Case Study 40: Failure to File - 2012

Index - https://steemit.com/tax/@alhofmeister/rqgmk-tax-blog-index

Introduction

After concluding my last series on back taxes, I felt unsatisfied with the projected tax savings. As a result, I've decided to do a second series on back taxes with a more extreme example.

Problem

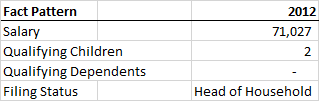

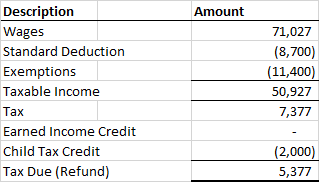

Taxpayer A did not file their tax returns for 2009, 2010, 2011, 2012, 2013, 2014, 2015, or 2016. In 2018, Taxpayer A decided to settle with the IRS before they received a notice.

Calculation

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

@OriginalWorks

a very interesting business

I agree.