TCS eyes $200 million in revenue from blockchain in FY19

TCS first put its weight behind blockchain two years back when it first started to work on BaNCS, based on the underlying technology behind bitcoin.

Bengaluru: Tata Consultancy Services Ltd (TCS) believes 2018-19 will be the year of blockchain adoption by the largest banks and stock exchanges, which should eventually help the Mumbai-based company generate at least $200 million in annual revenue from its blockchain practice.

TCS’s sanguine approach to one of many technology domains clubbed under digital is significant for two reasons.

First, it underscores how India’s largest information technology (IT) outsourcing company is making itself future-proof by investing and monetising from newer technologies. Second, TCS’s ability to scale up blockchain reflects the company’s overall strategy to build rather than buy talent and technology in the new areas.

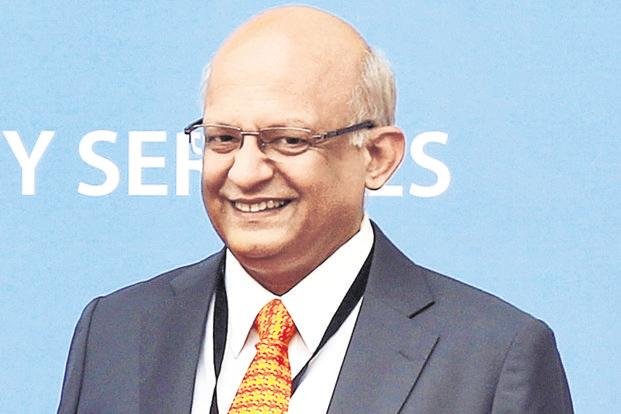

“I believe this year will be a year of Blockchain,” TCS’s chief operating officer N. Ganapathy Subramaniam said in an interview last week. “What I mean by this is that until now we have seen a lot of proof of concepts but over the next 12 months, we’ll see a lot of projects of significance, which will set us up for a greater momentum in the coming years.

“Banking is one sector, especially with respect to payments, trade processing and settlements in capital markets which are seeing very advanced stage of adoption of blockchain.”

Subramaniam declined to quantify for now the business generated by individual digital components, including blockchain but expressed optimism about the road ahead.

“Yes, I believe so as there is an opportunity and we are very-very focused on it,” Subramaniam said when asked if the company’s blockchain practice can become a $200-300 million business by the end of March 2019.

TCS, which started the current financial year on a good note by reporting its fastest sequential growth in four years in the first quarter, claims business from digital accounted for $1.26 billion in the April-June quarter. Digital is the fuzzy term to define all new technologies like data analytics which most Fortune 1000 clients want their IT vendors to offer to help them run their business better. Cloud computing and data analytics are believed to be the largest contributors to the digital revenue at TCS.

Blockchain technology, in the simplest terms, is a new approach to how databases can be shared by multiple individuals or entities. For example, unlike currently, when banks maintain individual databases, a blockchain is updated and maintained, not by a single company or government, but by a network of users.

Think of it the way Wikipedia is maintained by Internet users. Since blockchain works on a model of code-breaking and crowdsourcing, the technology decentralizes the way a traditional bank works—blockchain itself verifies a person’s identity or credit risk.

TCS first put its weight behind blockchain two years back when it first started to work on its core banking software, BaNCS, based on the underlying technology behind virtual currency Bitcoin, as reported by this paper in 2016. It was around the time when Infosys Ltd under its then CEO Vishal Sikka and Wipro Ltd had started investing in blockchain technology with Infosys being the most aggressive among homegrown technology firms in investing in the technology.

Some analysts, for now, remain sceptical on TCS’s claims on scaling business from blockchain.

“Yes, TCS has pool of skilled blockchain resources and a strong partnership ecosystem with emerging blockchain companies, platforms, consortia and academia under COIN (Co-Innovation Network). It also has technology agnostic approach, where it is following a multiplatform (Ethereum, Ripple) strategy for its clients engagements but no way can the company can get it to $200 million. The entire blockchain services market will be less than $1billion this year and TCS does not command 20% of it,” said Phil Fersht, chief executive officer of US-based HfS Research, an outsourcing research firm.

Khamosh Muhabbat Ka Ehsaas Hai Wo, Mere Khwahish Mere Jajbat Hai Wo, Aksar Ye Khyal Kyu Aata Hai Dil Mai, Meri Pahli Khoj Or Aakhiri Talash Hai Wo

Khamosh Muhabbat Ka Ehsaas Hai Wo, Mere Khwahish Mere Jajbat Hai Wo, Aksar Ye Khyal Kyu Aata Hai Dil Mai, Meri Pahli Khoj Or Aakhiri Talash Hai Wo

Khamosh Muhabbat Ka Ehsaas Hai Wo, Mere Khwahish Mere Jajbat Hai Wo, Aksar Ye Khyal Kyu Aata Hai Dil Mai, Meri Pahli Khoj Or Aakhiri Talash Hai Wo

Khamosh Muhabbat Ka Ehsaas Hai Wo, Mere Khwahish Mere Jajbat Hai Wo, Aksar Ye Khyal Kyu Aata Hai Dil Mai, Meri Pahli Khoj Or Aakhiri Talash Hai Wo

Khamosh Muhabbat Ka Ehsaas Hai Wo, Mere Khwahish Mere Jajbat Hai Wo, Aksar Ye Khyal Kyu Aata Hai Dil Mai, Meri Pahli Khoj Or Aakhiri Talash Hai Wo

Khamosh Muhabbat Ka Ehsaas Hai Wo, Mere Khwahish Mere Jajbat Hai Wo, Aksar Ye Khyal Kyu Aata Hai Dil Mai, Meri Pahli Khoj Or Aakhiri Talash Hai Wo

Khamosh Muhabbat Ka Ehsaas Hai Wo, Mere Khwahish Mere Jajbat Hai Wo, Aksar Ye Khyal Kyu Aata Hai Dil Mai, Meri Pahli Khoj Or Aakhiri Talash Hai Wo

Moreover all big giants are ready to move to blockchain because it is the future of world. Follow @text2crypto.

Unke Seenon Me Kabhi Jhank Kar Dekho To Sahi

Kitna Rote Hain Tanhai Me Auron Ko Hansane Wale. Sad Shayari Poetry Tadka Sad Shayari.

Hi brother.....

Kemon aachis onek dinpor...

Valo aachi...

Tumi kemon???

Barite sob valo...???

Sobay valo aache.

Ekhon kothay???

Barite aachi.

Tu kothay???

Tumi or shonge achoto???

Ha ha aachi.

Tomar mone aace...