UK Tax Year Dates and Deadlines 2024/25

Understanding tax year dates and return deadlines is essential for individuals, businesses, and contractors in the UK. Missing these deadlines can lead to fines, penalties, and financial stress. Whether you are self-employed, employed, or running a limited company, knowing your tax obligations helps with financial planning and compliance.

This guide covers the UK tax year dates and deadlines for 2024/25 and penalties for late submissions.

What is the UK Tax Year?

The tax year is the period used by HMRC to calculate taxable income, expenses, and payments. In the UK, the standard tax year runs from 6th April to 5th April of the following year. For the 2024/25 tax year:

Start date: 6th April 2024

End date: 5th April 2025

These dates are crucial for individuals and businesses, as they define the timeframe for reporting income and claiming deductions. They also influence tax calculations for PAYE, National Insurance, and other obligations.

Key Tax Year Dates for 2024/25

Important Deadlines for Individuals and Businesses

- 6th April 2024 -- Start of the new tax year.

- 31st July 2024 -- Second payment on account deadline (for Self-Assessment taxpayers).

- 5th October 2024 -- Deadline to register for Self-Assessment if you're self-employed or need to file a tax return.

- 31st October 2025 -- Deadline for paper tax return submission.

- 31st January 2026 -- Deadline for online Self-Assessment tax return submission and payment.

- 5th April 2025 -- End of the 2024/25 tax year.

PAYE and National Insurance Deadlines

Employers must submit PAYE information to HMRC under the Real Time Information (RTI) system. The key deadlines include:

- 22nd of each month -- Deadline to pay PAYE tax and National Insurance contributions (if paying electronically).

- 19th of each month -- Deadline if paying by cheque.

VAT Return Deadlines

- Quarterly VAT returns are due one month and seven days after the end of the VAT period.

- **Example: **If your VAT quarter ends on 31st March 2025, your return and payment are due by 7th May 2025.

Corporation Tax Deadlines

- Tax return filing: Due 12 months after the end of the company's accounting period.

- Tax payment: Due 9 months and 1 day after the accounting period ends.

Tax Return Deadlines for 2024/25

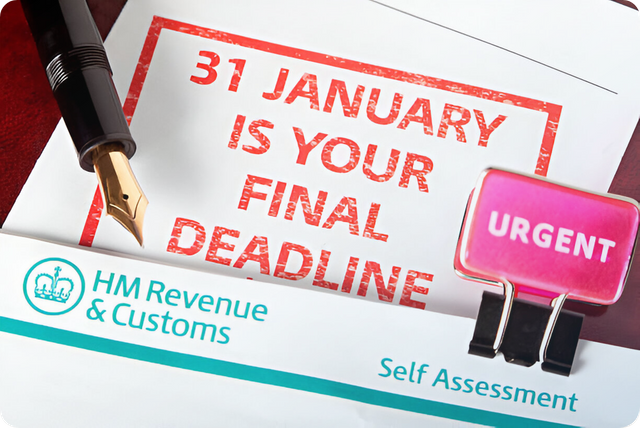

Self-Assessment Tax Return

Self-employed individuals, landlords, and those with additional income must file a Self-Assessment tax return.

- 31st October 2025 -- Paper tax return submission deadline.

- 31st January 2026 -- Online tax return submission and payment deadline.

Late submission penalties:

- 1 day late -- £100 fine.

- 3 months late -- Additional £10 per day (up to £900).

- 6 months late -- £300 or 5% of the tax owed (whichever is higher).

VAT Return Deadlines

Businesses registered for VAT must file returns quarterly, monthly, or annually, depending on their scheme.

- Standard VAT return deadline: 7th of the second month after the VAT period ends.

- Annual VAT return deadline: Varies based on the VAT accounting period.

Late VAT return submissions can result in surcharges and interest charges.

Corporation Tax Deadlines

Companies must file a Corporation Tax return (CT600) and pay tax on profits.

- Corporation Tax filing deadline: 12 months after the end of the financial year.

- Corporation Tax payment deadline: 9 months and 1 day after the end of the financial year.

Example: If a company's financial year ends on 31st March 2025, the Corporation Tax return is due by 31st March 2026, and the payment is due by 1st January 2026.

Late filing penalties start at £100 and increase based on how late the return is submitted.

Who Needs to File a Tax Return?

Self-Employed Individuals

- Sole traders earning over £1,000.

- Business owners, freelancers, and landlords.

Employees

- Employees with additional income (rental, dividends, or capital gains).

- Those earning over £100,000 annually.

Limited Companies

- All UK-registered limited companies must file Corporation Tax returns.

Consequences of Missing Tax Deadlines

Missing a tax deadline can lead to:

- Late filing penalties starting from £100.

- Interest charges on unpaid tax.

- HMRC investigations if repeated failures occur.

HMRC allows Time to Pay (TTP) arrangements for those struggling to pay tax bills, but it's best to meet deadlines to avoid extra costs.

Read more at, https://www.goforma.com/small-business-accounting/tax-year-dates-deadlines

Understanding the UK tax year dates and return deadlines for 2024/25 is essential for avoiding penalties and managing finances effectively. Whether you're self-employed, employed, or running a company, staying on top of these deadlines helps maintain compliance with HMRC.

To simplify tax filing and avoid costly mistakes, hiring tax accountants is a smart decision. A professional accountant can handle your tax returns, calculate liabilities, and help you maximise deductions. If you need expert tax advice, consider working with a qualified tax accountant today.