Taleb: "Best Thing For Society Is Bankruptcy Of Goldman Sachs"

Content adapted from this Zerohedge.com article : Source

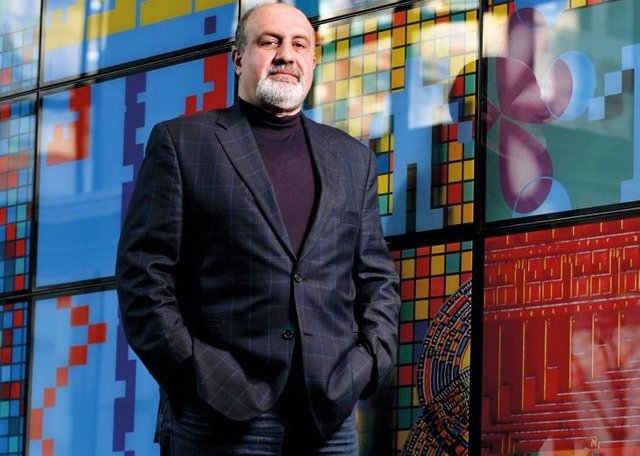

Nassim Taleb is never shy with his words. The outspoken former trader is known for his bold calls. He also has a reputation for calling others out. In this interview, in typical fashion, he goes after all the usual suspects. At the top of the list are bankers and other individuals who are exempt from their actions.

Being a trader, he is well school in risk and welcomes it. With that comes management, something those who are exempted do not have to face.

Authored by George Eaton via NewStatesman.com,

In Taleb's universe, the fieriest circle of hell is reserved for bankers and neoconservatives.

Nassim Nicholas Taleb is an intellectual brawler, a philosophical pugilist. His new book, Skin in the Game, put me in mind of the final scene of_ The Godfather _or Reservoir Dogs: everybody gets whacked. Bankers and bureaucrats, warmongers and wonks – all are targeted by Taleb.

For the Lebanese-American thinker, their shared sin is that (with some exceptions) they lack "skin in the game". By this, Taleb means they are insulated from the consequences of their actions: they do not have "a share of the harm" or "pay a penalty if something goes wrong". This "asymmetry in risk bearing", he warns, leads to "imbalances", "black swans" (the rare but high-impact events described in his 2007 mega-seller) and "potentially, to systemic ruin".

When I meet Taleb, 57, at the Club Quarters hotel in central London I am mentally primed for conflict (journalists are another of his targets). But the self-described flâneur is courteous and polite, helpfully advising me to add an espresso to the hotel's insufficiently strong coffee. I ask him how his deadlifts are (the stocky Taleb once boasted of lifting 400lbs). An unrelated injury, he laments, has "set him back" but he has shed fat, not muscle ("it could be that when you deadlift you're always hungry").

"I consider myself in the same business as journalists," Taleb says when I raise the subject of my trade. "But if you don't take risks it becomes propaganda or PR."

Taleb, a man sometimes described as having praise only for himself, speaks admiringly of the New Statesman's in-house philosopher John Gray.

"My respect for him is so great… He, visibly, has skin in the game, he was not afraid to be a Thatcherite when it was unpopular and later an anti-Thatcherite when it was also unpopular."

In Taleb's universe, the fieriest circle of hell is reserved for bankers and neoconservatives.

**"The best thing that could happen to society is the bankruptcy of Goldman Sachs," **he tells me. >

"Banking is rent-seeking of industrial proportions."

Taleb, who became rich as a derivatives trader, is not a foe of capitalism but of "cronyism".

"If you're taking risks, God bless you. This is why I accept inequality. I've seen people go from trader to cab driver and back again."

He similarly denounces armchair interventionists.

"There's a corrective mechanism in nature: a predator typically inflicts risk on others but also on itself.

Unless warmongers are more exposed to dying than others it's the equivalent of reckless drivers being isolated from the risks of reckless driving."

Is he suggesting that, like George Orwell in Spain, neocons should have joined the Iraq frontline? "They should have kept their mouths shut," he replies.

Taleb was raised in Lebanon by a Greek Orthodox family during the 1975-90 civil war (resulting in what he calls "post-traumatic growth"). He charges the West with excessive rather than inadequate support for the Syrian rebels. "Obama is the reason my people – the Orthodox Christians of Syria – are down by half. Assad's father blew up my house. But Assad's enemies make him look like Mother Teresa. You're not dealing with the Swedish parliament versus Assad: you're dealing with real scum."

Mindful of the charge of hypocrisy, Taleb seeks to ensure that he has skin in the game. Though he lives mostly in New York, he retains a property in Lebanon and houses six Syrian refugees. He does not employ an assistant ("it moves you one step away from authenticity"), rejects copy editing of his books and refuses to accept honours and prizes ("they give you an award, then they own you"). When later that day I join Taleb at a private dinner hosted by Second Home, an east London start-up hub, he dismisses the convention of Chatham House Rules, insisting that all his remarks are on the record.

As an investor, Taleb never advises others to make a trade that he has not done himself. He inverts our traditional conception of "conflicts of interest" ("no conflict, no interest," as one Silicon Valley slogan has it). When Taleb spoke sympathetically of Brexit in 2016, he simultaneously bought a large quantity of pound sterling. Once asked during a TV appearance to comment on Microsoft, he replied: "I own no Microsoft stock… Hence I can't talk about it."

"Those who seek money from a transaction, at least you know where they stand and what their norms are," Taleb explains. "But those who tell you 'I'm doing it for the benefit of humanity', you've got no way of checking them."

Yet are there times when a lack of skin in the game is defensible? Taleb concedes that an exception should be made for jurors. "You don't do it for a living, you have a cleaner opinion than someone who gets involved." Taleb, a philosophical sceptic, influenced by Burkean and libertarian thought, observes: "I'm against universalism right there. Skin in the game is not something universal."

By now, we have been talking for 90 minutes and Taleb remarks with surprise that he is running late for another appointment.

Our conversation concludes on an optimistic note:

"We've survived 200,000 years as humans," says Taleb.

"Don't you think there's a reason why we survived? We're good at risk management. And what's our risk management? Paranoia. Optimism is not a good thing."

Is the paradox, I ask, that human pessimism offers grounds for optimism? "Exactly," Taleb replies. "Provided psychologists don't fuck with it."

Non-adapted content found at zerohedge.com: Source

I've started in the new book Skin in the Game so far, so good. Taleb is a man who wants to be nice and with a long coffee. Her previous books have been tricked by Randomite, Black Swan and Antifragile, all of which are excellent, highly recommended.

I just looked up the book, seems pretty interesting, what are his main points? Might have to pick this one up

But the key players are connected to politicians, and America doesn't punish its politicians*. We never have and never will, because the next guy will always be afraid he'll be hit after he leaves office too. This is why Cheney and Bush will never get war crimes leveraged at them, this is why Nixon just had to resign. They can commit atrocious, vile crimes that go against the heart of our constitution but they won't be punished for it. Ever.

You are right .

I have to go to zeroHedge.com

so that everything is clear.

thank you @zer0hedge

useful information.

Yes, you are right .

however I have to look at zerohedge for news certainty.

I really hope ,, there I will find a more perfect news.

I will reproduce to give a sweet comment.

thank you very much for your good info and good news from you @zer0hedge

90 minutes with Nassim Taleb, this is good time spent sharing knowledge with a man who speaks his mind day in day out. I knew little about Nassim Taleb.. Thanks for sharing about him in this post @zer0hedge.

Rejecting copy editing of his books and not accepting honours and prizes is a sign of what he stands for. No one gets to reap from he's hardwork in a dirty way. This is what journalists have got to keep an eye on.. Hardwork builds reputation and this reputation can be stolen under your nose.

I love the Idea of risk taking.. something people have used to reap big in the cryptocurrency market. Though one has got to invest what he/she is willing to lose.. It's those that go all in that reap highest. We need to make that huge decision without thinking twice about it. People are already panicking because of the dip... and it's the smart ones that are willing to take risks with the hard decisions that will flourish out of this.

Taleb is an author well worth reading, and while he doesn't get all the specifics right, he is building a rather appealing philosophical system with his work. I have to say that the criticism in the review is exceptionally well argued, and Taleb would be well advised to address the points raised in the subsequent editions.

Taleb’s conclusion ... that the “West is currently in the process of committing suicide” is just silly.

It is only silly if his conclusion is not supported by his arguments.

"and more to the point, he has no skin in this game"

He lives in Western civilisation. If it fails, he suffers. Therefore he does have skin in the game.

That was really awesome i love this tough guy .

You kinda don't need a prophet to tell you where bankster will be if there will be hell.

I never knew much about him until now, but I appreciate his methods. If you are gonna tell me how to walk, at least it should be in the path that you walked before.

Goldman Sachs group is too powerful and like in any usual market of an economy, monopolies are not healthy for the well being of society, considering that, I must say I agree with Taleb, and while it is a bold call, it makes a lot of sense, especially considering the last decade and what Goldman Sachs did to/for the society.

This guy obviously doesn’t give a s..t about anyone. In his past deadlifted 400lb, drinking strong coffee, writing a book “Skin in the game”. Targeting journalism, bankers and bureaucrats, warmongers and wonks, but being polite. After reading your blog about this taugh guy I searche a bit more about him and I pretty much liked one of his quotes which just says it for itself about him:

Its pretty taugh for derivatives traders to become rich unless you are exceptionally goof just like Taleb. Interesting interview with Nassim Nicholas Taleb!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvote this reply.