How to pay only 5% of corporate Tax in Malta

Taxation of Maltese Companies

Companies which are incorporated in Malta are considered to be tax resident in Malta by virtue of their incorporation and are taxed on their worldwide income. Companies which are incorporated outside Malta but their management and control is exercised from Malta are also considered to be tax resident in Malta but are taxed on:

- income arising in Malta; and

- income arising outside Malta to the extend that such income is remitted to Malta; and

- gains realized in Malta (gains realized outside Malta would not be taxable in Malta even if remitted to Malta).

Under law, a Maltese company needs to have distributable profits in order to distribute dividends. For tax purposes the company needs to allocate its distributable profits to the following 5 tax accounts:

- Final Tax Account (FTA): consists of tax exempt profits.

- Immovable Property Account (IPA): consists of profits derived directly or indirectly from immovable property situated in Malta.

- Foreign Income Account (FIA): consists of income derived principally from investments situated outside Malta.

- Maltese Taxed Account (MTA): consists of income which is not allocated to FTA, IPA or FIA.

- Untaxed Account (UA): consists of the total distributable profits/losses less those amounts allocated to any of the other taxed accounts.

The Maltese Refund System

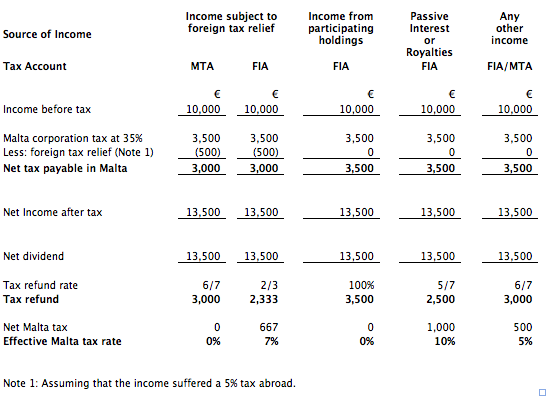

Malta operates a full imputation system whereby both resident and non-resident shareholders are entitled to a refund on tax paid by the company. The corporation tax in Malta is 35% but such a tax refund reduces the effective tax to 0% - 10% as explained below.

The refund is paid by the Malta fiscal authorities within 14 days of a valid application being submitted and there are 4 types of tax refunds:

6/7ths of the Malta tax

This is the most common tax refund to which shareholders are entitled upon payment of dividend by a company. This can be applied if all the sherholders are NOT resident.

5/7ths of the Malta tax

In cases where the distributed profits consist of Passive Interest or Royalties (PIR) then the tax refund is 5/7ths of the Malta tax suffered on those profits.

2/3rds of the tax payable in Malta

This tax refund applies when the distribution is made out of the FIA account (i.e. foreign source income) and the profits are subject to a claim of double taxation relief. The tax refund is 2/3rds of the tax payable in Malta.

Cheers,

Lazlo

Congratulations @kisslazlo! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPFor legal entities, the local tax system in Malta defines five separate "accounts," some of which have tax advantages: the Final Tax Account, the Real Estate Account, the Foreign Income Account, the Malta Tax Account, and the Tax-Free Account. Income and expenses must be allocated within the valid account. To benefit from the exemption from provisional tax in the case of share transfers, a company that operates mainly outside Malta must file a DDT10 application with the Commission of Revenue (CFR). But this is not a problem if you use the payslip generator. In my case, it was PayStubCreator . In yours, it could be any other generator.

Hmm, this is just a great scheme to make a lot of money by transferring your assets to Malta. Do you think it can be considered a great way?And I also wonder if you will be able to get documents on taxation in the United States, which you may need to provide for processing any transactions if your assets are transferred to Malta? For example, I can do this using a special pay stub generator. You may have problems, it seems to me.