SCOTUS Scuttles Sales!

That alliteration took some work.

So there I was, minding my own business when BAM! the Supreme Court of the United States (SCOTUS) made the lives of many an entrepreneur more difficult.

What I'm referring to (of course) is the case of South Dakota vs. Wayfair Inc.

You can read the mumbo-jumbo for yourself here:

https://www.supremecourt.gov/opinions/17pdf/17-494_j4el.pdf

Basically South Dakota passed a law a couple years ago saying that if you sell more than 100k USD worth of stuff to SD residents, then you have to pay SD sales tax. This is a change from the past several decades of law saying that a seller had to have a physical presence of some sort in the state before it will owe sales tax.

And in today's decision SCOTUS basically said that the old rules don't make sense for internet technology and the SD law stands.

So at this moment, if you are a retailer that sells at least 100k USD worth of stuff in a year to SD residents, you owe tax there.

But wait, there's more!

Let's think about the implications...

So right at this very second I'm willing to bet that state legislators in California are drafting their own version of the law. And there's nothing to say that 100k USD is some magic number. It might be 5k USD. Or anything above zero. We will have to wait and see.

States have been after this for over a decade now, ever since online ecommerce became a real thing. The states view these out-of-state retailers as stealing their rightful sales taxes from the state government. Because let's be honest, it's all about the money and how every state is broke.

So now online retailers are going to be on the hook for sales tax.

"But Neal," you say, "they don't know who we are. We can ship from off shore if we need to!"

Alas my dear friend, welcome to the world of tax harmonization. In this brave new world most of the governments of the world cooperate when it comes to collecting taxes. That means that if and when a state files a lien against you or your company, your bank accounts are up for grabs.

And if you think you can skate by under the radar, then... maybe... but it's unlikely to work in the long term. Plenty of states' revenue offices have people watching things like airports and marinas for un-taxed planes and boats. When there is a big pot of money at stake, you better believe they will put at least someone on the job.

Of course, this is STEEM, and you're all crypto-nerds like me. So you probably recognize that if you operate in crypto it will be more difficult but not impossible to be levied if you plan to be a scofflaw. Not a path I really recommend going down, but it might just help the speed of cryptocurrency adoption. So silver lining I guess.

So who wins in all this?

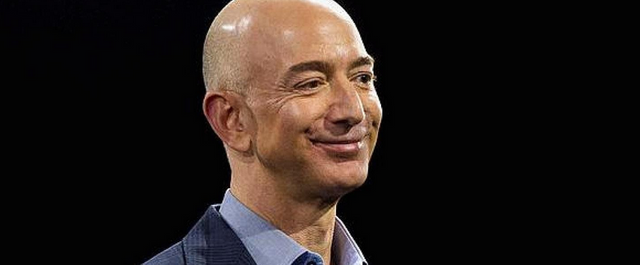

If you said Jeff Bezos, give yourself a steemit silver round.

Amazon has also been pushing for this for years. Since Amazon has set up warehouses in just about every state they/you pay sales taxes anyways on most Amazon purchases. So once they started operating this way they realized that other retailers without physical nexus in the state had a price advantage over Amazon products. Now when the states start levying sales tax against all of Amazon's competition, Amazon's products will be that much more attractive.

Game, set, match - Amazon.

It will take a couple years for the new laws to be passed, for them not to be followed, and for the levies and lawsuits to begin. But begin they will.

Upvoted ($0.12) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

I don't know what anyone else's states are like, but in Minnesota we have dozens of different sales tax jurisdictions. I can't wait for all of that to apply to online ordering.

There's something like 14,000 different sales tax jurisdictions in the US. So yeah, it'll be a mess.

Meanwhile, the people over at companies like https://taxify.co/ are probably doing cartwheels between the cubicles