Summaries (for Malaysians) - 17 March 2020

The Best Personal Finance Summaries - 17 March 2020

With this newsletter coming out at some uncertain times, we at More Money Malaysia have been thinking what we can do to help.

Unfortunately there is no way for us to help you over the next 2 weeks of the restricted movement order by the government, but we do have an idea that can help you make the most of the two weeks that will make you smarter.

For the duration of the restricted movement, we will be going live on as many social channels as possible to interview financial experts (whether it's related to investing, insurance, making money on the side or getting through the next 2 weeks).

We hope that through watching these, you will be entertained with how awkward we will be (none of this was planned and we have no idea who we will actually have on the show yet), get inspired by what is possible, and have the knowledge to take advantage of the current financial situation.

We will also leave lots of time in this to answer any and all questions you have.

Let's live up to the saying: what doesn't kill us, makes us stronger.

CS

From Us

[VIDEO] Book Summary: The Permanent Portfolio

It's been chaotic in the world right but it also comes with many investment opportunities. The Permanent Portfolio will teach you how you can build a portfolio that lasts a lifetime.

Want To Have Your Money Accelerate Your Goals?

Sign up for our free program and get ready to have your money fuel your aspirations.

Grow Your Wealth

How to Make Money Blogging in 2020

If you do it right, blogging is a fantastic way to make money to supplement your income or rely on it entirely.

Lars Lofgren from I will Teach You to be Rich recently shared a useful list on how to generate income as a blogger. The list is as follows:

- Advertisements and Sponsorships. Monetize your blog by displaying ads from Google Adsense or other paying sponsors. You can get paid if your readers complete an action (pay-per-action), click (pay-per-click), or just look (pay-per-impression) at the displayed ads.

- Affiliate Marketing. Mainly, you introduce or share a link (affiliate link) for a product or service. If your readers decided to make a purchase or subscription, you would receive a cut of the earnings.

- E-books. Once you have running your blog for a while, consider repurposing the published contents for your e-books. They can generate passive income as well as spread word about your blog and brand.

- Apps. Like e-books, apps are another great add-on to your blog. However, do take note that the barrier to entry is much higher.

- Memberships and Subscriptions. If you believe in the premium quality of your content, consider converting your blog into a subscription site. Nevertheless, it might take time and effort to create a successful membership site.

- Online Courses. Do you know enough about a topic that you can teach it? If your answer is yes, try streaming yourself and make online courses.

- Physical Products. You can also specially design your blog to sell physical products. While it’s hard to scale the sales, a blog comes in handy to launch the products to your readers.

- Coaching. Coaching is an easy way to start making an income. Not only that, but you can use your blog to attract clients for you.

- Freelancing. You can use your blog to find freelancing clients depending on your niche. Reach out to potential freelance clients and use your blog as an example of your knowledge and standards.

How to Make Money With Photography

Taking a hobby that you enjoy and turning it into a way to earn some cash is a fantastic dream. If you love photography, you can turn this dream into a reality.

In another post by Lars Lofgren, he shared some ways to make money with photography. The tips are summarised in a list below:

- Take Pictures or Small Businesses. Every business needs visual content. Pitch and offer your photography skills to local companies.

- Teach Photography Skills. Convert your mastery in photography into e-books or digital tutorials. Alternatively, consider organizing webinars or in-person lessons.

- Sell Your Original Photographs. Create a portfolio with your best shots and sell them either on stock photography sites or as physical prints.

- Blog about Photography. If you’ve got excellent writing skills, consider starting a photography blog. You can even use your blog as an extension for some of these other methods, like selling photos and teaching skills.

- Partner with Real Estate Agents. Digital innovations are actively changing the real estate industry. Pitch your photography skills to the agents and convince them photos are crucial to attract potential buyers.

- Become a Social Influencer. Dedicate your social media page to photography. Start building your followers and leverage them at the later stage.

- Photography Events. Offer your services at events. Depending on the gigs, these jobs can range from $100 to $1000!

- Master Your Editing Skills. Photo-editing skill is as essential as your photo-taking expertise. If you are good at it, you could potentially attract more prospects.

- Start a Local Photo Tour. If you happened to know the best photo-taking spots in your area, start a local photo tour for those who are interested.

- Enter a Photo Contest. One or two of your photos could strike gold if you win the right contest. Winning the proper competition can also have a significant impact on your brand.

Should I Contribute Less to EPF with Reduction to 7%?

Employees’ EPF contribution will be reduced from 11% to 7% from 1st April to 31st December 2020 as part of the stimulus package. Will you opt-out?

As announced on * 27th February 2020*, the minimum EPF employee contribution rate for fellow Malaysians has reduced from 11% to 7% - starting from 1st April to 31st December 2020. However, if one chooses to maintain the current rate of 11%, he/ she needs to complete the notice (Notis Pilihan Mencarum Melebihi Kadar Berkanun KWSP 17A (Khas)) and presents it to employers for further submission to EPF.

EPF Lowered Contribution Opting In or Out

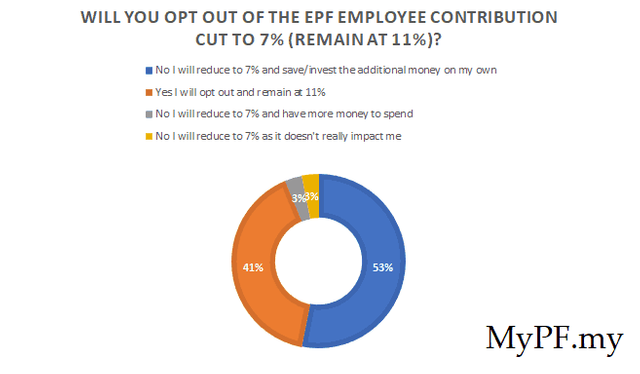

So, the question is – should you opt-in or out? Well, approximately 41% of people choose to remain at 11%, while the rest prefer reducing the rate to 7%.

Consider the following factors to help you decide whether should you take the cut:

- Maximising EPF Tax Relief. You should always max out your tax relief of RM4000. Therefore, if your monthly income is below RM4,166, you should keep your EPF employee deduction at 11%.

- Maximise Other Tax Relief. Consider maxing out other tax reliefs such as PRS (RM3000), life insurance (RM3000), and SSPN-I (RM8000).

- Investments with Higher Returns. Take the cut and invest in other investment instruments with better returns.

- Clearing off High Interests Rate Debt. Finance your debt with a high-interest rate (usually, above 6%).

Ways to Qualify for the Giveaway

Here are some ways you can qualify for our giveaway happening in

Here's the full list of the ways you can qualify for the giveaway.

Compare the different car insurance providers from one site

Is your car insurance coming up for renewal soon? If so, make sure you check if there are better deals that other car insurance providers are willing to give you by comparing them all at once.

The best part is you can customize what it is you want and have your quotes in real time.

Oh and your No Claim Discount will carry over to the new provider as well.

Check it out today and start saving!

A way for females to get free insurance

We were talking to our super humble financial advisor friend one day and she started talking about some insurance product for females that provides coverage for all these female related illnesses. But more importantly, the contract also states that all the premiums will be returned at the end of the contract.

Seriously something for all females to consider!

Learn how you can be paying 50% less for medical insurance

We had to interview an expert insurance agent who told us ways that we could be reducing our premiums by 50%+ by following these few tricks. Take a watch and qualify for the giveaway after answering a few questions to prove that you had watched the interview.

Figure out investing in 30 minutes and never deal with it again

Truly investing on autopilot. By signing up for Stashaway, you will literally be able to have it automate your investing. Plus with the super low fees, your path to success just got a lot easier.

You can start with any amount as there are no deposit or withdrawal fees!

Plus get the fees even lower by signing up for Stashaway through us*!

Figure out investing in 30 minutes and never deal with it again (halal version)

Truly investing on autopilot (halal version). By signing up for Wahed Invest, you will literally be able to have it automate your investing. Plus with the super low fees, your path to success just got a lot easier.

You can start with as little as RM100 and there are no deposit or withdrawal fees.

Plus get RM40 from Wahed Invest for signing up through us and funding your account by RM100.