GILTI or not GILTI : U.S tax Reform for intellectual property and corporate earnings

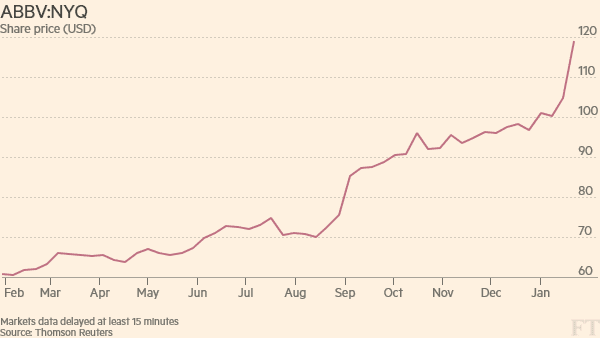

Two days ago, US-based global pharmaceutical company Abbvie announced a revised 2017 interim earnings forecast. The results were amazing. EPS was $ 7.33 to $ 7.43 per share, more than 10% above Wall Street's estimates. (Wall Street's average estimate is $ 6.66). This is because the Trump Administration's tax reform scheme has temporarily reduced the effective tax rate to 9% this year. Of course, it is expected to rise to 13% within the next five years, but it is still lower than the effective tax rate of 18.9% in the previous year.

Stock price chart for Abbvie (from FT)

Due to GILTI and FDII, global corporations based in US can reduce effective tax rate additionally.

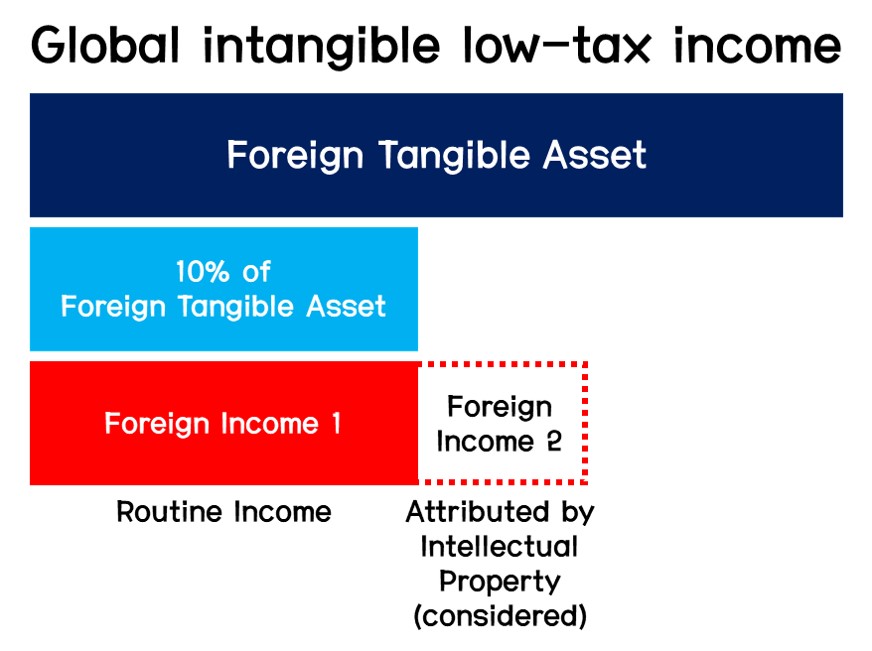

This is due to the introduction of the so-called global intangible low-tax income (GILTI) taxation from Trump Administration's tax reforms and the foreign-derived intangible income (FDII). A brief description of GILTI is that if a US corporation earned Routine Return overseas, it considers the excess amount to be a contribution to intangible assets if the amount of this ordinary income exceeds 10% of foreign tangible asset. In addition, this is automatically added to the taxable income of the parent company in the United States.

Therefore, US companies now have no incentive to move intangible property abroad and avoid taxation through Check-the-box rule or Double-Irish-Dutch-Sandwitch. In particular, if FDII rule gives 37.5% of the deductible income (reduced to 21.875% from 2021), the US tech companies and pharmaceutical / biotech companies, which have more and more intellectual property rights or patent rights, It may well be enough to consider the transferring intangible assets to the US.

By the way, if you read up to here, it looks like great tax overhaul, but here is another thing you keep in mind. This is due to the inherent limitations of the GILTI calculation method. As described above, the calculation of GILTI is as follows.

GILTI = Foreign Income - (0.1 * Foreign Tangible Asset)

The problem here is that there are two ways that US companies can use it to reduce taxes. The first is transferring intangible assets into the United States, as the Trump Administration would want, to reduce Foreign Income. The second direction is the Trump Administration never wanted, increasing the size of amount deducted by increasing overseas tangible assets. Then the relative amount of GILTI will decrease, and in this case, American companies will have the worst consequences of keeping their foreign intangible assets intact, enjoying the tax benefits as they were, and not increasing employment in the United States.

However, the tax rate is only half the new US corporation tax rate, and companies can credit taxes they pay overseas against this US liability. Mr Kleinbard says this will encourage them to keep as much of their profits in tax havens as they can, lowering their overall foreign taxes to a level where they can fully offset the minimal GILTI tax, but no more. The new tax could also lead tech companies to ship more jobs overseas, according to Chris Sanchirico, a law professor at the University of Pennsylvania. That is because they will have an incentive to add to their offshore facilities like factories — and the jobs associated with them — since this will boost their “tangible” assets outside the US and shelter more of their profits from tax. - from article

Personally, I cannot understand well how Trump Administration have created a bill that can produce such a completely extreme contradictory results. The tax law is so easy to touch that it is difficult for the state to create economic gains as desired. Because all economic entities want to avoid taxes. If I am an American manufacturing CEO, I will not have much fun with high wages if I invest in the US anyway, but I would rather increase my tangible assets * 0.1 by investing abroad. Reforming U.S. economy by Trump Administration's tax overhaul will not be easy.

Because of my poor English and contents itself, nobody will be interested at my post.

을지마 힝고. 우는 건 현성님이 할 거야 ㅋㅋ

good job . thanks for informations