The Chinese FinTech Revolution by Michael A. Gayed

Summary

- Long derided as the producer of fake products, China is reinventing its image as the leader of innovation, especially in the fintech arena.

- China is leading the fintech revolution with new processes being replicated globally, marking the transition to a ‘Copy From China’ model.

- The disruption caused by Chinese fintech companies does not only have implications to the Chinese banking system but is also a cause for concern for U.S. bankers.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Get started today »

China is a sleeping giant. Let her sleep, for when she wakes she will move the world. - Napoleon Bonaparte

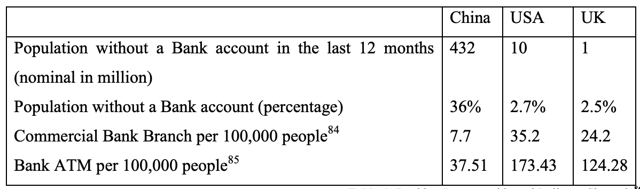

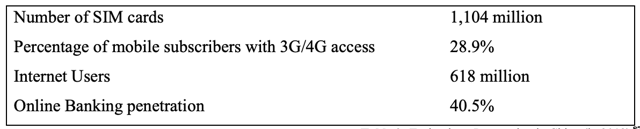

China is losing its status as the world's factory with labor prices rising due to unprecedented growth in the last three decades. The 'Copy to China' model is coming to an end as well. Long derided as the producer of fake products, China is reinventing its image as the leader of innovation, especially in the fintech arena. Fintech is the marriage of financial services and information technology. It refers to technology-enabled financial solutions. The success of Chinese fintech companies such as Tencent (OTCPK:TCEHY) and Ant Financial is highly attributable to the distinctive characteristic of the Chinese market. The physical and digital infrastructure mismatch in the country makes it a fertile ground for fintech to thrive. China is late in developing Western-level physical banking infrastructure, but the rise of fintech means it probably will never need to catch up.

Figure 1: Banking Demographics and Delivery Channels

Source: Arner, Barberis, and Buckley, 2015

Figure 2: Technology Penetration in China

Source: Arner, Barberis, and Buckley, 2015

China accounts for nearly half of the global digital payment market as well as three-quarters of online lending transactions. Alipay and WeChat boast of over 1.5 billion users combined. $2.9 trillion purchases were processed inside the two systems in 2016, equivalent to about half of all consumer goods sold in China. China is leading the fintech revolution with new processes being replicated globally, marking the transition to a ‘Copy From China’ model. It is rapidly becoming the world’s first cashless society.

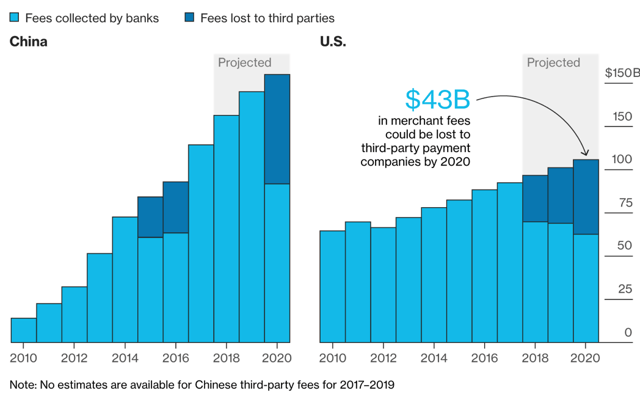

Financial services such as insurance and wealth management products are being delivered in China’s technology platforms with minimal banking participation. Fintech companies carve away billions of dollars in annual revenue from banks and other financial institutions for handling and processing payments. In China, analysts expect third-party payment providers to earn about 40 percent of such fees by 2020. Merchant fees lost by banks are projected at $60 billion in 2020. Banks lost $243 Billion in deposits to Alipay in 2017. This is due to the money market fund offered by the platform, which is considered as an excellent substitute for bank deposits. The disruption caused by Chinese fintech companies does not only have implications to the Chinese banking system but is also a cause for concern for U.S. bankers. U.S. technology giants, Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB), have already made steps to replicate Alipay’s and Wechat’s innovations.

Figure 3. Projected merchant fees lost for U.S. banks if the U.S. follows China pattern

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.