Penske Automotive Group: Motoring Into The Future by Michael A. Gayed

Summary

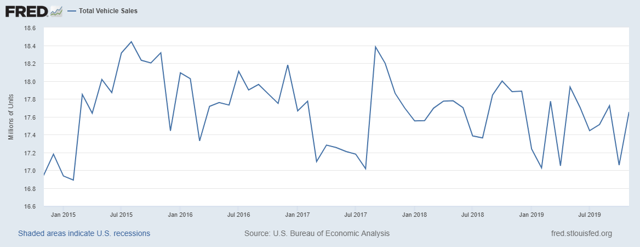

- Vehicle sales have not shown significant growth in the past few years.

- However, Penske has been able to mitigate this by increasing revenue generated by its Finance & Insurance and Service & Parts departments.

- With the trade war slowly being settled, the losses that it created in the automobile sector should reverse and create a boost to the industry.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Get started today »

Take care of your car in the garage, and the car will take care of you on the road. – Amit Kalantri

Penske Automotive Group, founded in 1990, has seen a steady increase in fortunes. Primarily a car and truck dealership, it has dealerships in the US, Canada and Western Europe that is included in the Fortune 500. However, vehicle sales in the US, mirrored in the other countries Penske is based, have been flat in the past few years. This is clear from FRED’s total vehicle sales statistics over the past five years.

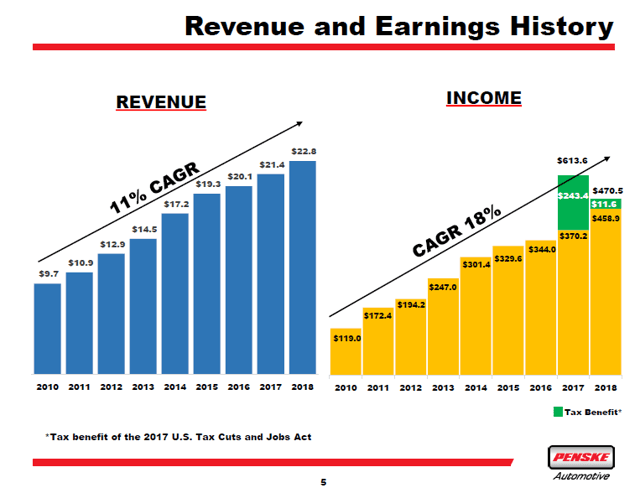

In such an environment, it would seem that automotive companies would be suffering. However, Penske’s revenue and earnings have continued to grow in this time period.

These two facts seem to be contradictory. However, the driver of earnings and revenue growth has not been in an increase in vehicle sales (same-store retail sales of new and used cars were flat in 3Q 2019), but in growth in its Parts & Services and Finance & Insurance businesses. This diversification has seen Parts & Services account for 45.8% of gross profit, with Finance & Insurance also becoming a significant source of profit.

In addition, the fundamentals of the business are likely to be improved as the trade war dampens. Chinese tariffs, as estimated by economist Michael Waugh, reduced US vehicle sales by $9.3 billion since being raised. If the tariffs are reduced due to a trade settlement being reached, the US consumer dependent on income raised from Chinese exports will have greater ability and inclination to purchase a new vehicle.

However, the share price has not followed the growth in revenue and earnings. Much like vehicle sales, it has remained flat through the time period. Does this present a buying opportunity? The RSI has fallen recently in line with a sell-off, indicating that the answer is a potential yes. It also broke through both the 50- and 200-day moving averages in October, suggesting that the momentum is still with this stock.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.