JPMorgan & Chase Company: Featured Stock In November's Dividend Growth Model Portfolio by David Trainer

Summary

- Nine new stocks make our Dividend Growth Stocks Model Portfolio this month.

- Selected stocks earn an Attractive or higher rating, generate positive FCF and economic earnings, offer a current dividend yield >1%, and have a five-year-plus track record of dividend growth.

- The methodology for this model portfolio mimics an All-Cap Blend style with a focus on dividend growth.

- Looking for a portfolio of ideas like this one? Members of Value Investing 2.0 get exclusive access to our model portfolio. Get started today »

Featured Stock from November: JPMorgan Chase & Company

JPMorgan Chase & Company (JPM) is the featured stock from November’s Dividend Growth Stocks Model Portfolio.

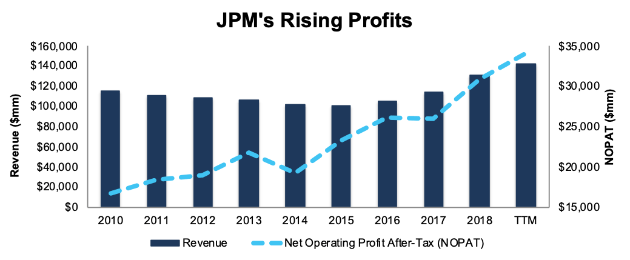

Since 2010, JPM has grown revenue by 2% compounded annually and after-tax profit ((NOPAT)) by 8% compounded annually. The company earned $34.2 billion in NOPAT over the trailing twelve months, which is up 15% over the prior TTM period. JPM’s NOPAT margin is up from 15% in 2010 to 24% TTM while its return on invested capital ((ROIC)) improved from 7% to 11% over the same time.

Figure 1: JPM’s Revenue & NOPAT Since 2010

Sources: New Constructs, LLC and company filings

Steady Dividend Growth Supported by FCF

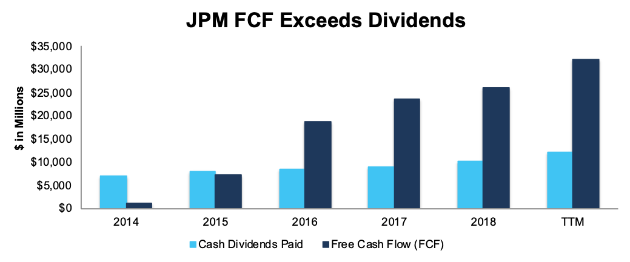

JPM has increased its annual dividend each of the past nine years. The company increased its annualized dividend from $1.58/share in 2014 to $2.72/share in 2018, a 14% compound annual growth rate. Its current quarterly dividend, $0.90/share, equates to $3.60/share annually. Most importantly, JPM easily generates the cash flow needed to continue paying and growing its dividend. Over the past five years, JPM has generated a cumulative $76.9 billion in FCF (19% of market cap) while paying $42.4 billion in dividends.

Companies with FCF well in excess of dividend payments provide higher quality dividend growth opportunities because we know the firm generates the cash to support a higher dividend. On the other hand, the dividend of a company where FCF falls short of the dividend payment over time cannot be trusted to grow or even maintain its dividend because of inadequate free cash flow.

Figure 2: Free Cash Flow vs. Regular Dividend Payments

Sources: New Constructs, LLC and company filings

JPM Is Undervalued

At its current price of $131/share, JPM has a price-to-economic book value ((PEBV)) ratio of 0.9. This ratio means the market expects JPM’s NOPAT to permanently decline by 10%. This expectation seems rather pessimistic for a firm that has grown NOPAT by 8% compounded annually since 2010 and 11% compounded annually over the past two decades.

If JPM can maintain TTM (24%) and grow NOPAT by just 3% compounded annually for the next decade, the stock is worth $158/share today – a 21% upside. See the math behind this reverse DCF scenario. Add in JPM’s 2.7% dividend yield and history of dividend growth, and it’s clear why this stock is in November’s Dividend Growth Stocks Model Portfolio.

...Read the Full Post On Seeking Alpha

Author Bio:

Steem Account: @davidtrainer

Twitter Account: NewConstructs

Steem Account Status: Unclaimed

Are you David Trainer? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.